Economic slowdown hits Telangana, Annual Budget cut by Rs. 35,525 Cr

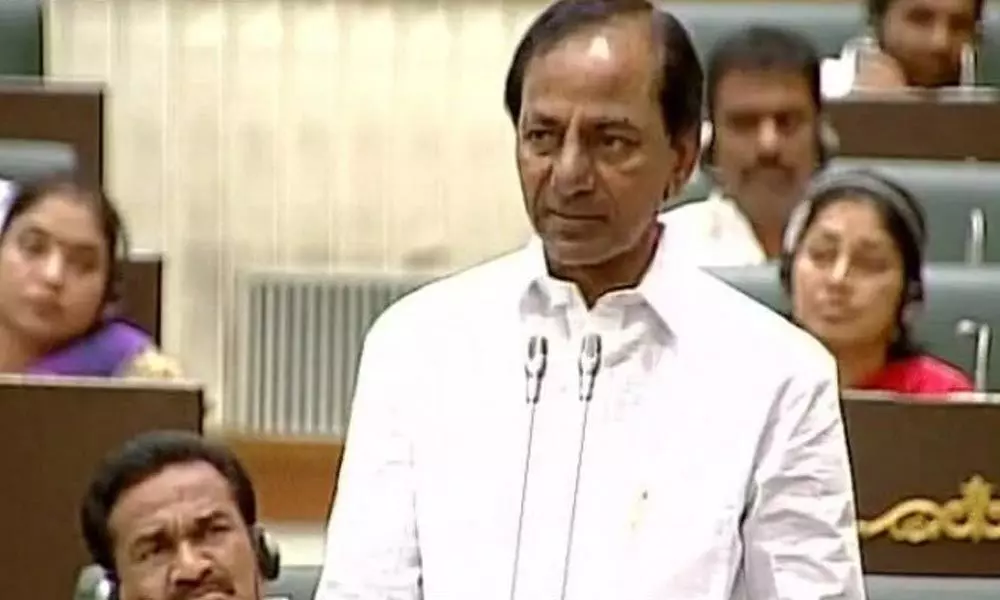

Chief Minister K. Chandrashekhar Rao admitted that the economic slowdown has badly hit the revenues of Telangana which consequently forced the State Government to cut the proposed budget expenditure by Rs. 35,525 crores.

Hyderabad: Chief Minister K. Chandrashekhar Rao admitted that the economic slowdown has badly hit the revenues of Telangana which consequently forced the State Government to cut the proposed budget expenditure by Rs. 35,525 crores.

Presenting the full budget for the financial year 2019-20 in the State Legislative Assembly on Monday, the Chief Minister said that for 2019-20 financial year, an amount of Rs 1,82,017 crore was shown as expenditure in the vote on account budget. However, the economic slowdown is continuing in the country for the past 18 months. "There is a steep fall in the Gross Domestic Product. All the major sectors are experiencing a downward trend. Revenues have fallen.

The country's economic situation has a bearing on the state too. The government has decided to formulate the budget based on the change in the scenario and the ground realities. The proposed expenditure for the 2019-20 financial year is Rs.1,46,492.30 crore. Of this, revenue expenditure is Rs.1,11,055.84 and capital expenditure is Rs.17,274.67 crore. As per the budget estimates proposed, revenue surplus is Rs.2,044.08 crore and the fiscal deficit is Rs.24,081.74 crore," he said.

"Though there is a fall in revenues due to economic slowdown, I am hopeful and optimistic that the situation will change for the better. This Budget is formulated based on the facts and realities, as they exist today. If the situation improves in future, there is always scope for making suitable changes in the estimates later," he said.

He hoped that the government could raise additional funds by the sale of lands. "The relentless legal fight put in by the State government to free government lands from the grabbers and to clear several cases pending in the courts have started yielding good results. The government could get back its rightful ownership of land worth thousands of crores. The Government can raise additional funds through the sale of these lands in a phased manner. The Government has decided to transfer these funds to SDF and to use them to meet any contingency arising in any department for meeting the needs of the people," he said.

Speaking about the economic slowdown over the last one and a half years, the Chief Minister said in the first quarter of 2018-19, the country's GDP recorded a growth of 8%. From then onwards the GDP was on the decline. In the second quarter the GDP growth was 7%, in third-quarter it was 6.6% and in the fourth and final quarter, it touched 5.8%. In the first quarter of this financial year, it further declined to 5%. This clearly indicates the steep decline of economic growth in the country. All these statistics are from the official reports put out by the central government. These statistics prove the continuous economic slowdown in the country. The severe economic slowdown is leading to serious repercussions in the country, which we are witnessing daily.

The Chief Minister said that the economic slowdown has adversely impacted all the sectors. There is negative growth in many key sectors, which mirror the prevailing economic situation. The official data put out by the institutions connected with these sectors present a gloomy picture. He also cited a report released by the Society of Indian Automobile Manufacturers (SIAM) which pointed out that the manufacturing of the vehicles all over the country was down by 33 per cent. The sale of vehicles has come down by 10.65%. Since there are no buyers for the vehicles already manufactured, several top companies have stopped the production temporarily. Taxes from the purchase of vehicles stopped. Sale of Petrol, diesel, and auto spare parts have also declined resulting in a decline in VAT collections.

Lakhs of people have lost their jobs and employment opportunities. The fact that about 3.5 Lakh persons lost their jobs in the automobile sector shows how severe the situation is. "There is a decline in air traffic from 11.6% to minus 0.3%. The decline in air passengers is 11.9 per cent. In the air cargo transport, the growth rate declined by 10.6%. Transport of goods through air cargo declined from 6% to 4.6%. Since there is a fall in the demand for all commodities, railway wagon booking growth rate declined from 4.1% to 1.6%. Since several industrial units have closed down, coal mining has stopped at several mines. With this, the growth in coal mining also decreased from 10.6% to minus 5.1%. Rupee exchange value is falling speedily and steadily. For the first time in history, the US Dollar value against the rupee is Rs.72.43 now. All these facts and figures that I have stated are being talked about on a daily basis all over the world," he elaborated.

"The severe financial crisis that the country has been witnessing impacted Telangana State's economy too. In the first year of GST implementation, in the absence of any proper calculations, Telangana got compensation as was done in the case of all other states. After this, there was no necessity for Telangana to take this compensation again. But due to economic slowdown, during April and May months this year, Rs 175 crore and during June and July months Rs 700 crore was given as GST compensation. The compensation taken during June and July was 4 times more than the compensation given in April, May and this alone reflects the steep decline in the financial situation," he said.

KCR said that the Central government alone decides the broad fiscal policies in the country. The states have no option but to follow the fiscal policies of the Centre and Telangana State is no exception.

"I regret that I am presenting the State Budget for 2019-20 in the House when both the Centre and State are going through a severe financial crisis. We have to tread carefully and cautiously during such a testing time. We cannot go beyond certain limits. Against this backdrop of severe financial crunch, our Finance Department did a lot of brainstorming, discussed the matter with several experts and with a practical approach prepared 2019-20 budget proposals," he said.

The Chief Minister admitted that there was a lot of difference between the estimates presented in the Vote-on-Account budgets of the Centre and the State, and the proposals being presented today. Based on the provisional figures published by the Controller General of Accounts (CGA), it was estimated that there would be 22.69 growth in the tax revenue of the Centre during 2019-20, but in the first quarter, only 1.36% growth was realised. "In Telangana State too, we anticipated 15% growth rate but only 5.46 percent could be realised," he said.

In the last five financial years, in commercial taxes, the State recorded an average of 13.6% growth rate while it is 6.61% in the first four months of this financial year. In excise, only 2.59% growth is registered in the first four months. In stamps and registration, till last financial year, 19.8 growth rate was recorded, but, in the first four months of this financial year 17.5% growth was recorded. In motor vehicle taxes, there is a steep fall. In the last five financial years, there was 19% growth rate in motor vehicle tax and it has now declined to minus 2.06% in the first four months in this financial year.

There is a steep decline in the non-tax revenue too. Till last year, the growth rate was 14.9% on an average and during the first four months of this financial year it fell down to minus 14.16%. In all, the non-tax revenue declined by 29%. This is purely due to economic slowdown. In addition to the decline in the State own revenue, the Centre also had made a reduction in the funds that are to be transferred to the State. For the 2019-20 financial year, the centre has cut 4.19% in the State's share in Central taxes (Devolution). The Centre also reduced allocations in several other items causing severe loss to the State.

The Chief Minister claimed that the situation of several other States in the country is much worse than ours. According to the Comptroller and Auditor General (CAG) report, Punjab, Karnataka and Haryana have registered a minus growth rate. "When compared to other States, Telangana is slightly in a better position. Because of the leverage the State has due to its economic growth and fiscal discipline, it could raise funds from other financial institutions. Within the limits of FRBM and following the Centre's guidelines, the State is raising funds from the financial institutions. The State government has decided to utilise extra-budgetary funds for the construction of major irrigation projects. With funds obtained from the financial institutions and margin money, the government is completing the irrigation projects. Let me assure people through this House that construction works on Kaleshwaram, Palamurur-Rangareddy, Sitarama, Devadula and other such major projects will continue without any interruptions," he said.

KCR said that the State government was committed to continuing the welfare programmes for the poor people and farmers despite the existing financial crisis. "The commitment of this government to farmers' welfare can be proved from the fact that it had increased the financial assistance under Rythu Bandhu Scheme from Rs. 8,000 per acre to Rs. 10,000 per acre per annum," he said while assuring the farming community that Rythu Bandhu Scheme would continue without any changes.

An amount of Rs. Rs 12,000 crore has been allocated for Rythu Bandhu; Rs. Rs 1,137 crore towards Rythu Beema premium, Rs. 6,000 crore for the crop loan waiver scheme and Rs. 8,000 crore for power subsidies.

The other major allocations Aasara pensions - Rs.9,402 Cr; Gram Panchayats - Rs. 2,714 Cr and Municipalities - Rs. 1,764 Cr.