Indian steel firms seek higher duties on steel imports as prices drop

Indian steel firms are putting pressure on the government to impose higher duties on imports as trade disputes and a global economic slowdown divert surplus Asian steel stocks to India, industry executives and government sources said

Imports of various grades of steel into India rose by around 8 per cent in the April-December 2018 period.

Mumbai: Indian steel firms are putting pressure on the government to impose higher duties on imports as trade disputes and a global economic slowdown divert surplus Asian steel stocks to India, industry executives and government sources said.

Local producers are suffering from the double whammy of a rise in cheap imports and low domestic steel prices, which threatens to wipeout the healthy profits made in the past couple of years.

The steel companies have approached the ministry multiple times over the past few months, alleging China, Japan, South Korea and Vietnam are dumping various grades of low-cost steel into the Indian market and stealing market share as a result, three government sources said.

India’s top four steelmakers - JSW Steel Ltd, Tata Steel Ltd, state-owned Steel Authority of India Ltd and Jindal Steel and Power Ltd - who together control over 45 percent of India’s total steel production, are the key companies who have complained, the sources said.

The ministry has given various indications that some measures might be taken, the sources added. However, they are more likely to be non-tariff measures as India has already suffered defeat in a dispute with Japan at the World Trade Organisation (WTO) on charges that New Delhi unfairly imposed import duties in 2016 to safeguard its steel industry.

The WTO upheld Japan’s complaint in November but India is planning to appeal.

The steel ministry did not respond to a Reuters email seeking comment.

RISING IMPORTS

Imports of various grades of steel into India rose by around 8 per cent in the April-December 2018 period, compared with a year earlier, government data showed.

During the same period, exports from India fell by more than 17 per cent, making the country a net importer of steel, mainly because the US, one of India’s biggest markets, imposed additional duties last year on steel coming from some Asian countries, including India.

As a result, the nation’s steel imports from countries such as Japan, South Korea and Indonesia surged. Chinese imports also climbed in the final quarter of 2018, Indian companies say.

According to government figures, for the April-September 2018 period imports from South Korea rose 29 per cent from the year-earlier period, Japanese imports increased 35 per cent, and Indonesian imports by 106 per cent.

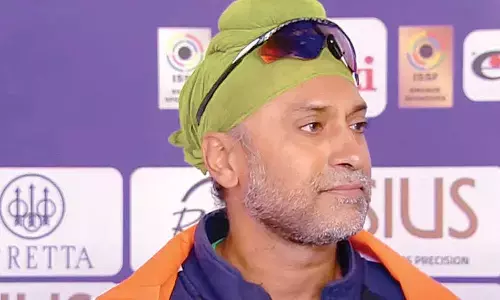

“The worry is imports,” said Seshagiri Rao, joint managing director at JSW Steel, India’s biggest steel company based on local production. He said the government had to “ensure that our borders are protected and goods will not come into India and hurt the domestic steel industry.”

The price of steel in India dropped by an average of more than 10 per cent between October and December, according to government data.

Domestic brokerage firm Edelweiss Securities said that they see earnings at metals companies “going downhill” after the third quarter.

Anil Kumar Chaudhary, chairman of SAIL, and Rao from JSW Steel, told Reuters they have both told the government of their concerns about imports.

Tata Steel and JSPL did not reply to an email seeking comment.

EXISTING MEASURES

India has been monitoring the impact of imported cheaper steel from China on domestic industry, the government said last month.

In a bid to support use of locally made steel, the ministry has urged automakers to cut imports from Japan and Korea. That has led to a dispute between the government and automakers who claim local producers are unable to make the high-quality steel they need.

India has already imposed stricter quality controls on more than 85 percent of steel products and it is expanding the list of locally made steel that must be used in government infrastructure projects, two government sources said. It is unclear if any low quality shipments have been turned back.

India’s steel minister Chaudhary Birender Singh told Reuters earlier this month that the government wants to expand the quality control regime to all steel products very soon.

The government is also considering imposing higher duties on the import of iron ore, a key raw material, to help state-owned miner NMDC Ltd, the sources said. While this could hurt JSW Steel, other steel majors have their own captive iron ore mines which shields them from price volatility.

Abhyuday Jindal, managing director of Jindal Stainless, the country’s largest stainless steel producer, said the company had asked the government review import duty on raw materials, as well as the impact of free trade agreements with the likes of Japan, South Korea and southeast Asian countries.