Private investment revival: Govt must stay the course on reforms

For a long time, policy makers and experts have faced a curious conundrum: despite the high growth rate of India, generally fiscally prudent policies, and high capital expenditure, the country was not able to attract huge private investment. This seems to be changing, with data compiled by the investment monitoring firm Projects Today showing that in the second quarter of the current fiscal there was a steep rise in private sector investment plans. New outlays by private companies almost doubled to Rs 10.55 lakh crore in 1,800 projects, up from Rs 5.69 lakh crore in the same period in 2024-25.

In fact, the entire first half of 2025-26, witnessed a spurt in private investment. It touched Rs 34 lakh crore, which is a 22.3 per cent rise on a year-to-year basis. What is more encouraging is that manufacturing, the Indian economy’s Achilles’ heel, received considerable investment. Electricity projects also got a lot of money. This upturn is a happy break to the prolonged investment famine, a phenomenon that plagued India’s post-pandemic recovery, the most distressing consequence of that being sluggish employment generation.

A concomitant development has been a sharp rise in public expenditure; in fact, the government has borne the burden of infrastructure building in the last few years. Large-scale infrastructure spending did lead to the building of highways, ports, airports, energy networks, etc., but it was never a happy situation. For a long period, private players hesitated to put in their money in India, despite government functionaries, including Finance Minister Nirmala Sitharaman, repeatedly beseeching them to do so. The present surge, therefore, will come as a pleasant surprise not just to the government but also everyone else.

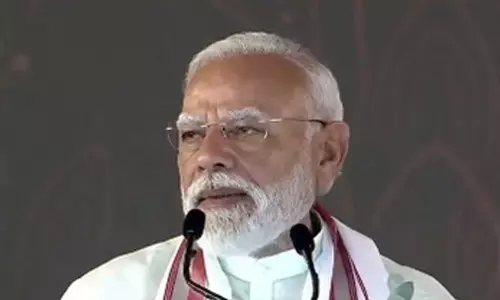

It will not be unfair for the Narendra Modi government to take credit for the glad tidings. It can justifiably claim that its policy framework created a macroeconomic environment that brought in the turnaround. Its fiscal responsibility (despite continuously high capital expenditure) and inflation management did play an important role in imparting stability to the policy framework. We hope that the upturn is a reflection of the growing robustness of the economy rather than just a cyclical bounce; the government would also like to believe that this is the beginning of a new phase of private-led expansion.

The two major decisions that it took this year must have had a salutary effect on the investment climate. The first was the generous income tax relief announced in the Budget for 2025-26, leaving considerably higher disposable income in the hands of consumers. This, in turn, bolstered domestic demand—a phenomenon that has the potential to trigger the virtuous cycle of higher consumption, more demand, capacity expansion by businesses, more investment and job creation, leading to further rise in demand, and so on. Such a chain reaction is a prerequisite in a developing economy.

The second decision, the rollout of GST 2.0 just ahead of Diwali, also augmented the purchasing power of common people. Anecdotal evidence and some estimates suggest a shopping carnival during this festive season. While such decisions don’t impact directly and may not have a big bearing on decision making by investors, they do underscore the government’s commitment to reforms, which businesses all over the world will welcome. The government must continue its emphasis on structural reforms to sustain investors’ interest in India.