RBI announcements to maintain liquidity, credit flow; Reactions from PM to Industry bodies

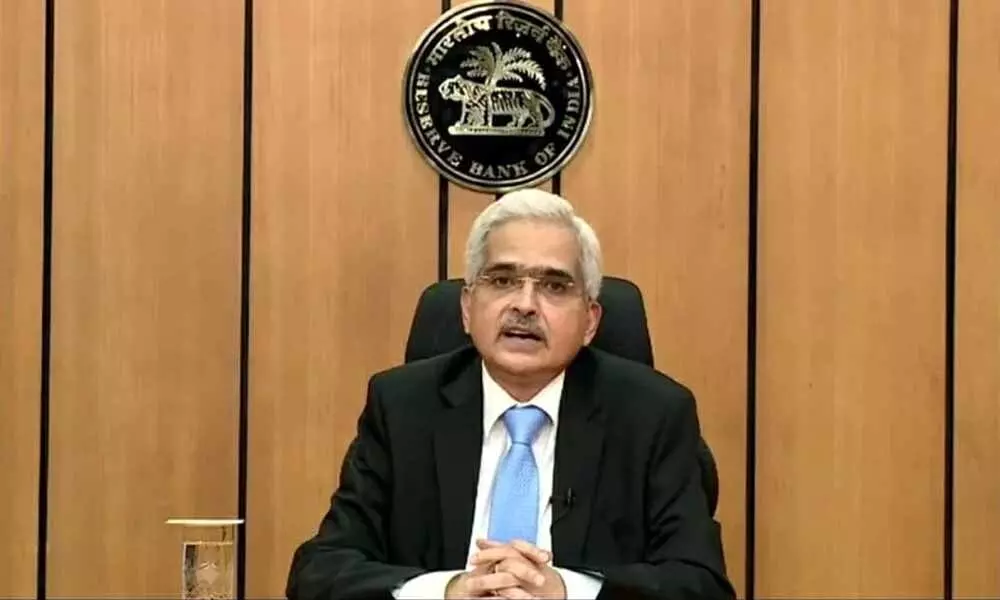

RBI Governor Shaktikanta Das

RBI Governor Shaktikanta DasAmidst the steep fall in the rupees and continuing volatility in other segments of the financial market, the Reserve Bank of India

Amidst the steep fall in the rupees and continuing volatility in other segments of the financial market, the Reserve Bank of India (RBI) yesterday announced measures to help in maintaining liquidity & increasing in credit flow and reduced reverse repo rate to 3.75 per cent from 4 per cent while keeping the repo rate unchanged.

While addressing media, RBI Governor Shaktikanta Das also announced Rs 50,000 crore booster package for small and medium-sized industries to recover from the lockdown.

Address by RBI Governor @DasShaktikanta announcing further measures to deal with the pandemic fallout @RBIsays #rbitoday #rbigovernor #rbikehtahai #IndiaFightsCorona

— ReserveBankOfIndia (@RBI) April 17, 2020

The action of RBI brought reactions from different sections from Prime Minister Narendra Modi to Industry bodies. Find below the reactions:

Prime Minister Narendra Modi: Appreciating the measures announced by the RBI, the Prime Minister said that the announcements made by Reserve Bank of India will greatly enhance liquidity and improve credit supply. In a tweet, Mr Modi said, "Today's announcements by @RBI will greatly enhance liquidity and improve credit supply. These steps would help our small businesses, MSMEs, farmers and the poor. It will also help all states by increasing WMA (wage and means advance) limits."

Today's announcements by @RBI will greatly enhance liquidity and improve credit supply. These steps would help our small businesses, MSMEs, farmers and the poor. It will also help all states by increasing WMA limits.

— Narendra Modi (@narendramodi) April 17, 2020

Finance Minister Nirmala Sitharaman: The finance minister has said that the Reserve Bank of India has taken a slew of steps in view of the difficulties being faced due to COVID-19. In a series of tweets, the Minister said, these steps aimed at maintaining adequate liquidity in the system, incentivising bank credit flows, easing financial stress and enabling the normal functioning of markets. She said RBI has increased the ways and means advance limit for states to 60 per cent over and above the level as on 31st of March to help state governments tide over cash flow problems due to a temporary dip in revenue collections.

The @RBI has increased the ways and means advance limit for states to 60% over and above the level as on March 31 to help state governments tide over cash flow problems due to a temporary dip in revenue collections. #IndiaFightsCorona pic.twitter.com/PVBRdM0pBS

— NSitharamanOffice (@nsitharamanoffc) April 17, 2020

The Minister said it has now been decided that the Non-Performing Asset (NPA) classification norms will exclude the three-month moratorium window that banks are allowed to give on loan repayments to ease the worries of MSMEs that are in danger of becoming NPA accounts.

The minster in a tweet also said, "The @RBI has issued the circular for the targeted long-term repo operation (TLTRO) that will be aimed at mid and small NBFCs and MFIs. The funds thus availed are to be deployed in investment-grade bonds, commercial paper and non-convertible debentures of NBFCs."

The @RBI has issued the circular for the targeted long-term repo operation (TLTRO) that will be aimed at mid and small NBFCs and MFIs. The funds thus availed are to be deployed in investment grade bonds, commercial paper and non-convertible debentures of NBFCs. pic.twitter.com/KdchvpInPV

— NSitharamanOffice (@nsitharamanoffc) April 17, 2020

Industry bodies FICCI and ASSOCHAM: Industry body FICCI and ASSOCHAM have welcomed the second set of RBI steps to address the COVID-19 situation. Secretary-General, FICCI, Dilip Chenoy said, these will be a positive impact both on liquidity and more importantly on the sentiments.

ASSOCHAM has described the new RBI measures as a life-saving dose for millions of businesses. In a tweet, ASSOCHAM said, "It remains up to the banks to respond effectively to @RBI measures in order to provide financial stability to the economy in the current scenario. Being a major stakeholder in banks, Government is taking the brunt on revenue from stoppage of dividend: #ASSOCHAM SG @Deepaksood69."

It remains up to the banks to respond effectively to @RBI measures in order to provide financial stability to the economy in the current scenario. Being a major stakeholder in banks, Government is taking the brunt on revenue from stoppage of dividend: #ASSOCHAM SG @Deepaksood69 pic.twitter.com/vela7lmoit

— ASSOCHAM #StayHome (@ASSOCHAM4India) April 17, 2020

Secretary-General, ASSOCHAM Deepak Sood said, there are several relief measures unveiled by the RBI which should help the NBFCs, Housing Finance Companies and small businesses.