What to Know Before Buying Term Plan Insurance?

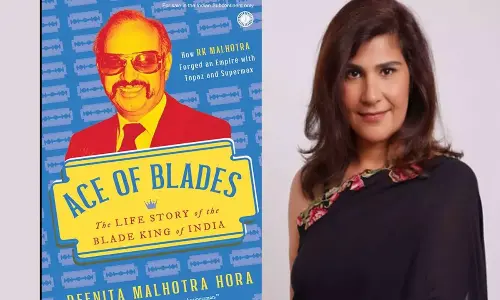

What to Know Before Buying Term Plan Insurance? (Image Source: Shutterstock)

A term plan insurance is the simplest form of life insurance. It is a type of life insurance that covers you for a certain period in return for a specific amount of premium you pay.

A term plan insurance is the simplest form of life insurance. It is a type of life insurance that covers you for a certain period in return for a specific amount of premium you pay. A term plan guarantees the payment of the stated death benefit to the beneficiary if the policyholder dies during the term specified in the policy.

A term plan insurance is typically less expensive than a permanent whole-life policy. The best term plan can provide financial security to the family of the policyholder at the most affordable rates. One of the best benefits of a term plan is that the entire premium goes into securing the policyholder's insurance cover.

What is a Term Plan Insurance?

A term plan insurance is a life insurance product, which offers financial coverage to the policyholder for a specific time. In case of an unfortunate event during the policy term, the death benefit is paid by the insurance company to the nominee. An individual should know the importance of key features of the best term plan before purchasing it. It is also advisable to understand the benefits of health insurance. The main objective of taking term insurance is to provide life cover to the policyholder and financial security to their family.

Term insurance provides a genuine life cover. Hence, there are no savings or profits components. It is a basic plan which makes life insurance more affordable compared to the other options. It is also possible for the policyholder to opt for a larger cover at a nominal premium when compared to a similar policy.

Image Source: Shutterstock

How Does a Term Plan Insurance Work?

A term plan insurance is an agreement between the person who owns the policy and an insurance company. The policyholder must agree to pay a premium for a specific time. In return, the insurance company guarantees to pay a specific death benefit in a lumpsum to the beneficiary upon the death of the policyholder. The death benefit amount is usually tax-free. The lumpsum pay-out offered by the term plan to the family of the policyholder can be used to clear various liabilities like loan repayment, medical emergencies, etc. It can also be used to meet their regular expenses in case of the sudden death of the policyholder.

Benefits of a Term Plan Insurance

There are several benefits of a term plan insurance. Here are the most important ones.

• One of the most important benefits of a term plan is that it comes with affordable premium costs. The entire premium paid towards a term plan insurance covers the risk of unexpected losses. It also offers a higher coverage amount for the long term at exceptionally low premiums.

• A term plan insurance also provides the benefit of flexible premium payment options. The policyholders can choose their preferred frequency and mode of premium payment from the diverse options provided by the insurance company.

• As per Section 80C of the Income Tax Act, the premiums paid towards the term plan are deductible from taxable income up to a maximum of Rs. 1.5 lakh. Moreover, the death benefit received by the nominee is tax-free as per Section 10(10D).

• The policyholder can purchase a term insurance rider to get an additional cover over the base plan, as per their needs.

Image Source: Shutterstock

Things to Consider Before Choosing a Term Plan Insurance

Before buying the best term plan, the policy seekers are usually perplexed about the best plan available in the market. So, here are some factors which can help them select the best term plan provided by the different insurance companies.

Requirement of Coverage Amount

An individual can calculate the amount of cover required from a term plan insurance by subtracting their assets from their long-term financial obligations.

Claim Settlement Ratio – CSR

The CSR is the ratio between the life insurance claims paid to the claims received by the insurance company in a financial year. A higher claim settlement ratio of around 90% indicates that the insurer has a quick and robust claim settlement process.

Amount of Premium

An individual should compare the premium rates of all available term plans and choose a plan that offers a high coverage at affordable premium rates.

Solvency Ratio

The solvency ratio of an insurer helps the policyholder determine whether the chosen insurer will be financially capable of settling their claim if required.

Read the Terms and Conditions

The policy seekers should make sure to read the terms and conditions written in fine print on their term policy. It provides vital information on exceptional cases where the death benefit cover is provided.

Conclusion

Investing in a term plan insurance is a smart way to secure the financial well-being of your loved ones in case of unfortunate events that may deprive them of your protective presence. Moreover, you can avail of it at affordable premium rates.

Author Bio: Mithilesh Singh is a writer who specializes in writing content on Finance and Banking subjects. He is a Digital Marketing Consultant, Blogger, and Co-Founder of Planet Nursery Live.