PL Sector Report - Consumer - Apr-Jun’23 Earnings Preview – Demand and margins set to improve

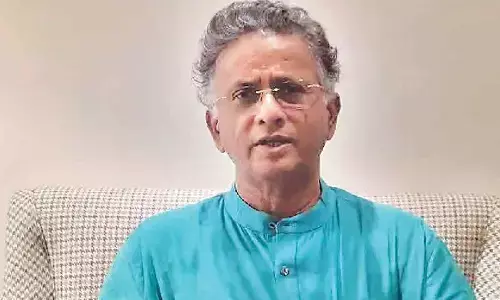

Consumer - Amnish Aggarwal - Head of Research, Prabhudas Lilladher Pvt Ltd

Apr-Jun’23 Earnings Preview – Demand and margins set to improve

We estimate our coverage universe (ex-ITC) to report Sales, EBIDTA and PAT growth of 12.2%/18.1%/20.0% YoY (9.2%/14.7%/17.6% including ITC) due to lower priced inventory coming into usage, reduced pressure in LUP and tactical price cuts. APNT, BRIT, HUL, ITC, NEST, PIDI and WFL will have strong 1Q while JUBI will have tepid performance.

Consumer demand & sentiments improved during 1Q24 as rural demand for staples saw a pick up on a low base supported by price cuts/grammage increases while urban demand remained steady.

Demand across discretionary categories like QSR, Apparel, Footwear and Retail remained under pressure while Paints and Jewellery sales bucked the trend. We expect wide demand variations across HPC, Food, QSR, Jewellery, Apparel, Footwear and Paints etc.

We remain structurally positive on Westlife, Britannia, HUL, D’Mart, ITC and Titan given sustainable competitive advantage and business moats. However, valuations have factored in green shoots in rural demand, lower RM prices and margin expansion. We rate D’Mart and Titan as top picks.

Rural demand improves as discretionary segments mixed

♦ Staples to outperform; Discretionary demand remains mixed: Discretionary demand remains weak in 1Q across QSR (seasonal QoQ uptick is seen) & Apparel even as Jewellery will do relatively better. Demand for staples in rural India has improved with green shoots in Foods and HPC. Urban consumption remained steady in staples & HPC categories.

♦ Discretionary segments to report mixed performance: Discretionary demand remained weak with customers holding back purchases across categories. Apparel continues to see weakness at the mass end. Jewellery has seen pressure in Apr due to gold price rise, but saw a pick up post Akshaya Tritiya and June with cooling of gold prices. QSRs has seen some pickup post 4Q but the Pizza segment is likely to remain under pressure in 1H24.

♦ Price cuts to support volume growth: Commodity prices continued to correct QoQ and are down significantly YoY. We do not expect sharp spike in input prices, given tepid demand globally. Staples companies have increased consumer promotions/offers and took selective price cuts/grammage increases, which will improve demand and reverse consumer downtrading.

♦ 1Q24 margins likely to improve QoQ/YoY: We expect margins to improve QoQ/YoY with peaked out input cost inflation and high cost inventory (largely exhausted). However, discretionary segments like QSRs may continue to see margin pressure due to higher inflation in cheese & chicken and consumers migrating to value offerings. We expect margins to remain under pressure, but may see recovery only after couple of quarters in 2H24.