Enabling enterprises to meet strategic goals

Docufund specialises in end-to-end solutions to help businesses become market leaders

Today's market belongs to those who know what their consumers want and work to fulfil those needs. The only brands that survive and thrive in a competitive market are the ones that best manage change and evolve with growing consumer needs and if you think that you have made it after concluding your company name, registration and started it, then you are missing the fact that it actually just started then. It is then imperative that you would have an organisation that helps clients with end-to-end business solution service to be a market leader.

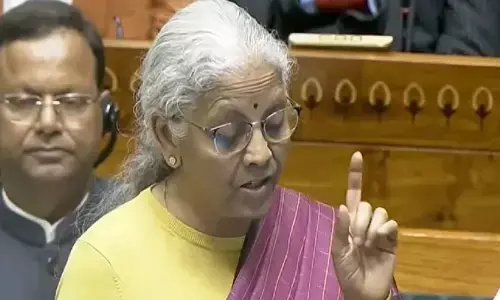

T Chandra Kala, Managing Director of Docufund, which specialises in documentation of client goals, their capital expenditure and revenue expenditure requirements, for an all inclusive competitive business intelligence, financial and funding advisory, spoke to Bizz Buzz at length. "We support all micro, small and medium enterprises with various competitive business intelligence and development services which enhance their finances and business management to be a better player in the market compared to their competitors," she said.

Docufund, she continued, believes in building a healthy relationship with clients, small and medium entrepreneurs, partners, auditors and employees to deliver great results by providing a great service to clients. "Every firm needs business expansion investment one day to be at par with their competitors and also for the market share. We work for the betterment of our clients by introducing various business and financial models into their business by becoming an integral part. Detailed business expansion forecast report with future projections of P&L and bottom line projections will make their decisions hassle-free for business expansion," adds Kala.

Use of proven investment strategies designed to meet a firm's risk tolerance and standing up against market volatility with an authentication of auditors and accountants to generate financing from banks instead of melting your company cash flows client can count on unbiased recommendations and impartial guidance based directly on your needs and goals." We create a strategised plan with a supporting business case that evaluates risk and returns on investments then compare them with market research for accurate analysis," she elaborates.

Like every other startup, Kala also faced struggles and challenges. "We always had a major challenge of acquiring client and delivering the service required; it took nine months to serve the first client. Service delivery with limited resources was always a challenge for us until we made changes in our human resources plans." Presently we get new clients from the leads of existing clients; we are part of a few business networking groups and attend MSME meetings too to improve our business and clientele," she says.

Helping raise funds

Financial Detailed Report (DPR) is an umbrella for all the insights of a client's project. A right documentation which self explains all their requirements to the fund providers, which makes the client stand unique when compared to competitors.

Matching client's goals

Docufund has expertise in project financing documentation; we support for a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral.

Foreseeing client's investment yields

Bottom-up, top-down, fundamental, and technical analysis report evaluating an overall financial strategy predicts a company's future performance and determines its suitability to a specific investor.

A good financial plan keeps a client focused and on track as the company grows, when new challenges arise, and when unexpected crises hit. It helps the client communicate clearly with staff and investors, and build a modern, transparent business.

Right info for right strategic decision

"As we are in a service industry since last five years, we never were in requirement of a loan. It took about four plus years to improve Docufund and we never counted money during this process," adds Kala.

She explains why rules and procedures should be more entrepreneur-friendly. "As all the entrepreneurs are job creators and tax payers, getting right assistance from regulatory bodies at the right time brings a lot of difference. Startups are like plants that need hyper care from promoter and support from regulatory bodies when we have a vision to enjoy fruits forever."

Being ethical and visionary, if one can connect the missing dots of requirements of this world, yes they can be a great company in the future, Kala signs off, wishing good luck to all the startups.