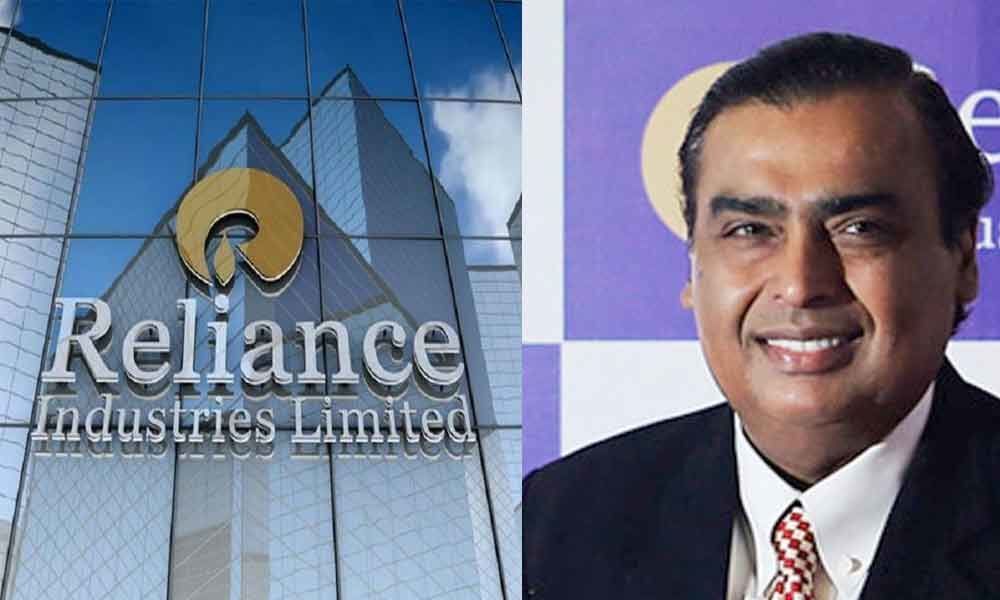

Reliance Q4 net at record `10,362 cr

Oil-to-telecom conglomerate sees 19.4% jump in revenues to `1.5 lakh cr during Jan-March 2019 period

New Delhi: Richest Indian Mukesh Ambani-led Reliance Industries on Thursday posted the highest quarterly net profit by any Indian private sector firm with a 9.8 per cent rise in earnings in the period ended March 31 after robust business in retail and telecom sectors offset a dip in oil refinery margins.

The oil-to-telecom conglomerate reported a 9.8 per cent rise in its consolidated net profit at Rs 10,362 crore, or Rs 17.5 per share, in the fourth quarter ended March 31, 2019, as compared to Rs 9,438 crore, or Rs 15.9 a share, in the same period of the previous financial year, the company said.

This is the highest quarterly profit by any Indian private sector company.

State-owned Indian Oil Corp (IOC) holds the distinction of posting the highest ever quarterly profit by any Indian firm when it had reported a net profit of Rs 14,512.81 crore in January-March 2013 after it received the full-year fuel subsidy in just one quarter.

Reliance saw its revenue jump by 19.4 per cent to Rs 154,110 crore in January-March 2019, even though they were 9.7 per cent lower than Rs 170,709 crore revenue in the third quarter of the fiscal.

The company opened more retail stores and added 26.6 million new subscribers to its Jio mobile phone service that helped increase the profitability of the venture as its traditional oil refining business witnessed margin pressures on fluctuating international oil prices.

In full year 2018-19, the company posted a record Rs 39,588 crore net profit on a revenue of Rs 622,809 crore.

"During FY2018-19, we achieved several milestones and made significant strides in building Reliance of the future. Reliance Retail crossed Rs 100,000 crore revenue milestone, Jio now serves over 300 million consumers and our petrochemicals business delivered its highest ever earnings," Reliance Industries CMD Mukesh Ambani said.

The record profit for the year came in a period of heightened volatility in the energy markets, he said, adding pre-tax profit has more than doubled in the last five years to Rs 92,656 crore.

"Focus on service and customer satisfaction led to higher numbers of subscribers and footfalls across our consumer businesses, driving robust revenue growth. Our endeavour is to create better experiences for our customers, leading to a better-shared future," he added.

Its retail business, which comprises 10,415 stores with 510 being added in Q4, saw pre-tax business profit jump 77.1 per cent to record Rs 1,923 crore.

"Reliance Retail is the only Indian retailer to be in the top 100 global retailers list and the 6th fastest growing retailer globally as per Deloitte's Global Powers of Retailing 2019," the statement said.

The operator of the world's largest oil refining complex saw pre-tax earnings from the business decline for the fourth quarter in a row. Pre-tax earnings fell 25.5 per cent to Rs 4,176 crore as margins dipped.

It earned $8.2 on turning every barrel of crude oil into fuel as compared to a gross refining margin (GRM) of $11 per barrel in January-March 2018.

The GRM was also lower than $8.8 and $9.5 per barrel earned in the second and third quarters respectively.

"Refinery and marketing segment performance was impacted by lower crude throughput due to planned maintenance," the statement said, adding they were also impacted by lower product differentials.