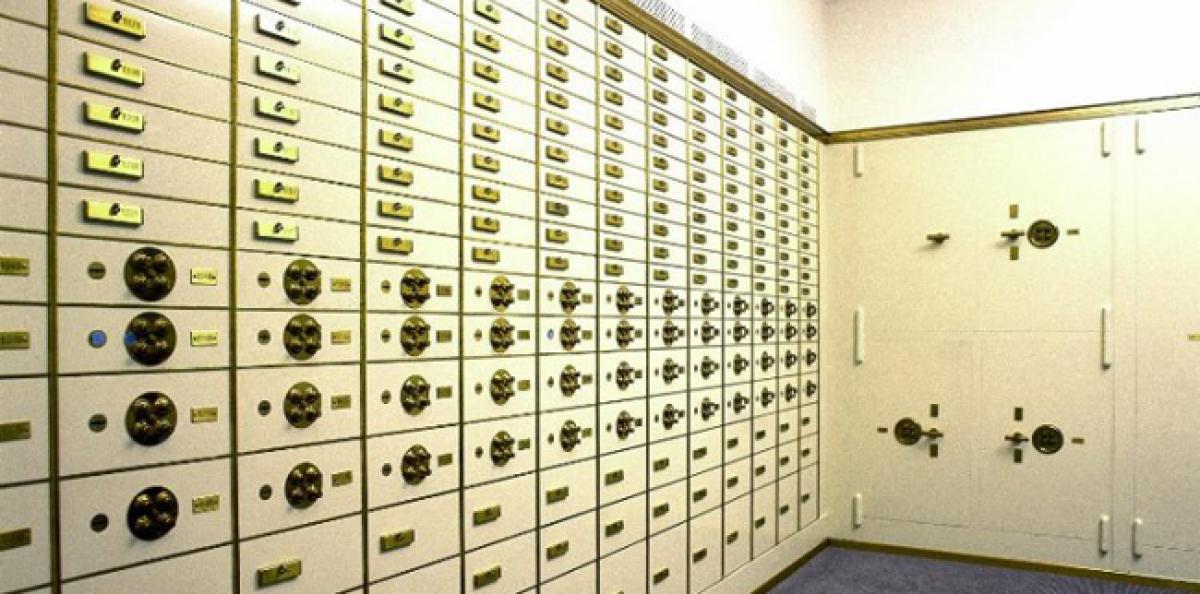

The deep pit beneath Swiss banks

Two contradictory reports are available regarding the money held by the Indian citizens in Swiss Banks The amount declined by 80 per cent between 2014, when Modi government came to power, and 2017

Two contradictory reports are available regarding the money held by the Indian citizens in Swiss Banks. The amount declined by 80 per cent between 2014, when Modi government came to power, and 2017.

The months are not clear, so let us assume these figure relate to calendar years and this decline took place between January 2014 and December 2016. In 2017, that is, between January and December 2017, the deposits increased by 50 per cent.

We can understand the two movements like this: Let us say, Rs 100 was deposited in January 2014. It fell to Rs 20 in December 2016. It again increased to Rs 40 in December 2017.

Therefore, the government’s argument that the amount has declined from Rs 100 in January 2014 to Rs 40 in December 2017 is correct. The Opposition’s argument that the amount increased from Rs 20 in January 2017 to Rs 40 in December 2017 is also correct.

Is the increase in 2017 important? Let us say the temperature of the patient declined from 104 degrees to 100 degrees in the first three days of admission in the hospital. It increased from 100 degrees to 101 degrees on the fifth day? Is this important? I would think yes. The small increase in temperature on the fifth day indicates that the patient is no longer responding to the treatment and a change in the treatment is required.

Is the decline between 2014 and 2017 important? In order to answer this question we have to look in the context of the larger Indian economy. The GDP growth rate in the four years before the Modi government came into power, that is, between 2011 and 2014, was 6.8 per cent. It remained at nearly the same level, that is, 6.9 per cent, in the four years of Modi government from 2015 to 2018.

This means that the money withdrawn from the Swiss Banks by Indian citizens has not come back to India. India’s growth rate would have increased if the money had come back. Perhaps the money has moved to other safe havens like Antigua and Lithuania. The intense scrutiny of the Swiss bank accounts by the Modi government has led the Indian nationals to shift to less visible countries.

Now, it is clear that our GDP growth rate was at 6.8 per cent when money was flowing out of India in 2011 to 2014. The fact that it has remained at nearly the same rate could mean that the money continues to flow out of India. The growth rate would have shown a noticeable increase if the outflow of money had stopped.

Many indicators of continuation of the outflows are available. First indicator is that the rupee has declined. The US dollar was valued at Rs 61 in 2014. It has declined to Rs 69 at present. This means that more people want to buy dollars; and less want to sell dollars. Part of this demand is for sending out the money from India. Thus, the decline in the rupee indicates continued outflow of money from India, but, maybe, not to the Swiss Banks.

The second indicator is the outmigration of rich people from India, called “High Net worth Individuals” or HNI in the financial parlance has gained pace. 23,000 wealthy Indians have given up their India citizenship since 2014, according to a report by Morgan Stanley.

The outmigration has speeded up in the fourth year of Modi Government. 5300 wealth Indians out-migrated every year between 2014 and 2016. This increased to 7,000 in 2017. These HNIs are taking their wealth along with them to foreign countries.

The third indicator is that corruption remains rampant, and may actually have increased. Inquiries with jewelers indicate that gold demand is down by about 80 per cent. The property market too is down. Grease money is not being invested in gold or property.

It is likely that the grease money is going abroad. For these reasons my assessment is that the outflow of money from India has increased in the last four years of Modi Government.

So how do we explain the decrease in the deposits by Indian citizens in the Swiss Banks? One explanation is that Indian citizens were previously depositing the money in accounts linked to their identity as Indian passport holders.

They have now rerouted the same money and deposited in the Swiss bank through “front” companies. Let us say, Mr. X held a deposit of Rs 1 crore in a Swiss Bank. He established a front company, say, “X Trading Company,” in Belgium. He withdrew the money from his own account; deposited the money in the Belgium account of “X Trading Company;” this Company then deposited the money in the same Swiss Bank.

Now, the records of the Swiss Bank will count this deposit as made by a Belgian company and not count it as money deposited by an Indian national. Another explanation is that the depositors have changed their nationality in the records of the Swiss Banks. Mr. X deposited Rs 1 crore in a Swiss Bank as an Indian citizen in 2014.

Say, he gave up his Indian citizenship and acquired an Antigua citizenship in 2016 and had this recorded in the Swiss Bank. In 2017, the money is still with the Swiss Bank but is not counted in the monies held by Indian nationals.

There is no reason to be happy at the decrease in the deposits in Swiss Banks. One, the money may still be with the same Swiss Banks but not counted as being held by Indian citizens. Two, the money may be going to other destinations such as Antigua and Lithuania. Proof of the pudding lies in the eating. The fact that India’s growth rate has remained unchanged means that the outflow continues.

Mr. Modi must focus on the core reasons for the outmigration of HNIs and outflow of grease money from India. The Modi narrative is that he is rooting out corruption, which, of course, is a good thing. But this narrative has taken the shape of possibly honest businessmen being hounded by blatantly dishonest bureaucracy.

Thus there is, in my assessment, an increased outflow of money from India. That is the reason for the GDP growth rate remaining unchanged. The decline in deposits by Indian citizens in Swiss banks, even if real, does not change this hard reality. Author was formerly Professor of Economics at IIM Bengaluru