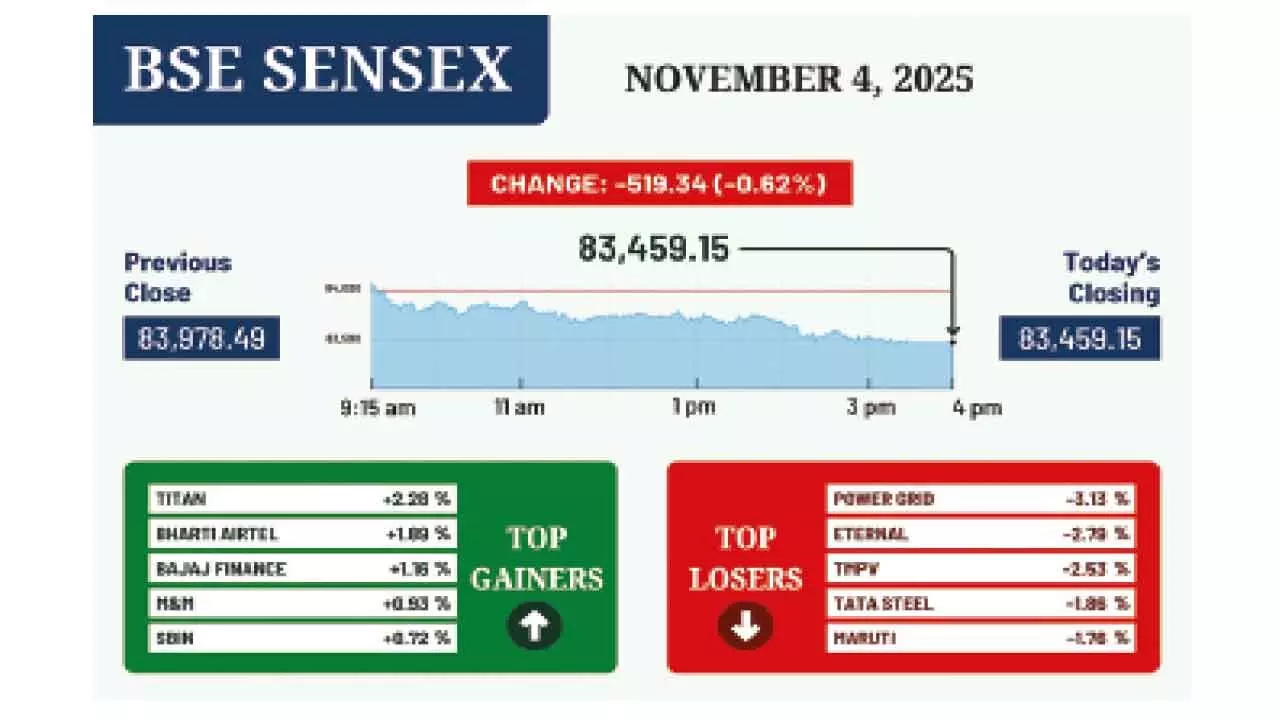

Sensex tanks on profit booking as FIIs offload

Utility, metal and IT shares in red; Weak global trends, foreign fund outflows weigh on investor sentiment; No trading today for Guru Nanak Jayanti

Mumbai: Benchmark Sensex tanked 519 points and broader Nifty settled below the 25,600 level on Tuesday due to profit-taking in utility, metal and IT shares triggered by weak global trends and foreign fund outflows.

The 30-share BSE Sensex dropped 519.34 points, or 0.62 per cent, to settle at 83,459.15 with 25 of its constituents ending lower and five with gains. During the day, it tanked 565.72 points, or 0.67 per cent, to 83,412.77. The 50-share NSE Nifty declined 165.70 points, or 0.64 per cent, to 25,597.65. It hit a low of 25,578.40 due to losses in bluechip shares such as PowerGrid, Eternal and Adani Enterprises.

“Indian equity markets ended lower, tracking weak global cues and broad-based selling, particularly across IT, metal, and power sectors. Investor sentiment remained subdued ahead of the holiday-shortened week. FIIs extended their selling streak for the fourth consecutive session, as rising US bond yields and waning expectations of a near-term Fed rate cut curtailed risk appetite,” Vinod Nair, head (research), Geojit Investments Limited, said.

A total of 2,549 stocks declined while 1,618 advanced and 162 remained unchanged on the BSE. Stock markets would remain closed on Wednesday for Guru Nanak Jayanti.

“Profit-taking across heavyweight sectors dampened overall mood, while risk appetite remained subdued amid weak global cues. Additionally, inconsistent foreign institutional investor (FII) flows further added to the cautious tone,” said Ajit Mishra, Sr V-P (research), Religare Broking Ltd.

Among Sensex firms, Power Grid fell the most by 3.13 per cent after the utility posted a decline in the September quarter profit. Eternal dropped 2.79 per cent, Tata Motors Passenger Vehicle by 2.53 per cent, Tata Steel by 1.86 per cent, Maruti by 1.76 per cent and Bharat Electronics by 1.69 per cent.