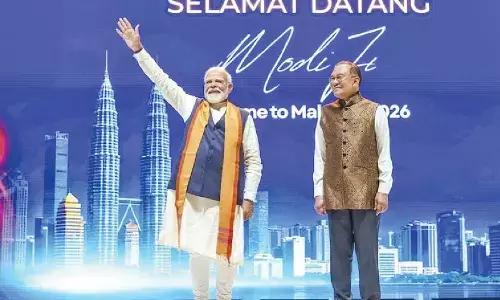

PM Modi congratulates RBI Guv for top global rating 2nd time in a row

Share :

Prime Minister Narendra Modi on Wednesday congratulated RBI Governor Shaktikanta Das on being rated “A+” for the second time in a row in the ‘Global Finance Central Banker Report Cards 2024’.

New Delhi: Prime Minister Narendra Modi on Wednesday congratulated RBI Governor Shaktikanta Das on being rated “A+” for the second time in a row in the ‘Global Finance Central Banker Report Cards 2024’.

Responding to a post on X by the Reserve Bank of India, PM Modi said, “Congratulations to RBI Governor Shri @DasShaktikanta for this feat, and that too for the second time”.

“This is a recognition of his leadership at the RBI and his work towards ensuring economic growth and stability,” said the Prime Minister.

The Global Finance magazine released the names of Central Bank Governors who earned the highest grades, “A+”, “A” or “A-”, in the ‘Central Banker Report Cards 2024’.

The report, published annually since 1994, grades the central bank governors of nearly 100 key countries, territories and districts, as well as the European Union, the Eastern Caribbean Central Bank, the Bank of Central African States and the Central Bank of West African States.

Grades are based on success in areas such as inflation control, economic growth goals, currency stability and interest rate management.

“Central bankers have waged war against inflation over the past few years, wielding their primary weapon: higher interest rates. Now, countries around the world are witnessing the tangible results of these efforts, as inflation has dropped significantly,” said Joseph Giarraputo, Global Finance founder and editorial director.

Meanwhile, Das said on Tuesday that banks need to carefully monitor the persistent gap between credit and deposit growth because it could become a challenge, leading to liquidity issues.

In an interview with NDTV Profit, the RBI Governor said they are cautioning banks to monitor this situation carefully.

“Banks should also carefully monitor the change in investment strategies of young aspirational Indians,” Das told NDTV Editor-in-Chief Sanjay Pugalia.

He further mentioned that a decision on reducing the key policy repo rate will depend on keeping inflation in check and the fall in food and vegetable prices in July was not enough to cut rates.

The central bank Governor said any adverse impact on economic growth due to not reducing the policy rate is "minimal and negligible".