RIL posts record Rs 11,262-crore net

Q2 net up 18.6% from last year; retail, telecom verticals drive growth of the company in July-Sept period

Mumbai/New Delhi: India's most valuable company Reliance Industries on Friday posted a record quarterly net profit of Rs 11,262 crore as a steady rise in the share of its consumer businesses of retail and telecom countered lower earnings from traditional petrochemical and refining segment.

The oil-to-telecom conglomerate, led by richest Indian Mukesh Ambani, reported a net profit of Rs 11,262 crore, or Rs 18.6 per share, in July-September, up from Rs 9,516 crore, or Rs 16.1 a share, in the same period of the previous financial year, the company said in a statement.

This is the highest quarterly net profit earned by any private company, surpassing its own previous best of Rs 10,362 crore in the January-March period.

State-owned Indian Oil Corp (IOC) holds the distinction of posting highest ever quarterly profit by any Indian firm when it had reported a net profit of Rs 14,512.81 crore in January-March 2013.

Reliance's standalone net profit of Rs 9,702 crore was also a record high. It clocked a 4.8 per cent rise in consolidated revenue at Rs 163,854 crore in Q2.

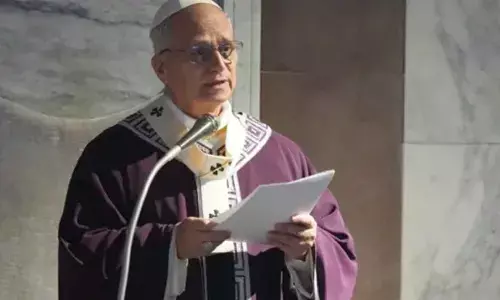

Mukesh Ambani, Chairman and Managing Director, Reliance Industries, said: "The company has reported record net profit for the quarter.

These excellent results reflect the benefits of our integrated oil to chemicals (O2C) value chain and the rapid scale-up of our consumer businesses."

"Continuing growth trends in our retail business is heartening. Guided by our obsession to provide the best value for our customers, Reliance Retail delivered robust performance with record quarterly revenues and EBITDA," he said.

Jio has become India's largest mobility services provider. Jio today also has the highest market share in terms of 4G subscriber base and 4G data traffic in India, he added.

The company opened 337 more retail stores and added 24 million subscribers to its Jio mobile phone service that helped increase the profitability of the venture, even as its traditional oil refining and petrochemical businesses continued to see weak earnings.

Reliance reported record pre-tax profit from its retail and telecom businesses. The two now account for a third of its EBITDA, up from close to 25 per cent last financial year.

With its retail store strength rising to 10,901 from 10,644 at the end of Q1, the retail business posted a 67 per cent jump in pre-tax profit to Rs 2,322 crore and a 27 per cent rise in revenue at Rs 41,202 crore.

Reliance Jio, the group's telecom arm, posted a standalone net profit of Rs 990 crore, which was 45.4 per cent more than the previous year, as subscriber base swelled to 355.2 million from 331.2 million at the end of the June quarter and 252 million in Q2 of the previous fiscal. Net subscriber addition was a shade lower than 24.6 million added in the previous quarter.

Earning per subscriber declined to Rs 120 a month from Rs 122 in the previous quarter. Jio crossed Rs 5,000 crore quarterly EBITDA for the first time and saw a 56 per cent data traffic growth and 52 per cent voice growth year on year, the company said.

Despite record production of 9.9 million tonnes, the petrochemical business saw pre-tax profit drop 6.4 per cent to Rs 7,602 crore on fall in product prices.

The operator of the world's largest oil refining complex saw pre-tax earnings from the business decline for the sixth quarter in a row.