Rising OI bases hold range-bound bullish bias

FII long positions surging in F&O space, while increased short positions by retail traders suggest some caution at higher levels

The support and resistance levels remained at 24,500PE and 25,500CE, respectively for a second consecutive week, while heavy Open Interest (OI) addition is visible on Put strikes. The latest options data is pointing to strengthening undercurrent bullish bias in a range-bound trading.

The 25,000CE has highest Call OI followed by 25,500/ 25,200/ 25,300/ 24,800/ 24,900, 24,400/ 24,700/25,400/ 25,600 strikes, while 25,200/ 25,100/ 24,900/ 25,250/ 25,300 strikes witnessed reasonable to heavy build-up of Call OI. Deep Call ITM strikes from 24,500 onwards recorded moderate OI fall.

Coming to the Put side, maximum Put OI is seen at 24,500PE followed by 24,000/ 24,700/ 23,900/ 23,600/ 24,650/ 24,650/ 24,100 strikes. Further, the 24,800/ 24,700/ 24,500/ 24,650/ 24,000/ 24,200/ 23,700 strikes recorded robust addition of Put OI. No Put strike witnessed fall in Put OI.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “Looking at Nifty’s derivatives data, the highest Call Open Interest was observed at 25,000 and 25,500 strikes, while Put writers were most active at the 24,500 and 24,000 strikes.”

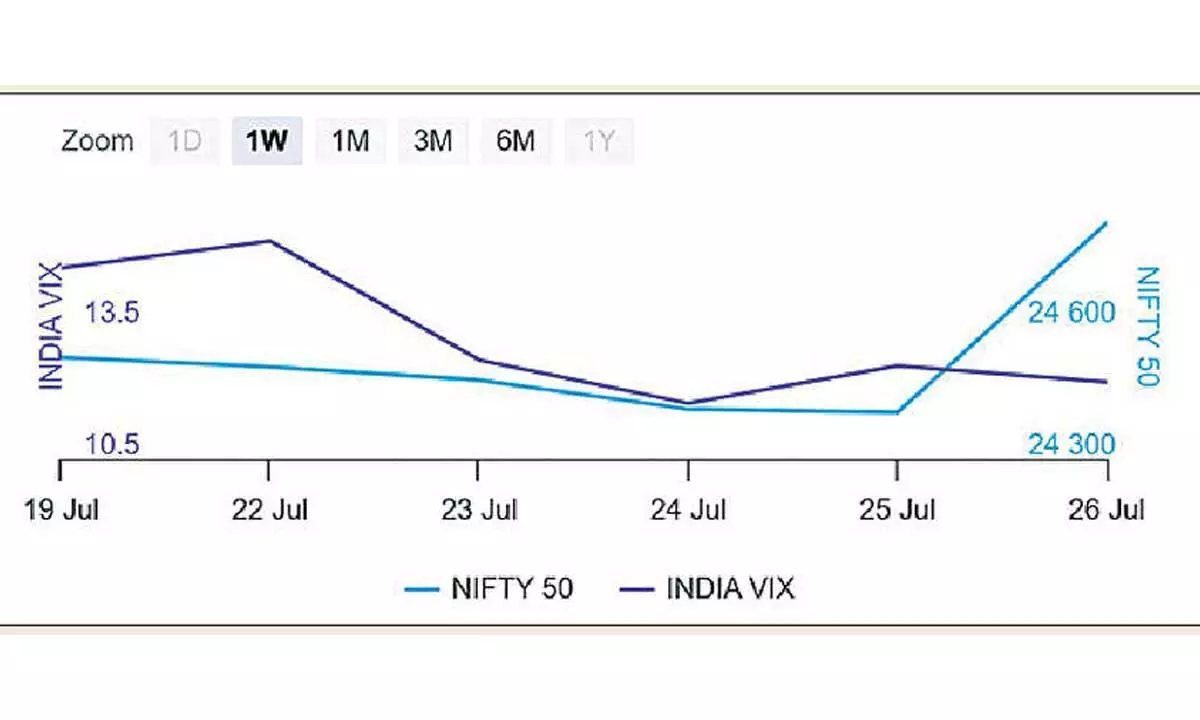

The Nifty index was hovering in range-bound during the last truncated week. However, the trading was volatile on Thursday and Friday as Nifty’s benchmark index testing highs near 24,800 level. Moreover, broader markets underperformed as profit-taking triggered more than 2% decline in both mid-cap and small-cap stocks.

Analysts predict that Nifty may find support near 24,350 level, which is the VWAP level for the July F&O series. A move below this may result in profit-taking towards the 23,800-24,000 range this week.

“After reaching an all-time high, NSE Nifty ended the week with a gain of over one per cent. In contrast, Bank Nifty fell by more than 1.5 per cent due to selling pressure on banking stocks. Last week, pharma, media and healthcare sectors showed outperformance, while private banks, real estate and financial services sectors lagged behind,” added Bisht.

BSE Sensex closed the week ended July 26, 2024, at 81,332.72 points, a net recovery of 728.07 points or 0.90 per cent, from the previous week’s (July 19) closing of 80,604.65 points. For the week, NSE Nifty also rose by 303.95 points or 1.23 per cent to 24,834.85 points from 24,530.90 points a week ago.

Bisht forecasts: “For upcoming days, we expect bullish momentum to continue. Traders are advised to adapt buy on dips strategy as bulls are likely to keep control over markets. Technically, now the 24,600-24,400 zone would act as a strong support area for Nifty, while 25,000 level would be a key psychological hurdle for the index.”

The India VIX level fell 2.93 per cent to 12.25 level.

“Implied Volatility for Nifty’s Call options settled at 12.21 per cent, while Put options concluded at 13.79 per cent. The India VIX, a key indicator of market volatility, concluded the week at 12.62 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 0.94 for the week,” observed Bisht.

“Nifty’s rollover rate declined to 69.69 per cent, falling short of both last month’s rate and the three-month average of 71.04 per cent. This suggests some distribution and potential sluggish movement for the upcoming August series,” remarked Bisht.