Parliament passes 'the Insurance (Amendment) Bill, 2021'

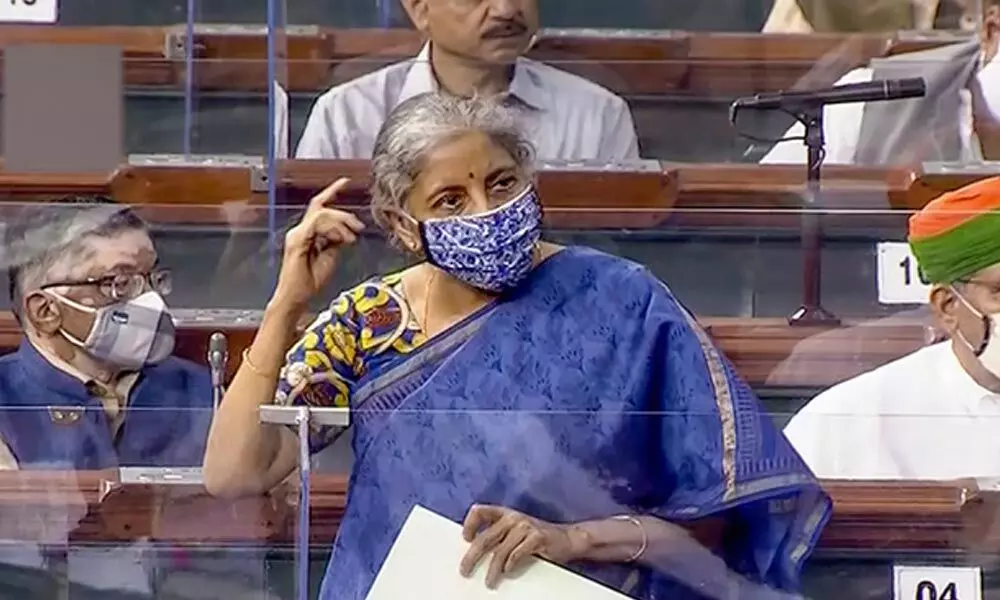

Finance Minister Nirmala Sitharaman

The Parliament on Monday, March 22, 2021, passed the Insurance (Amendment) Bill, 2021 with the Lok Sabha approving it today

The Parliament on Monday, March 22, 2021, passed the Insurance (Amendment) Bill, 2021 with the Lok Sabha approving it today. The Rajya Sabha has already passed the legislation.

The Bill seeks to amend the Insurance Act, 1938, which will increase the ceiling limit of foreign investment allowed in Indian insurance companies. The Bill provides to increase the foreign direct investment limit from existing 49 per cent to 74 per cent. It also has a provision for the removal of restrictions on ownership and control of insurance companies.

Speaking on the Bill, Finance Minister Nirmala Sitharaman said that the insurance sector requires a huge and long term investment as it is a capital intensive sector.

She said, raising the ceiling limit to 49 per cent in the year 2015 has resulted in a foreign direct investment of Rs 26,000 crore in the past five years and assets under management registered a growth of 76 per cent.

She said, the government is committed to providing insurance cover to all the people and more resources will grow the number of insurers.

She assured that policy holders' fund will only be invested in the country. Countering the oppositions' accusation of privatization of LIC, the Minister said that this Bill has nothing to do with the LIC in specific but for the entire insurance sector.

Ms. Sitharaman said the Bill has been brought after extensive consultation with multiple stakeholders and it has all necessary provisions to safeguard insurers' interest. She said, this Bill will also safeguard the interest of 24 lakh employees engaged in the private insurance sector in addition to 17 lakh working in public sector insurance companies.

Initiating the discussion, Manish Tewari of Congress opposed the legislation saying that it is against the interest of small insurance holders. He said, Congress is not against liberalization but it opposes further opening up of certain sectors like insurance as it will have adverse effects for common people. He said, this Bill must be seen as part of the government's efforts to privatize banks and disinvestment of Public Sector Units. He urged the government to reconsider the legislation.

Supriya Sule of NCP raised the question over changing the ceiling limit saying that more foreign investment will make the self-reliant programme weak. Echoing the same view, Dr. S T Hasan of the Samajwadi Party said that foreign companies will take the money out which will hamper the interest of policyholders.

Shyam Singh Yadav of BSP also opposed the Bill saying that more weightage must be given to the Indian companies rather than foreign companies. Rahul Shewale of Shiv Sena said that the claim that this legislation will help in attracting foreign investment is elusive.

On the other hand, Jagdambika Pal of BJP said, raising the FDI limit will attract Rs 15,000 crore worth of investment in the upcoming three years. He said, it will also help in increasing the penetration of insurance and providing insurance cover to common people. Another party MP Ganesh Singh said that this legislation will increase competition, social security coverage and provide affordable insurance policies to common people.

Magunta Sreenivasulu Reddy of YSRCP also welcomed the Bill saying that the move will increase the penetration of insurance coverage.

Some other members also participated in the discussion.