Market likely to move in narrow range

Indian equity markets bounced sharply after two weeks of decline With positive global cues, decline in crude oil prices and record level recovery in rupee helped indices to recover from an oversold zone The GST collections have also boosted the sentiment

Indian equity markets bounced sharply after two weeks of decline. With positive global cues, decline in crude oil prices and record level recovery in rupee helped indices to recover from an oversold zone. The GST collections have also boosted the sentiment.

The midcaps and smallcaps outperformed the large caps. The BSE Sensex gained 1,662 points or 5 per cent higher, Nifty closed 5.2 per cent higher with 523 points gain. Whereas midcap index gained 7.1 per cent, smallcap index gained 8.6 per cent.

The major indices clocked the best weekly gains since Mary 2016. PSU bank index rose 13.6 per cent, the most since recapitalization plan announced last year. In quarterly earnings space, only eight companies beat the market estimates while about 11 companies missed the estimates. They account for 75 per cent of Nifty constituents. The remaining are in line with the expectations.

With these earnings, Nifty Price Earnings (P/E) ratio still higher side with 25.40. Generally, it is an overvalue zone. We cannot expect the remaining 25 of the companies will boost the Nifty earnings and will push the P/E to the reasonable level.

We feel that markets are not in an investment zone. Therefore, investors need to be selective on stock selection front. Identify the stocks which registered at least 20 per cent growth in sales and earnings. This week is going to be very crucial for global markets, as US sanctions on Iran oil supplies are coming into force.

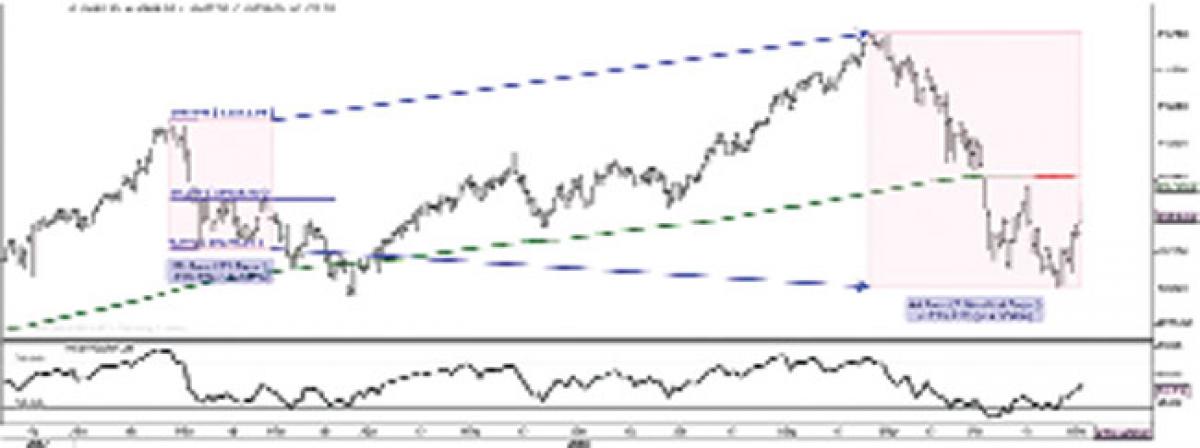

Any adverse developments will certainly dampen the sentiment of financial markets. Watch them closely. Technically, market is moving like a magnified mirror image to February downfall. It retraced 38.2 per cent from the bottom.

As we earlier mentioned, market entered a consolidation phase, where prices form smaller highs and lows. As long as it sustains below 10765-10800 level, there will be another leg of a downside.

The long-term indicator 200dma placed at 10765. Only above this level, we can expect the trend reversal to the upside. In the upcoming truncated week due to the festive season, we expect stock specific activity to continue as there will be only three days of trading.

Most of the indicators came out of the oversold zone and confirms that the market will be in a counter-trend corrective consolidation phase. Expect the market to move in a narrow range for the next few weeks.