Tokenisation Replaces Card Storage as Merchants Embrace Safer Online Checkout Models

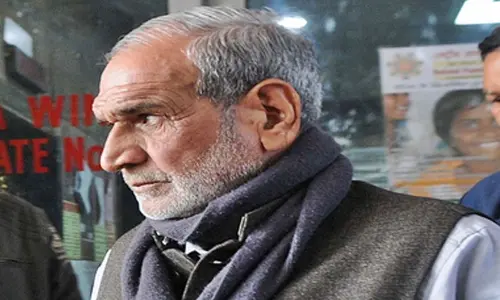

Arun Neelan discussed how tokenisation replaces sensitive card data with secure tokens, enhancing payment security and reducing fraud. He highlighted its role in enabling seamless, scalable, and user-friendly digital commerce.

As digital commerce grows, businesses are increasingly moving away from storing raw card data and adopting tokenisation as a more secure, scalable, and seamless method for processing online payments.

“When a returning customer makes a purchase using a saved card, merchants who have adopted tokenisation typically do not access or transmit the actual card number during the transaction,” explains Arun Neelan, a Lead Software Engineer with expertise in designing, implementing, and maintaining digital payment systems. “Instead, a secure token is used. This token is generated the first time the card is saved, either during checkout on the merchant’s site or through a digital wallet integration.” The token replaces the sensitive card number in future transactions, which helps reduce fraud risk, simplify PCI compliance, and strengthen checkout security.

Tokenisation works by securely transmitting the customer’s actual card details to a trusted tokenisation service provider, such as a card network, issuer, or PCI-compliant vault. The provider generates a unique token to replace the sensitive card information. This token is securely mapped to the original card data within a protected environment and is recognised throughout the payment ecosystem. Merchants, acquirers, and issuers use the token to process transactions without exposing the real card number, which helps reduce fraud and minimise the risk of data breaches. By separating card information from the transaction layer, tokenisation significantly reduces the likelihood of a data breach.

“If a token is compromised at one merchant or device, only that token is affected. It can be deactivated and replaced with a new token, or reactivated once the issue is resolved,” Arun explains. While merchants may retain card data for compliance or recordkeeping, tokens are primarily used for repeat purchases. This approach provides a safer, more seamless checkout experience for customers, he adds.

With deep experience in large-scale tokenisation platforms, including managing the full lifecycle of international card tokenisation programs, Arun plays a key role in modernising integrated rewards systems by adopting and expanding issuer-backed tokenisation through microservices architecture and cloud-native technologies. This modernisation eliminates legacy dependencies on sharing card details during transactions, while also enhancing user experience, strengthening security, and improving operational efficiency. These platforms support millions of cardholders across branded and co-branded credit card programs, enabling secure, scalable, and issuer-integrated tokenisation across a broad ecosystem of merchants and consumers.

As a technical lead, Arun brings deep expertise in aligning technology solutions with business goals while driving the delivery of scalable and secure platforms. He partners with stakeholders to gather requirements, ensures solutions meet strategic objectives, and leads agile teams through the full software development lifecycle. Arun proactively improves codebases by identifying refactoring opportunities, promoting maintainable architecture, and applying sound design principles. He works closely with leadership on planning and execution, contributing to estimations and thoughtful resource allocation. Additionally, he collaborates with architecture, product, operations, and support teams to deliver technically sound solutions that meet industry best practices and compliance standards. His focus on risk management, security, and operational efficiency contributes to the successful delivery of complex, enterprise-grade systems.

“Tokenisation is no longer just a security enhancement. It is becoming the default architecture for forward-looking commerce,” says Arun Neelan. “By decoupling sensitive data from the transaction layer, we’re enabling safer, faster, and more adaptive payment ecosystems.”

As tokenisation continues to shape the future of secure digital commerce, Arun remains deeply engaged in building innovative, scalable, and secure solutions that empower merchants and financial institutions to improve both security and user experience. His expertise and ongoing contributions establish him as a trusted technologist in the evolving digital payments landscape.