Options data reflects range-bound trading

The resistance level marginally declined by 200 points to 26,000CE and the support level rose 2,900 points to 24,500PE as per the options data on NSE after Friday session.

The resistance level marginally declined by 200 points to 26,000CE and the support level rose 2,900 points to 24,500PE as per the options data on NSE after Friday session. The Open Interest (OI) data is pointing to a narrowing trading range. Implied volatility (IV) also declined significantly on both sides of the options chain.

The 26,000CE has highest Call OI followed by 26,450/ 25,800/ 26,400/ 26,200/ 25,600/ 25,500/ 25,600/25,000 24,800/24,750/ 24,800/ 24,700 strikes, while 25,100/ 26,450/ 26,000/ 25,300/ 25,400/ 25,600/ 24,800 strikes recorded hefty addition of Call OI. And 24,900/ 24,600 and 24,550 ITM strikes witnessed heavy to modest OI fall.

Coming to the Put side, maximum Put OI is seen at 24,500PE followed by 23,000/ 24,000/ 23,500/ 22,500/ 23,700/ 24,800/24,600/ 24,500/ 24,300/ 23,900/23,700/21,600 strikes. Further, 24,000/ 21,600/ 21,650/ 222,500/22,800/23, 000/23,220/ 23,400/23,500/24,300/ 24,700 strikes posted heavy build-up of Put OI. And there's no OI decline at any Put strike.

Despite the sharp recovery on last Friday, Call options OI is relatively higher than the Puts with highest Call OI placed at 26,000 Call strike, while the ATM 24700-750 Call itself holding noteworthy open interest. On the downside, higher Put base is at 24,500PE, below which a retest of 24,200 level can’t be ruled out.

BSE Sensex closed the week ended December 13, 2024, at 82,133.12 points, a modest recovery of 424 points or 0.51 per cent, from the previous week’s (Dec 6) closing of 81,709.12 points.

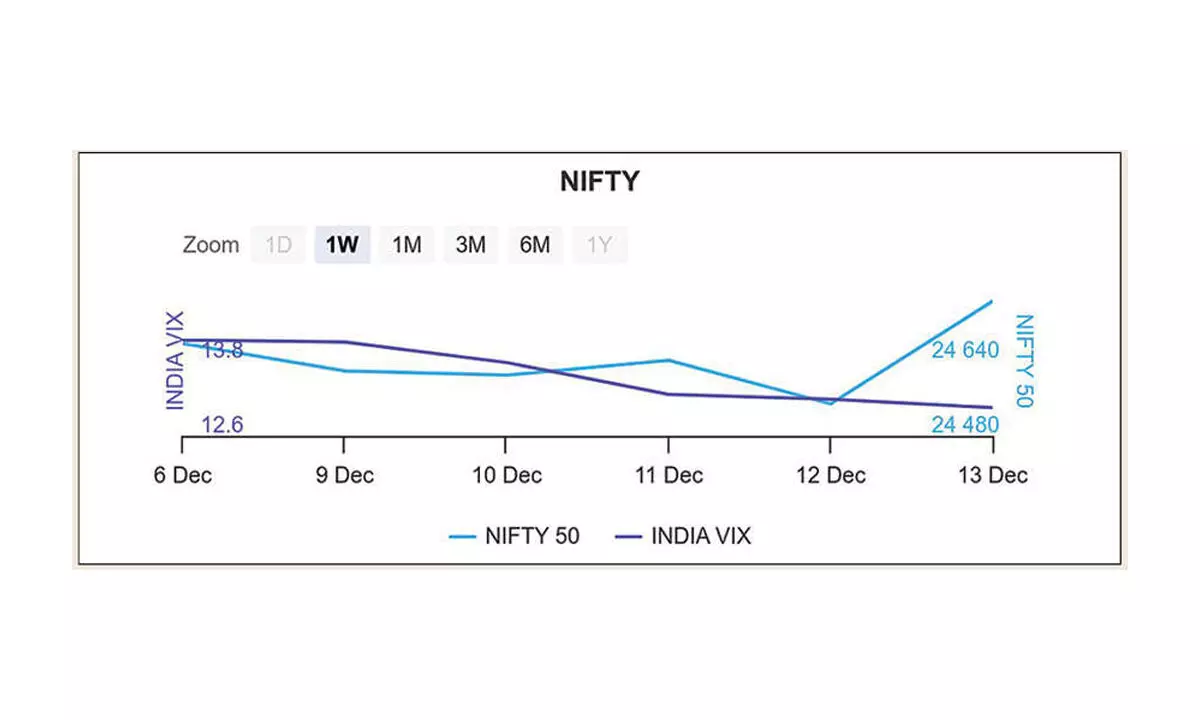

For the week, NSE Nifty also climbed 90.50 points or 0.36 per cent to 24,768.30 points from 24,677.80 points a week ago.

Nifty futures OI continues to be low in the current December F&O series and current OI is hovering at 1.1 crore shares. It’s indicating an ongoing short covering in the index. Net short positions by FIIs also fell sharply to less than 40,000 contracts, from 1.15 lakh contracts seen last week, lowest short volume in over two months. Analysts predict that Nifty may consolidate this week amid some intraday volatility.

India VIX fell 0.14 per cent to 13.05 level. The volatility index declined, but still hovering above 13 per cent. Derivatives analysts with exclusion of many weekly settlements, forecast that volatility may remain relatively higher this week. Put-Call ratio of Open Interest (PCR-OI) is at 0.94 and it's reflecting easing bullish bias.