Live

- Srikakulam: Hard work pays dividends for Nadikuditi Eswara Rao

- 90 statements recorded: SIT

- Inter-state hunt on for Hathras satmpede Bhole Baba

- CBSE students of government schools stare at bleak future

- Bihar suspends 15 engineers over bridge collapse incidents

- NEET-PG entrance test on August 11

- Centre, NTA oppose NEET pleas for cancellation

- Ayyanna sets 9 months deadline for completion

- Record 26 Indian-origin MPs elected

- Modi congratulates Starmer, praises Sunak’s leadership

Just In

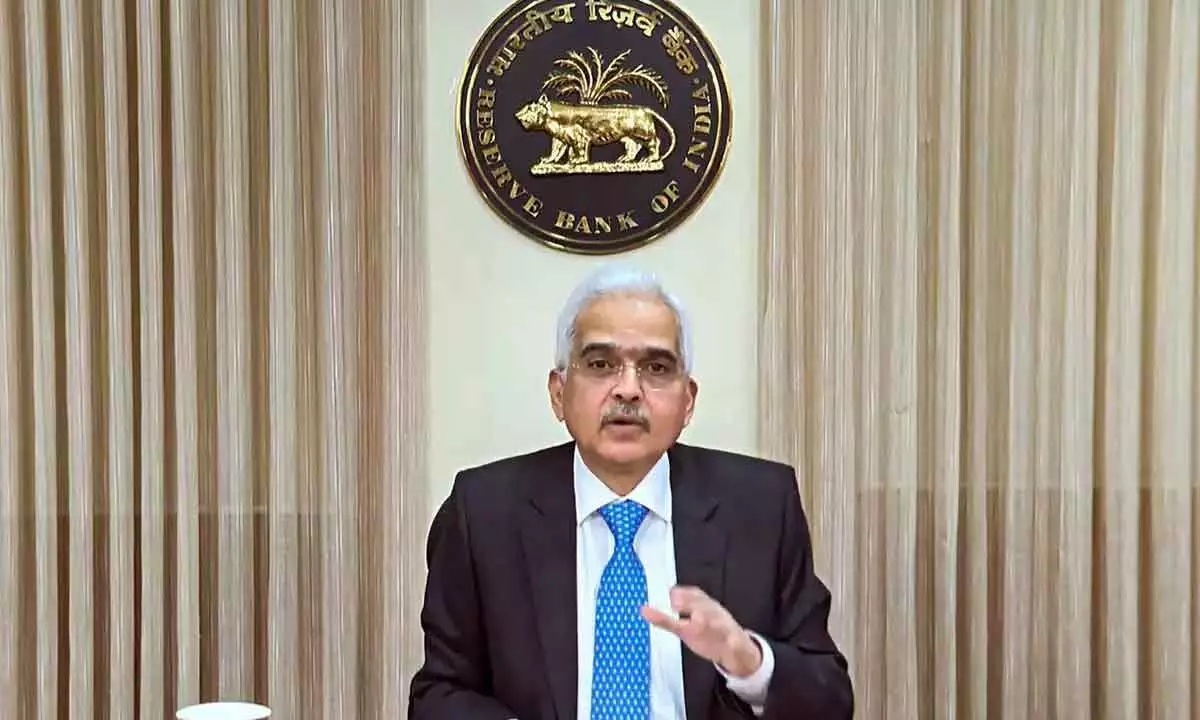

RBI status quo on Repo, retains 7% growth

Repo rate remains at 6.5% for 7th time amid food inflation concerns; Forecast on inflation for FY25 at 4.5%, GDP growth t 7%; Home, auto EMIs to remain unchanged

Mumbai: Reserve Bank of India (RBI) on Friday kept the benchmark interest rates unchanged at 6.5 per cent for the seventh time in a row, citing concerns over food inflation in view of IMD’s prediction of above normal maximum temperatures during April to June. As RBI has held key policy rates steady, the EMIs on home and auto loans are likely to remain stable for some more time. The central bank has kept interest rates unchanged since February 2023. While unveiling the first bi-monthly monetary policy for the current financial year, RBI has retained its growth and inflation forecast for the current fiscal at 7 per cent and 4.5 per cent respectively.

“After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, it (MPC) decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.50 per cent,” RBI Governor Shaktikanta Das said.

He further said that the six-member MPC would remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Referring to inflation, Das said food price uncertainties continue to weigh on the inflation trajectory going forward. Also, the tight demand-supply situation in pulses and the production of key vegetables warrant close monitoring, given the forecast of above normal temperatures in the coming months.

The RBI retained the GDP growth projection at 7 per cent for 2024-25 fiscal on the back of expectations of a normal monsoon, moderating inflationary pressures, and sustained momentum in manufacturing and services sector. The headwinds from protracted geopolitical tensions and increasing disruptions in trade routes, however, pose risks to the outlook, Reserve Bank Governor Shaktikanta Das said

Retail inflation in February was 5.1 per cent, with food basket inflation at 8.66 per cent. For the full 2023-24 fiscal, inflation is projected at 5.4 per cent. In the current fiscal, the RBI expects inflation to be around 4.5 per cent, with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent. Recalling 7.8 per cent retail inflation in April, 2022, Das said the elephant in the room at that time was inflation.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com