Live

- Andhra Pradesh Leads the Way in Tackling Social Media Negativity

- Samsung Bets Big On Ac Business In India, Set To Launch New Windfree Models In 2025

- Sahil Salathia, Apeksha Porwal Among Others Honoured at Dr. Rekha Chaudhri’s The World Digital Detox Day Event

- KLH Hyderabad Drives AI Innovation with the 2nd International Conference on AI-Enabled Technologies

- Tata Motors flags off electric buses for workforce transportation in Pantnagar; reiterates its commitment towards carbon neutrality

- ITC Hotels Expand Presence In The National Capital With The Opening Of Welcomhotel Delhi

- Mangaluru city police bundobust for Dec 31

- 26 Grievances Received at Prajavani Program - Collector Badavath Santosh

- Essential New Year's Party Rules in Hyderabad: Follow These or Face Legal Consequences

- Nagarkurnool District SP Office Inspected by IG Ramesh Naidu

Just In

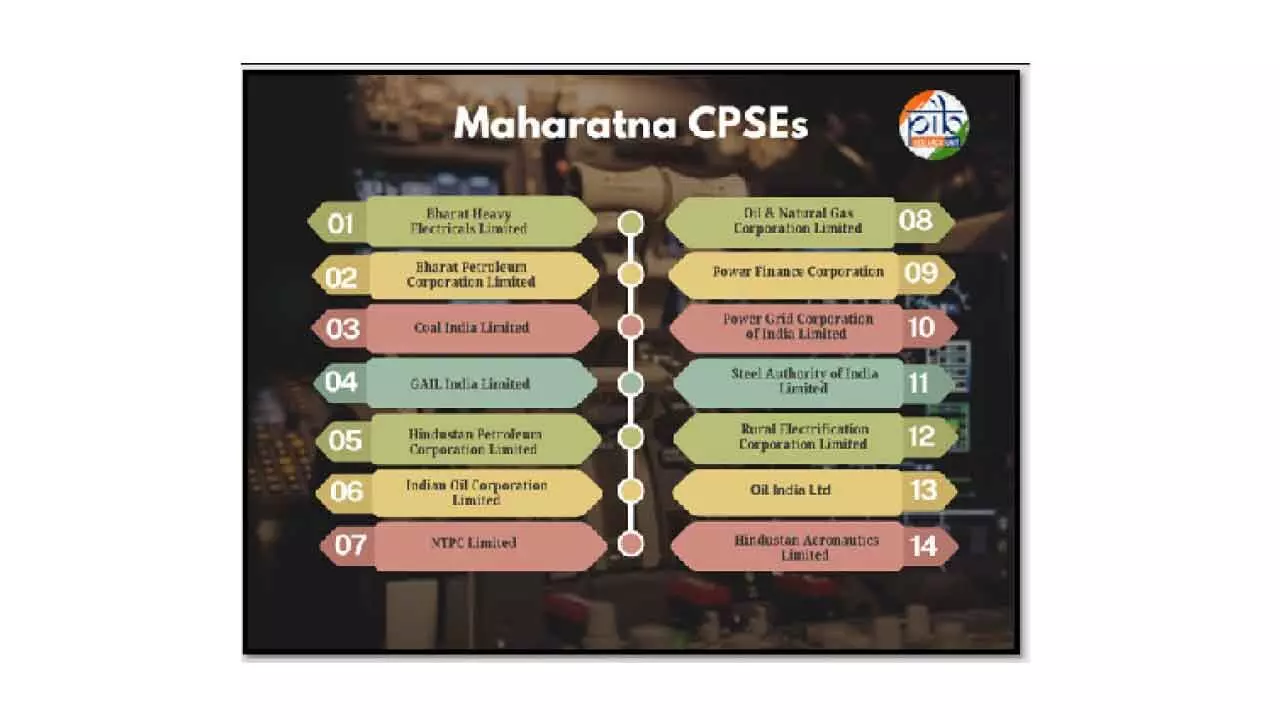

There are 14 ‘Maharatna’ central public sector enterprises (CPSEs) in the country

We must be ever grateful to the political leadership that created ‘Maharatna’ companies one of the key pillars of the country’s economy – over the years.

As per the details updated on October 22, on the website of the Department of Public Enterprises (DPE), there are 14 ‘Maharatna’ central public sector enterprises (CPSEs) in the country.

They are Bharat Heavy Electricals Limited (BHEL), Bharat Petroleum Corporation Limited (BPCL), Coal India Limited (CIL), GAIL India Limited, Hindustan Petroleum Corporation Limited (HPCL), Indian Oil Corporation Limited (IOCL), NTPC Limited, Oil & Natural Gas Corporation Limited (ONGC), Power Finance Corporation (PFC), Power Grid Corporation of India Limited (PGCIL), Steel Authority of India Limited (SAIL), Rural Electrification Corporation Limited (RECL), Oil India Ltd (OIL) and Hindustan Aeronautics Limited (HAL).

According to a 2018-2019 DPE survey, the total assets of Maharatna companies are value at Rs. 26,33,956 crore. There are certain criteria for a CPSE to be granted Maharatna status.

For example, a CPSE should have Navratna status, should be listed on Indian stock exchange, with minimum prescribed public shareholding under SEBI regulations. It should have an average annual turnover during the last three years of more than Rs. 25,000 crore. Its average annual net worth during the last three years should be of more than Rs. 15,000 crore. It should also have an average annual net profit after tax during the last three years of more than Rs. 5,000 crore. Last but not the least, an aspiring Navratna CPSE eyeing Maharatna status must have significant global presence or international operations.

Let’s briefly look at the history of the evolution of Maharatna CPSEs before I return to the core purpose of writing this critical piece. BHEL has its origin in the signing of an agreement by the Government of India on 17th November, 1955, with Associated Electrical Industries (AEI), UK, for the establishment of a factory at Bhopal complete in all respects for the manufacture of heavy electrical equipment in the country.

On 24th January 1976, a new era dawned, as a 100 per cent public sector enterprise, Bharat Refineries Limited, acquired complete ownership of Burmah Shell’s interests in India. It is today’s BPCL. CIL came into being in November 1975. With a modest production of 79 million tonnes (MTs) at the year of its inception, CIL today is the single largest coal producer in the world and one of the largest corporate employers with manpower of 228861 as on 1st April, 2024. Across eight states, CIL operates in 84 mining areas, managing a total of 313 active mines, consisting of 131 underground, 168 opencast, and 14 mixed mines.

GAIL (India) Limited, India’s leading natural gas company with diversified interests across the natural gas value chain of trading, transmission, LPG production and trans-mission, LNG regasification, petrochemicals, city gas, and so on, was incorporated in August 1984 as a Central Public Sector Undertaking (PSU) under the Ministry of Petro-leum and Natural Gas. HPCL’s history starts from 1910. It was finally formed in 1974 by merging Esso Eastern Inc, Lubes India Ltd, and Caltex Oil Refining (India) Ltd. Incorporated in Mumbai in 1959, IOCL has embarked on a bold journey to become a ‘one trillion-dollar giant’ by 2047. Incorporated on November 7, 1975, NTPC is India’s largest integrated power company, dedicated to lighting every corner of the country and building a sustainable future for all.

The foundation of ONGC in the form of Oil and Gas division, under the Geological Survey of India, was laid in 1955. In its illustrious journey so far, ONGC has crossed many milestones to realize the energy aspirations of India – a great tale of conviction, courage and commitment. PFC, incorporated on July 16, 1986, is a leading non-banking fi-nancial corporation in the country. PGCIL, India’s largest electric power transmission utility, was incorporated in October 1989 under the Company Act, 1956.

RECL was incorporated in 1969 in the backdrop of severe drought and famine in the country to energize agricultural pumpsets for irrigation purposes, thereby reducing the dependency of agriculture on monsoons. With an over hundred-year legacy, OIL continues to uphold its unwavering commitment to the nation’s energy security. Established on December 23, 1940, HAL is one of the oldest and largest aerospace and defence manufacturers in the world. It is, thus, crystal clear that our national leader-ship, irrespective of their affiliations and leanings, have not been able to evolve even a single ‘Maharatna’ CPSE in the past about 40 years. However, I have no complaints as well.

Why myself as a journalist is vouching for the vibrancy and resilience of Maharatnas, or for that matter, Miniratnas or CPSEs in general, is the fact that they are not only the backbone of our economy but are also comparatively much better in terms of transpar-ency and commitment in spending funds under the Corporate Social Responsibility (CSR) and following affirmative policies in recruitments.

I am not convinced about value system of other entities in the public and private sector as regards their commitment to the principle of affirmative policies such as quota in jobs for SCs, STs, OBCs and other marginalized sections if any. If they are following quota norms and ensuring effectiveness of funds being spent under CSR, my heartfelt compliments to them as well. I have two suggestions to make - First, CPSEs should get a free hand in running their affairs but with total accountability towards the Union or State governments’ affirmative policies and the utilisation of CSR funds. There must not be any political interference in their working. Rather, our CPSEs should be encouraged to become global players in their respective fields by acquiring the best of technologies, know-how through their R&D pursuits and collaborations.

Second, all commercial and business entities with over Rs. 100 crore annual turnover should make public their yearly spending on CSR works with complete details and recruitments in sync with the Constitution’s affirmative policies in a manner which is easily accessible digitally and the physical copies are also readily available for scrutiny by the stakeholders and media as well.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com