Reality Of Real Estate: Fraud a constant, shadowy presence

New Delhi: Real estate fraud, a sinister underbelly of property transactions, manifests in various forms, exploiting unsuspecting individuals and tarnishing the integrity of digital transactions. From deceptive housing projects ensnaring professionals to the misuse of QR codes in online dealings, its impact call for stringent measures to safeguard the digital economy.

Recently, several JNU and IIT professors were duped to the tune of Rs 11 crore on the pretext of providing affordable housing project under land pooling policy of Delhi Development Authority (DDA), an official had said, adding that they have arrested varsity’s senior technical assistant in connection with the fraud and cheating.

The scam came to light after an FIR was filed based on complaints from professors at Jawaharlal Nehru University (JNU) and Indian Institute of Technology (IIT) Delhi by the Economic Offences Wing (EOW) of Delhi Police. The complainants alleged that in 2015, the accused identified as P.D. Gaikwad, a Scientific Officer at JNU, formed the Noble Socio-Scientific Welfare Organisation (NSSWO) to offer affordable housing.

Gaikwad, as the President, lured them into becoming members, presenting details of a proposed housing project under DDA’s land pooling policy in the L-Zone, Najafgarh. The complainants joined NSSWO, booking units in the project and making payments.

Gaikwad, in his role, provided false updates on the project’s progress. In 2015, he showed them a piece of land in L-Zone without supporting documents, and over time, they realised he had deceived them throughout the project. In 2019, Gaikwad informed them of a new society, Siddhartha Officers Housing & Social Welfare Society, suggesting a switch from NSSWO. Complaints to return their money went unanswered. Gaikwad collected over Rs 11 crore, misappropriating the funds.

“During the investigation, complainants provided materials, brochures, and receipts from Gaikwad. Scrutiny revealed deceptive pictures and representations of the housing project, along with inducements in emails depicting DDA’s land pooling policy,” said Deputy Commissioner of Police (EOW), Surendra Choudhary.

From cunning schemes that prey on the dreams of home seekers to the exploitation of digital payment methods, real estate fraud takes on diverse disguises. While ‘Scan the QR Code and Pay’- is undoubtedly a very convenient method of payment in the Digital Age, major inroads have been made by cyber criminals to misuse the same to the disadvantage of the hard-earned money of other individuals.

There has been a rise in real estate frauds using QR Codes. The target platforms are online real estate broker portals where the seller/property owner is spotted and given a call regarding the property. On showing a level of urgency to purchase or rent the property, the impersonator sends a QR Code/link to the Property Seller to enable his payment. As soon as the same is scanned by the seller, money gets debited from the account of the seller.

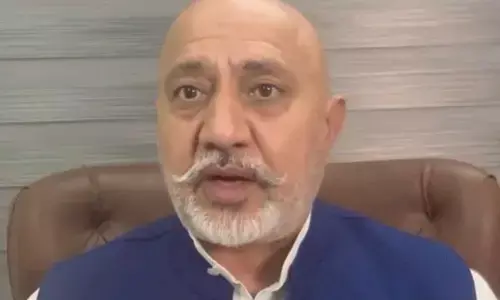

Advocate Anant Malik said that the basic mistake which is made here is the fact that the receiver of money ought not to do or scan anything to receive payment. It is for sending money to other accounts and thus it is the sender who is required to follow the guidelines for online transfer. The chain of offences committed herein commence from impersonation to cheating to dishonestly and fraudulently inducing the seller.

Given the scale at which such crimes are being committed and the losses that are being incurred, the above legal remedies may help but only to a certain extent. “Digital India is unfolding new features and with every such development there are loopholes which allow the criminals to go scot-free. The same has even been observed by the Delhi High Court in Vineet Jhavar v. State of NCT of Delhi,” said Malik. Such offences extend well beyond the immediate financial losses associated with fraudulent transactions, and it is the economy at large which suffers firstly through the immediate loss and secondly, it is the loss of the people’s trust in the online financial transactions.

Malik further said that the economic impact is two-fold – first, the direct financial losses incurred through the fraud of often hard-earned money of gullible people, and second, the indirect losses resulting from the diminished trust of the people in online financial transaction platforms which is against the aspirations of an advanced Digital Bharat.

In essence, these cyber-enabled offences not only breach individual trust, but also have far reaching consequences that reverberate through the economic landscape of the country.