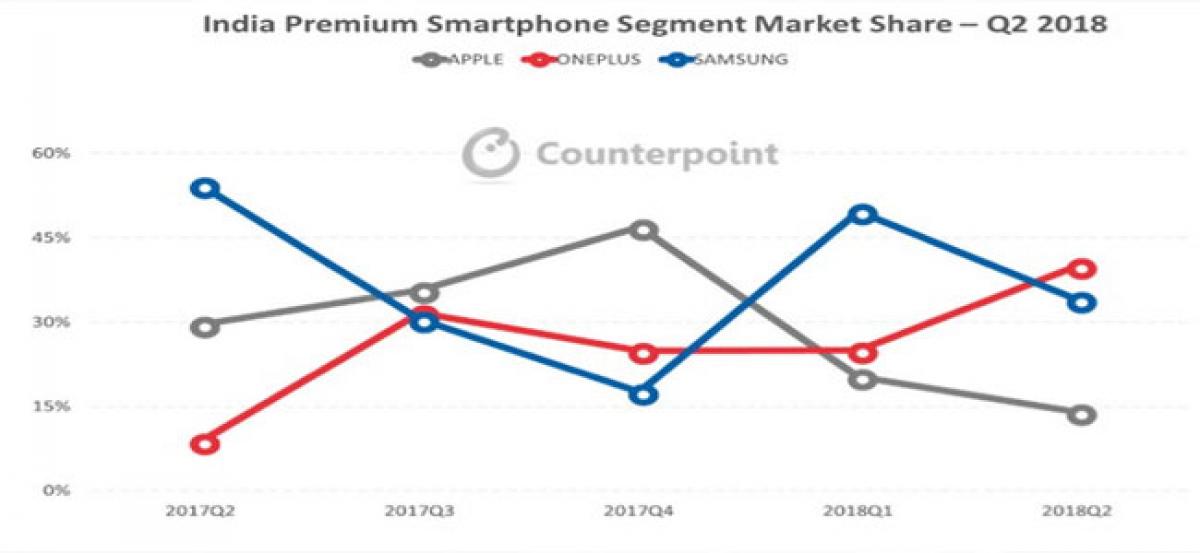

OnePlus surpasses Samsung, Apple to lead the growing Indian premium segment during Q2 2018

As per Counterpoint Researchs latest analysis on the important Indian smartphone market see here, the premium smartphone segment INR 30,000 grew 19 per cent annually and 10 per cent sequentially during Q2 2018 as more consumers upgrade to 2018 flagship launches by different Android OEMs in India

Bengaluru (Karnataka) : As per Counterpoint Research's latest analysis on the important Indian smartphone market (see here), the premium smartphone segment (>INR 30,000) grew 19 per cent annually and 10 per cent sequentially during Q2 2018 as more consumers upgrade to 2018 flagship launches by different Android OEMs in India.

The uptick in consumer demand in the premium segment was driven by increasing offers around the new launches as compared to a year ago. These offers range from Cashbacks, EMI, Data bundling and Trade-ins, aimed at reducing the affordability gap and therefore the overall premium smartphone segment grew 19 per cent YoY during Q2 2018.

"The steady focus on high-end flagship smartphones and unprecedented community connect helped OnePlus earn user trust and spread brand awareness through word of mouth. OnePlus became a strong No. 1 brand in premium segment with 40 per cent share within just 14 quarters of entering India as well that also catapulted it into the coveted group of the 5 biggest smartphone brands with over 4 per cent revenue share for the first time ever," said Neil Shah, Partner & Research Director, IoT, Mobile & Ecosystems, Counterpoint Research.

OnePlus surpassed Samsung to lead the premium smartphone segment for the first time ever for a full quarter. This was due to strong sales of its flagship OnePlus 6 which was launched during the quarter. India remains an important market for OnePlus, contributing to almost a third of its global revenue. Furthermore, with every flagship OnePlus userbase has been growing in India and this has now started translating into record sales for every new flagship it launches. The brand is also capitalizing on strong word of mouth and leveraging social media effectively to reach out to its target user base.

Samsung captured over a third of the total premium smartphone market during the quarter with promotions around its flagship S9 series remain strong.

Apple, on the other hand, had a weak second quarter as demand for its iPhone 8 and iPhone X begin to taper off due to seasonality and challenges in terms of pricing post duty increase. The Cupertino giant is also streamlining its channel structure as it gears up for all important 2H 2018 in India.

While the premium market grew but the demand is being skewed towards sub-INR 40,000 devices due to aggressive offerings such as OnePlus and that through online segment. This is a new trend where "affordable ultra-premium" is wooing aspiring rich and young consumers away from more expensive offerings from likes of Samsung and Apple. With likes of OPPO, Huawei, Vivo and Google looking to be aggressive in INR 40,000-60,000 segment in coming quarters, pressure on likes of Apple and Samsung will be even higher.

Market Summary:

• The top three brands Samsung, OnePlus and Apple contributed to 88 per cent of the overall premium market as compared to 95 per cent a quarter ago.

• This is due to the entry of new players in the segment led by Huawei (P20), Vivo (X21), Nokia HMD (Nokia 8 Sirocco) and LG (V30 Plus)

• OnePlus led the premium smartphone segment for the first time ever in India, capturing 40 per cent of the market driven by record shipments of its OnePlus 6 as compared to its previous flagships.

• OnePlus was also the fastest growing brand in the premium segment (+446 per cent) while shipments for Apple and Samsung declined YoY.

• OnePlus is now increasing its points of sale by launching its offline and exclusive stores across key cities. This will enable the brand to reach out to a larger user base going forward, as the premium segment market is estimated to grow faster than the overall smartphone market in India for CY 2018 and beyond.

• Samsung captured 34 per cent share of the premium segment. Its shipments declined 25 per cent YoY due to declining in shipments of S9 as compared to S8 last year. However, the promotions related to the S9 series remain strong which helped to push sales in both offline as well as online channels during the end of the quarter to streamline the inventory levels.

• Apple's share in the premium segment reached its lowest ever 14 per cent due to decline in shipments for its iPhone 8 and X series. Additionally, the increase in import duty and absence of local manufacturing impacted its pricing strategy in India. Apple is also looking to streamline its channel structure in India.

• Cashback and EMI offers continue to remain the major promotional activities leveraged by brands in the premium segment, with cashback being used by 8 out of 10 models in the premium segment in the online channel.

• In terms of best selling models, OnePlus 6 was the best-selling model in the premium segment followed by S9 Plus and OnePlus 5T. OnePlus 5T sales were due to the push by the brand during the first half of Q2 2018, clearing off inventory in anticipation of OnePlus 6. However, OnePlus 5T went end of life post OnePlus 6 launch.

• S9 series sales remain skewed in favour of S9 plus as users didn't mind spending extra for the upgrade to a larger screen.