CAG Report: Delhi Liquor Policy Led to Rs 2,002 Cr Revenue Loss

Arvind Kejriwal

CAG audit reveals Delhi liquor policy caused a Rs 2,002 Cr loss due to regulatory failures, excise mismanagement, and policy loopholes.

A report presented by the Comptroller and Auditor General (CAG) in the Delhi Assembly on Tuesday detailed financial losses amounting to Rs 2,002.68 crore due to the implementation of the now-scrapped 2021 Delhi excise policy. The report attributes the revenue shortfall to policy missteps and regulatory failures.

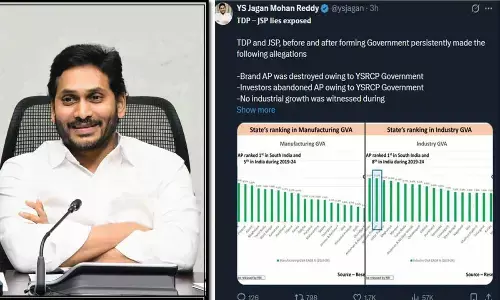

The Delhi excise policy, enforced in November 2021 and withdrawn in September 2022, had far-reaching consequences. Several leaders of the Aam Aadmi Party (AAP), including former Chief Minister Arvind Kejriwal and ex-Deputy Chief Minister Manish Sisodia, were arrested in connection with corruption allegations linked to the policy. The controversy is also cited as a key factor in AAP’s electoral defeat this month, paving the way for the Bharatiya Janata Party (BJP) to return to power in the national capital after 26 years.

The report outlines multiple components contributing to the financial setback. The most significant factor, accounting for Rs 941.53 crore, was the prohibition on liquor vends in non-conforming areas—zones not aligned with land use regulations. Another Rs 890.15 crore loss resulted from the absence of new tenders for 19 zones where liquor licenses had been surrendered. The CAG noted that no alternative arrangements were made to ensure the continuation of retail operations in these zones.

Additionally, the government’s decision to waive license fees under Covid-19 relief measures led to a revenue loss of Rs 144 crore. Another Rs 27 crore loss was attributed to errors in collecting security deposits from zonal licensees. These factors collectively amounted to the Rs 2,002.68 crore shortfall, as documented in the CAG audit.

The audit identified regulatory lapses within the Delhi Excise Department. The failure to enforce Rule 35 of the Delhi Excise Rules, 2010, was flagged as a major violation. The rule restricts individuals or entities from holding multiple licenses across different categories—wholesale, retail, and hospitality—yet certain firms allegedly benefited from its non-enforcement.

A key contention raised in the report concerns the increase in the wholesale margin from 5 per cent to 12 per cent. The Enforcement Directorate had previously alleged that a portion of this margin was earmarked as kickbacks for AAP leaders. Justifications provided for the margin hike, including costs associated with setting up government-approved quality control labs and transportation expenses, were deemed insufficient by the CAG. The report pointed out that these labs were never operationalized, further raising concerns about regulatory oversight.

The CAG report also highlighted issues related to monopolization within Delhi’s liquor market. Three wholesalers—Indospirit, Mahadev Liquors, and Brindco—dominated distribution, collectively accounting for over 70 per cent of liquor sales. Among the 367 Indian Made Foreign Liquor (IMFL) brands available in Delhi, 76 brands were exclusively supplied by Indospirit, while Mahadev Liquors and Brindco controlled 71 and 45 brands, respectively. The report indicates that this market structure led to cartel-like behavior, further impacting revenue generation.

Another critical finding in the audit concerns the disparity in liquor sales between private and government-run outlets. High-demand whiskey brands such as Royal Stag Reserve/Premier saw just 9.25 per cent of sales through government shops, while 90.75 per cent were recorded at private vends. Officer’s Choice Blue whiskey had a higher government sales share at 22.04 per cent, but McDowell’s No 1 registered a mere 2.26 per cent in public sector outlets. The skewed sales figures resulted in a loss of potential government revenue, the report suggests.

The findings have intensified the ongoing political battle over liquor policy corruption in Delhi. The AAP government had previously defended the policy as a revenue-enhancing measure aimed at curbing illicit liquor trade. However, opposition parties, particularly the BJP, have used the CAG report to reinforce allegations of mismanagement and favoritism under AAP’s administration.