There are more important things in life than money

After reading one of my pieces in this column, my grandson called up one night enquiring anxiously whether the phenomenon of the falling rupee is likely to result in alarming consequences to the country’s economy. By way of reassuring him, I told him that what really matters for common citizens, in a situation such as this, is the relative purchasing power parity (PPP) of the currency of the nation. A ₹100 note today in India, for instance, goes much further, in terms of the goods and services it can enable one to access, than a dollar in the United States of America. A meal, for instance, can come for as little as ₹30 to 100, while a similar meal in America will probably cost $10 or more.

Now, that may be an overly simplified example, as the falling value of the rupee has many implications, desirable and otherwise. Depreciation influences the trade balance positively, contracting the demand for imports and improving the prospects for exports of goods and services. Exports of goods and services, such as IT, textiles and pharma, will receive a boost, on account of their having become cheaper globally. FDI will also increase, along with remittances from non-resident Indians, improving the trade balance over time. However, fuel, electronics goods, education and travel will cost more and a rise in inflation will take place, increasing the foreign debt burden; and, if depreciation sustains for long, lead to instability, potentially causing foreign investors to pull out, apart from putting pressure on household budgets.

In sum, a weak rupee benefits exporters and service providers, but squeezes importers, consumers and borrowers, leading to broader inflationary pressures.

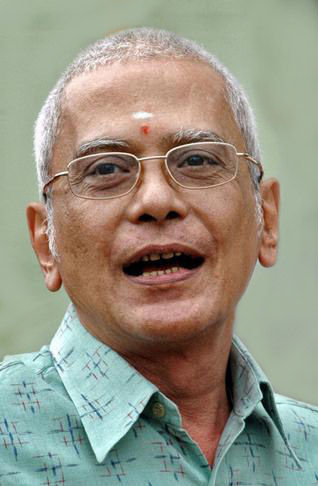

The earliest memory I have of understanding the value of money was when I was in the last year of school. The then Education Minister of Andhra Pradesh often used to drop in at our place. He once told me to always be sure of carrying a rupee in my pocket, just for the sense of assurance it gave one, in case an unforeseen contingency arises. A piece of advice that I have followed ever since.

It was not until years later, as a college student, however, that the concept of pocket money first entered my life, in the beginning as a daily allowance, and then, as the weekly pocket money. It began at the level of ₹ three a day, followed, a few years later, by ₹ 25 a week, both limits set by my mother. But then, those days, one could eat a hearty meal in the Taj Mahal hotel at Abids in Hyderabad for ₹1.25 or, if one was feeling rich, a plate of vegetable pulao with salad at Kwality’s next door for the same price. Coca-Cola came at 25 paise a bottle and the costliest entry ticket for a movie was ₹2.50. One lived comfortably.

I am no economist, but I have gotten into the habit of multiplying, by a factor of 300, the value of a commodity or service in rupees, between then and now. Things have not changed much, in terms of the purchasing power parity, although this time over a period of time, and not in different currencies.

When I joined the IAS, my consolidated monthly pay was ₹400 a month. And, today, I draw more than ₹1,25,000 as pension every month. Meanwhile, even after applying the factor of 300, I am nowhere near being able to afford what I could get for ₹300 those days.

But no matter what the cost of living, and irrespective of what my monthly income was, one thing I do remember is that my income was perpetually unable to catch up with my expenditure!

My wife and I have never denied ourselves reasonable comfort, and occasional luxury. However, money came and money went, as it does now, but neither of us has ever mastered the art of living within a budget, having never either made one, or followed it! My good fortune, perhaps, or maybe the other way around, that I should have married a person, whose approach towards money was precisely the same as the one I inherited from my mother!

Those were the days when successful lawyers rarely accepted an offer to be elevated to the Bench for fear of having to live within contracted means, although it meant moving to a position of higher recognition. My father, however, gladly accepted the offer; and not merely because, even as a successful lawyer, his earnings in terms of money never matched the reputation he enjoyed, both at the Bar and at the Bench. And in his will, he left all his earthly possessions to my mother, his vast library of over several thousands of books, to my elder brother, out of which 100 of my choice, were to go to me. And it was not until a ruling of Justice Chinnappa Reddy, as a Judge of the Supreme Court, ordered family pension to be applicable to the widow of High Court judges that our mother had any independent income. Once that came to be, however, she thoroughly enjoyed herself, splurging her modest earnings on her grandchildren.

I have always felt that money, beyond a point, has little value. Even today, I wonder what more I could do to be happier than I am now, if my income were more than what it is now. I often wonder what people, who are said to be worth hundreds and thousands of crores of rupees, do with that sort of wealth, compared to the satisfaction and comfort I enjoy, with my present financial situation.

Having never cultivated a sense of attachment to money, I do not, even to this day, carry a wallet. Silas Marner would certainly have looked at me with disfavour. So would Henry VIII, who was obsessed with wealth, especially from the Church. And the paradox in the relationship between me and the commodity called money is that while I was never short of cash, I also remained constantly in debt! From overdrawing from my accounts in banks, borrowing against life insurance policies, fixed deposit receipts, and share certificates. By the time I superannuated from service, however, I took care to see that most of my debts were liquidated; a situation that would have given much pleasure and satisfaction to William Shakespeare, who famously said “never a lender or a borrower be”, in the words of Polonius from the play Hamlet.

I stated earlier in this piece that I attach no particular value for money beyond the point. That is because I think there are more important things in life. But there are those for whom the feeling is the same, but because they have so much of it that it matters little to them, even if what a normal person considers a small fortune goes down the drain. That brings me to a humorous conclusion to this piece.

There was this Texan billionaire, whose Mercedes car stopped at a gas station to fill up. The engine was left running. After a little while, the attendant shouted to the driver saying, “Hey! Turn off the engine, will you? I am unable to keep pace with the engine!”

(The writer was formerly Chief Secretary, Government of Andhra Pradesh)