PL Stock Report: Pidilite Industries (PIDI IN) - Q2FY24 Result Update – Strong volume trend, benign RM positive - HOLD

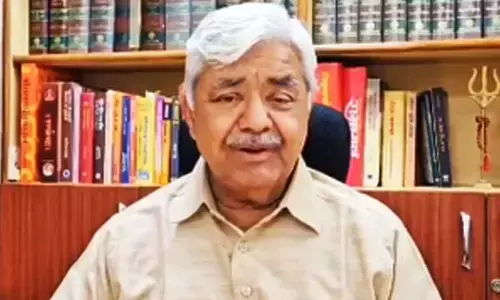

Pidilite Industries (PIDI IN) - Amnish Aggarwal - Head of Research, Prabhudas Lilladher Pvt Ltd.

Rating: HOLD | CMP: Rs2,458 | TP: Rs2,644

Q2FY24 Result Update – Strong volume trend, benign RM positive

Quick Pointers:

♦ VAM prices at USD850-900/ton, 2Q24 usage at USD1000/ton (USD2000/ton in 2Q23), Margins to range between 20-24% in FY24

♦ PIDI to foray in NBFC for funding channel partners with Rs1bn

We cut our FY24/25 EPS estimates by -2.5%/-3.1% as 8% price cut since March23 (5% in 2Q24) will impact realizations even as demand and margin outlook remains robust. PIDI aims at growing at 1.5xGDP growth in volumes led by 1) rising construction activity & govt capex 2) rising share of growth and pioneer categories to ~40% of sales (25% 2 years back) 3) sustained innovation across segments and 3) gains from deeper distribution reach in rural India and small towns. We believe PIDI foray into NBFC space for funding its channel partners (Dealers/ Contractors) has limited capital commitments (upto Rs1bn/2 years) as of now, however any aggressive plans can be taken negatively by the street. We expect strong profit growth in 2H led by strong volume momentum and benign input costs. We estimate 27% EPS CAGR over FY23-26 and assign DCF based target price of Rs2644 (Rs2610 earlier). We expect moderate returns in near term given premium valuations of 51.1xSep25 EPS. Retain Hold.

C&B volumes up 8% YoY; GM expands 229bps QoQ; Consolidated Revenues grew 2.2% YoY to Rs30.76bn. Gross margins expanded by 1032bps YoY/229bps QoQ to 51.3%. EBITDA grew by 36% YoY to Rs6.8bn; Margins expanded by 550bps YoY/51bps QoQ to 22.1%. PBT grew by 43% YoY to Rs 6.2bn. Adj. PAT grew by 37.4% YoY to Rs4.6bn. Standalone – Sales increased 2.4% to Rs27.8bn, GM improved by 1089bps YoY/229bps QoQ to 51.2%. EBITDA grew by 38.5% to Rs6.4bn; Margins expanded by 602bps YoY/45bps QoQ to 23.1%. PBT grew by 40.8% to Rs6.1bn. Adj. PAT grew by 35% to Rs4.5bn. Consumer and Bazaar Sales grew by 3.2% YoY to Rs25bn (volumes up 8%); EBIT grew by 31.7% YoY to 6935mn. Industrial Products sales declined by 1.3% YoY (volumes up 20%) to Rs6.15bn; EBIT grew by 38.3% YoY to 684.5mn.

Concall Takeaways: 1) Demand trends remain strong with double digit volume growth; rural/ semi-rural markets continue to grow ahead of urban markets 2) Domestic B2B volume grew by 20% UVG led by robust growth in Industrial & Project verticals 3) International markets like Middle East ,Africa & Asia continue to show strong growth 4) Extreme monsoon conditions led to some disruptions in July however situation improved thereafter 5) GM are expected to remain strong amid stable RM prices 7) VAM prices are near bottom and expect prices to inch up by 50USD/ton to USD1000/ton in the coming quarters 8) PIDI opened 8 manufacturing facilities over the last 6 months with 4 new facilities in 2Q24 9) PIDI to venture into NBFC business as a formalized way of lender financing and will start with test runs in towns in Andhra Pradesh, Telangana & Orissa having population<50k 10) Araldite has grown volumes by 20% CAGR since acquisition led by increased distribution 11) Paints have been launched in tier 3 cities and more clarity will emerge over next couple of quarters