Delhi LG raises alarm over delayed CAG reports, calls for special session on Dec 19-20

Share :

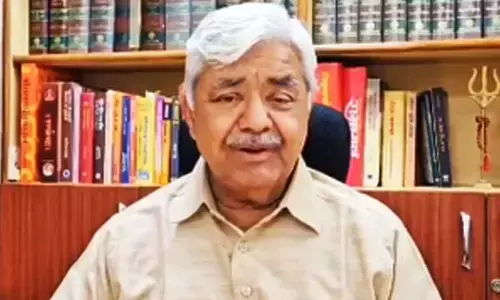

Delhi Lieutenant Governor, VK Saxena, on Wednesday raised serious concerns regarding the Delhi government's failure to lay the Comptroller and Auditor General (CAG) reports and asked to convene a special session on December 19-20 before the Legislative Assembly.

The letter underscores the constitutional responsibility of the elected government to uphold transparency and accountability, stressing the importance of laying the statutory audit reports before the legislature.

VK Saxena began his communication by drawing attention to the significant public importance of the issue, reminding Chief Minister Atishi of her obligations as an elected leader.

He pointed out that as per constitutional requirements, it is the government's duty to present the CAG audit reports to the Legislative Assembly. These reports are a vital part of the accountability framework, intended to ensure the functioning of government departments is scrutinised and that public funds are utilised properly.

“I am sure that as elected Chief Minister of Delhi, you are conscious of the significance of statutory audit on the functioning of various departments undertaken by the Comptroller and Auditor General (CAG) of India,” Saxena wrote.

He went on to remind the CM that it has been two years since these reports were withheld despite consistent reminders sent to both Atishi and her predecessor.

Saxena expressed disappointment that an administration which came to power on a platform of transparency had chosen 'opacity in disclosure' by deliberately failing to lay these reports before the Assembly.

The L-G's letter pointed out that fourteen CAG reports, covering different departments of the Delhi government, remain unpublished.

Saxena described this as a 'conscious and deliberate lapse' on the part of the government, a failure that had reached such an extent that a few Members of the Legislative Assembly were forced to approach the Delhi High Court to enforce their constitutional rights. This, he said, was a severe blow to the dignity of the legislature, the body meant to represent the will of the people.

Saxena also noted that it was only after the Delhi High Court took judicial notice of the issue that the Delhi government took action.

In his letter, he recounted how the Delhi government finally forwarded the CAG reports to him for approval on December 13, 2024, just before a hearing on the issue in the Delhi High Court. Saxena had promptly returned the reports with his approval for them to be laid before the Legislative Assembly.

Further drawing attention to a recent development, Saxena cited an order from the Delhi High Court on December 16, 2024, in the case of Vijender Gupta and others vs. GNCTD and others. The court had recorded an assurance from the Delhi government’s counsel, Senior Advocate Sudhir Nandrajog, that the CAG reports would be forwarded to the Speaker of the Delhi Legislative Assembly within two to three days.

Saxena expressed concern about the limited number of sessions convened by the Delhi government over the past five years.

“Normally, any legislature, including the Parliament of India, convenes at least three sessions a year, apart from special sessions,” he noted.

However, under the current government, Delhi has convened only five sessions in the last five years, with the latest session of the Delhi Legislative Assembly adjourned sine die on December 4, 2024.

Given the urgency of the matter and the approaching expiration of the current Assembly's term in February 2025, Saxena urged Chief Minister Atishi to consult with the Speaker of the Assembly to convene a special sitting to lay the CAG reports before the House.

Saxena further emphasised that this situation required immediate action to preserve the integrity of legislative accountability. He concluded the letter by affirming that he was sharing a copy of the communication with the Speaker of the Legislative Assembly and the Leader of the Opposition, underscoring the bipartisan nature of the call for transparency.

As elections for the Delhi Legislative Assembly approach, the handling of this issue is likely to be a point of focus in political campaigns.

STOCK PICKS

ABB India | TRADE-BUY |CMP: Rs7,817 | SL: Rs7,500 | TARGETS: Rs8,400 and Rs8,500

ABB India has broken above its 9-period and 21-period exponential moving averages, signalling strong bullish momentum. The stock is trading well above its 200-day moving average, reinforcing its upward trend. With an RSI of 63, indicating positive momentum, ABB India is positioned to reach targets of Rs8,400 and Rs8,500. A stop-loss at Rs7,500 is recommended for effective risk management.

HUDCO | TRADE-BUY |CMP: Rs256.70 | SL: Rs244 | TARGET: Rs295

HUDCO has broken out above Rs255.80, indicating a strong upward trend. The stock is above key moving averages, with an ADX of 30 and an RSI of 68, signalling robust momentum. Given the favourable technical setup, the stock is expected to continue higher towards Rs295. Traders should enter at current levels, setting a stop-loss at Rs244 to manage risk effectively while targeting the upside potential.

(Source: Riyank Arora, technical analyst at Mehta Equities)