Sebi snubs NSE’s plan for extended session

New Delhi: Capital markets regulator Sebi has rejected a proposal by the National Stock Exchange (NSE) to extend the trading hours in the equity derivatives segment citing a lack of feedback from the stock brokers community.

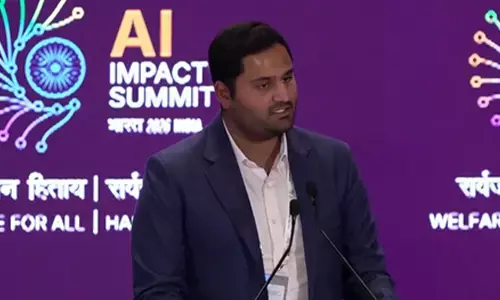

“Currently, there is no plan to extend the timings as Sebi has returned our application as the stock brokers have not given the feedback that Sebi wanted. So, as of now, the extended time frame (plan) is shelved,” NSE MD and CEO Ashishkumar Chauhan said in a post-earnings analysts call.

This came after the NSE had urged Sebi to extend trading hours in the equity derivatives segment in a phased manner. This was aimed at potentially curtailing the overnight risk arising from global information flow.

Sriram Krishnan, Chief Business Development Officer of NSE, had told PTI in September that the bourse was planning a session from 6 pm to 9 pm after a break from the closure of the regular session from 9:15 am to 3:30 pm. Based on the response, a gradual extension of the market timing till 11:55 pm was proposed on the lines of commodity derivatives. To begin with, only index derivatives in phase-1 were proposed to be available followed by single stock options and others. In 2018, the Securities and Exchange Board of India (Sebi) allowed stock exchanges to set their trading hours in the equity derivatives segment between 9 am and 11:50 pm. This was similar to the trading hours for the commodity derivatives segment, which are currently fixed between 10 am and 11:55 pm. The move was part of Sebi’s efforts to enable the integration of stocks and commodities trading on a single exchange. With regard to NSE’s IPO, Chauhan said that “situations remain as in.”