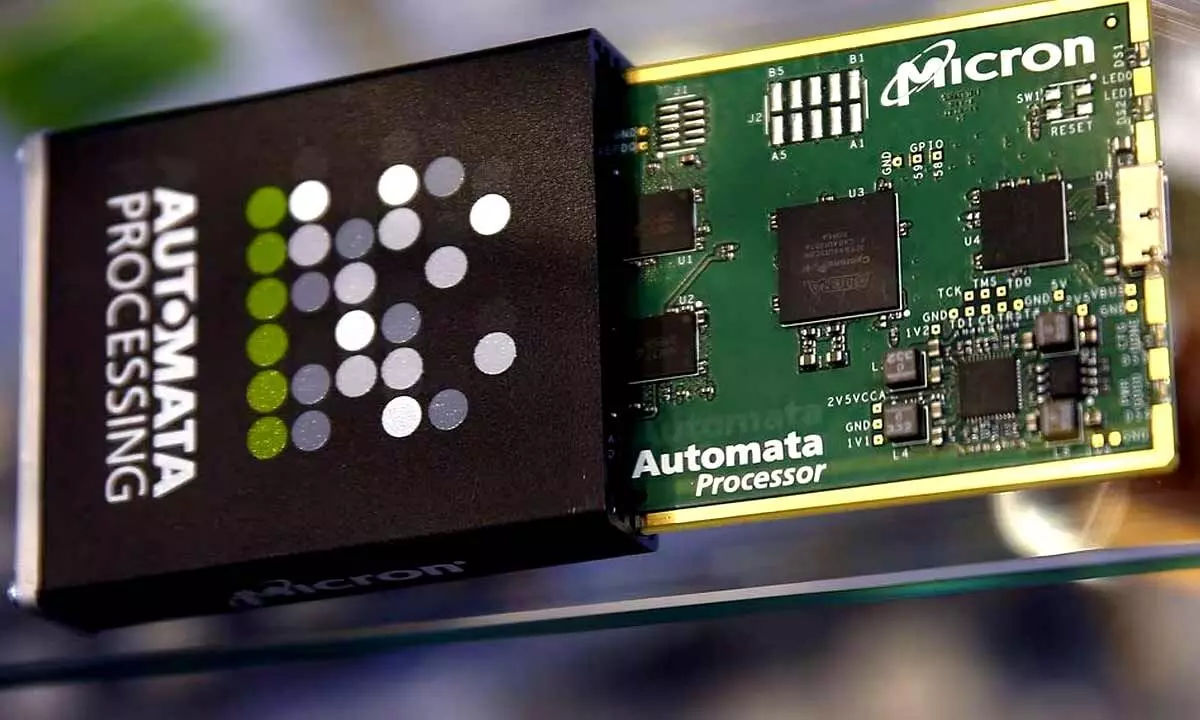

Micron shares fall as demand recovery 'off to slow start'

Share :

Micron Technology's (MU.O) first-quarter loss forecast has triggered concerns of a sluggish recovery in the memory chip maker's end-markets such as data centers, sending its shares down over 5% in early trading on Thursday.

Micron Technology's (MU.O) first-quarter loss forecast has triggered concerns of a sluggish recovery in the memory chip maker's end-markets such as data centers, sending its shares down over 5% in early trading on Thursday.

The company on Wednesday forecast a bigger loss than analysts had expected and a return to positive gross margin in the second half of fiscal 2024, later than Wall Street expectations for the first half.

Micron has been under-utilizing its production capacity to match supply with a slump in demand for memory chips that started last year, but analysts have said excess inventory appears to have cleared in most of its end-markets such as smartphones and personal computers.

Low memory prices since early last year have also been hurting Micron's profit margin.

"The recovery path is off to a slow start," analysts at Evercore ISI said in a note.

Still, analysts were hopeful that the artificial intelligence (AI) boom should boost overall prospects for the company, which expects "several hundred million" dollars worth of revenue from its new high-bandwidth chips, meant for AI work, next year.

Micron is also working to become a supplier to AI chip giant Nvidia (NVDA.O), it said on Wednesday.

The company forecast adjusted loss per share of $1.07 for the current quarter, steeper than analysts' estimates for a 95 cents-per-share loss.

Citigroup now expects Micron to post a loss of $1.79 per share in fiscal 2024, compared with its earlier estimate of a 99 cent profit.

A correction across the semiconductor industry had sent Micron's shares roughly 50% lower last year. Those losses have largely been recouped, with its shares rising about 36% in 2023 as investors hoped for a recovery.

Micron's price-to-earnings ratio for the trailing 12-month period is a negative 16.3, per data from LSEG.