Poor are made to bleed more – by design

Poor are made to bleed more – by design

More recently, as India emerged as the fifth largest economy in the world, economist Rathin Roy remarked: “Bangladesh as a country is much poorer than India, but its citizens are richer.” The economic design that the world follows has perfected the art of sucking wealth from bottom to the top. This has to be reversed. MNREGA workers need more support than multi-billion dollar industries

A few months back, in January 2022, the India supplement of the Oxfam's latest report entitled 'The Inequality Virus' explained the huge wealth disparity that prevails. It mentioned that the increase in wealth of the top 11 billionaires in India in the pandemic years was sufficient to fund the MNREGA programme for ten years.

This compare and contrast essay did point out the vast differences – as contrasting as the brightness during the day and the dark nights – but somehow it didn't make the country sit back, think and deliberate. Knowing that MNREGA entails an expenditure of Rs 73,000 crore per year, the report certainly brought out the appalling wealth inequality that prevails. But perhaps, the comparison was more notional in a way that the contrast, as well as the gravity of the extreme inequality that it pointed to, was lost.

The rich were always known to becoming stinking rich while the poor have seen their incomes stagnate. For instance, in the US, 745 billionaires now hold more wealth than half of American households. In India, as the 2019 World Inequality Report had categorically mentioned that the inequality that prevailed "had no precedent in recent history", but not till when the Prime Minister talked of the "revdi culture" that a debate actually began about what constitutes freebies in a society where majority live in poverty and remains deprived of social safety and security.

More recently, as India emerged as the fifth largest economy in the world, economist Rathin Roy remarked: "Bangladesh as a country is much poorer than India, but its citizens are richer." He was commenting on the higher per capita income of $1,962 recorded in neighbouring Bangladesh in 2020-21 as against India's $1,935. This comes at a time when industrialist Gautam Adani has become the second richest person in the world.

Nevertheless, let's go back to discussing MNREGA, which is known to provide 100 day guaranteed income to rural households. A few weeks back, writing in The Times of India senior journalist Swaminathan S Anklesaria Aiyar had talked of Rs 80,000 crore ($10 billion) subsidy to be provided to the Vedanta-Foxconn's proposed silicon fabrication plant in Gujarat. In addition, Gujarat will be providing free land and other facilities for the plant, adding on to the enormous cost of freebies at tax payers' expense.

Interestingly, the Rs 80,000 crore subsidy to just one industrial plant is higher than the annual allocation that is made for MNREGA. Since the Vendanta's fab plant is unlikely create a large number of jobs, the money could have better used. It could have either been used for doubling entitlements under MNREGA or to double the wages of MNREGA workers. In both the cases, it would have garnered a thumping applause for doling out the much needed incentive. In either case, this amount would have helped create more rural demand, which many economists believe is the way forward to reignite the economy.

This step would have been in tune with the findings of a 2015 IMF study that had conclusively shown that more money into the hands of 20 per cent poor leads to a higher GDP growth. On the other hand, the study that analysed economic data of 150 countries over the period 1990 to 2012 had also shown that giving more to the top 20 per cent in fact lowers economic growth. I believe policy makers should treat this study as an economic mantra, and like Mahatma Gandhi's Talisman, engrave it in the corridors of the Finance Ministry.

Knowing well that the Trickle Down theory has failed, this mantra should enable them to focus on where the economic needs are. The US President Joe Biden too has publicly acknowledged the failure of Trickle Down and has promised to put efforts in building the bottom and the middle. As the US public advocacy group Public Citizen tweets: "In the past 30 years, the richest 10 per cent have collectively added over $59 trillion to their wealth. The poorest half of America have added only $900 billion. It was never meant to trickle down to us – it's being siphoned from us."

This is what India too needs to accept, and shift the policy approach to pull the needy out from the clutches of poverty, hunger and malnutrition. Howsoever subtle, the winds of economic change are silently flowing. Only a few days back, in what appears to be an effort to boost economic growth, the right-wing UK Prime Minister Liz Truss had announced income tax cuts of 45 billion pounds. This would have benefitted the top 5 per cent (and to some extent the lower strata) with more tax savings and bonuses. Removing the additional tax rate of 45 per cent on earnings in the highest income bracket it was aimed at reining more freebies for the rich and mighty. In a surprise move, even the IMF questioned the deal asking the UK treasury to re-evaluate the tax measures.

In a u-turn, the treasury chief abandoned plans to scrap the top 45 per cent rate of income tax paid on earnings above 150,000 pound sterling. Coming after the publicly disowning of the trickle down concept by Joe Biden, the withdrawal of the tax concessions to the UK super-rich by Liz Truss is indicative of a positive trend in economic rethinking, however small it may appear to be.

In another move, the US Federal Communication Commission (FCC) has rejected $886 million subsidy package that Elon Musk's SpaceX venture had applied for. Even though SpaceX is crying foul, the fact remains that Elon Musk is the richest person in the world, whose wealth Bloomberg estimates at $240 billion. Earlier, Musk had decried public subsidies but when it comes to getting a finger in the pie, he is now all for it. Whatever be the reason, I expect FCC to stay firm. After all, a person who makes $81.25 million ever hour should give up on any right to seek claim over federal subsidies.

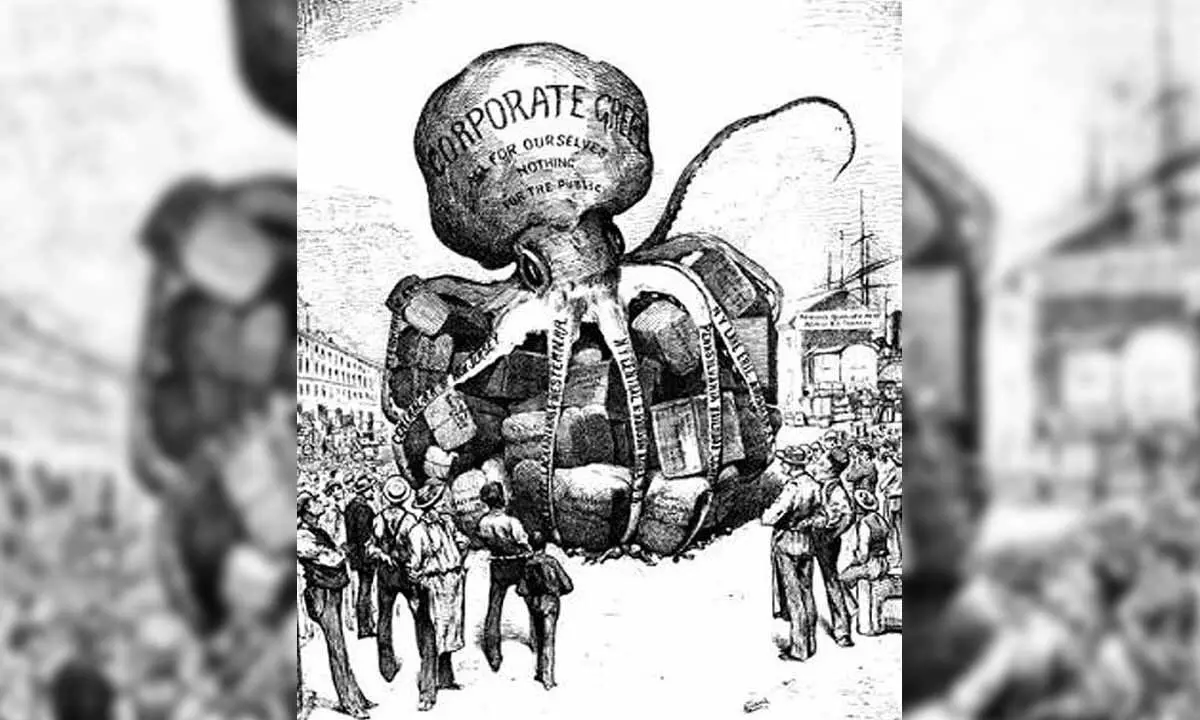

Corporate greed knows no bounds. It is quite obvious that wealth inequality is eating the world. The economic design that the world follows has perfected the art of sucking wealth from the bottom to the top. This has to be reversed. MNREGA workers need more support than multi-billion dollar industries. That's the way to reach out to the masses, and realise the Prime Minister's vision of Sabka Saath Sabka Vikas.

(The author is a noted food policy analyst and an expert on issues related to the agriculture sector. He writes on food, agriculture and hunger)