Live

- Rama Sena leader Kambala joins BJP

- Now, cattle to be issued Aadhaar ID

- Former I&PR chief in ACB net

- Naidu presents wishlist to Centre

- MyVoice: Views of our readers 26th Dec 2024

- Empowering lives: One drop at a time

- Pros & cons of simultaneous polls

- Sustain Greenery: Meagre Rise In Forest Cover

- Boxing Day Test Weather Forecast: Rain Delays Expected on Day 3 and Day 4 in Melbourne

- Baby John Twitter Reviews: Varun Dhawan Impresses, But Fans Feel the Remake Lacks Theri's Charm

Just In

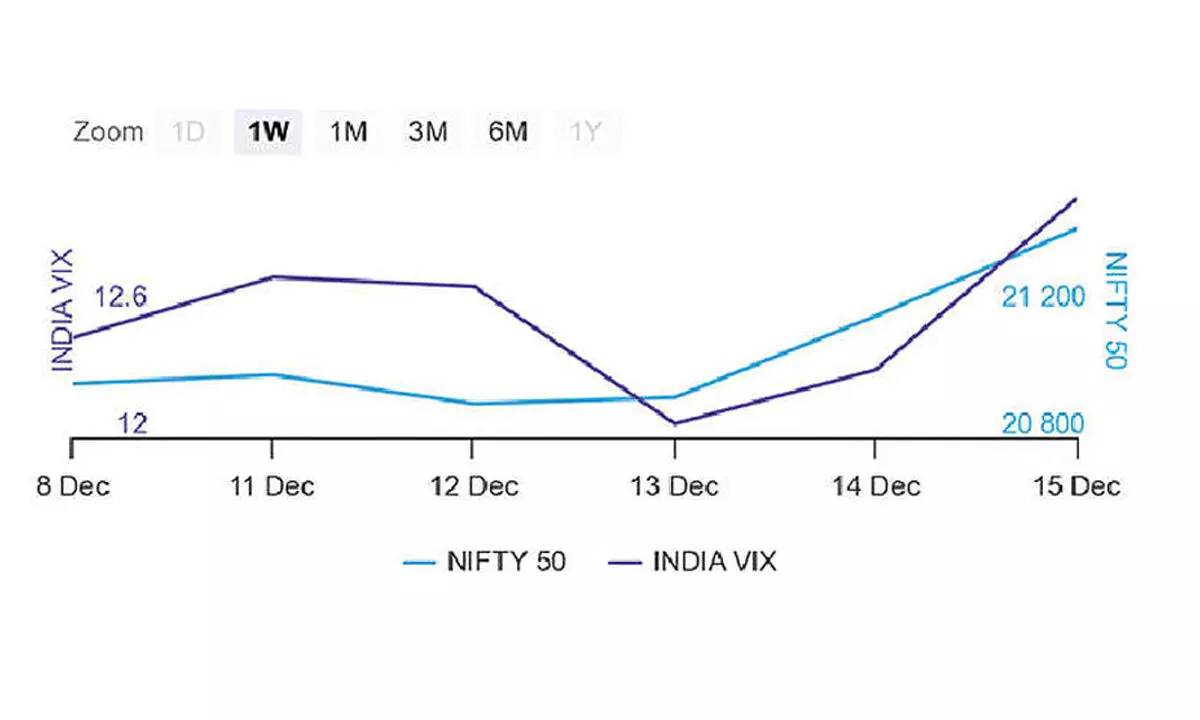

Options data holds positive bias

Put-Call Ratio of OI at 1.47 suggests resilient support zones; Strong Put OI at 21,300 and 21,200 strikes

The resistance level moved up by 1,000 points to 22,000CE, while the support level rose 1,300 points to 21,300PE level as per the latest options data on NSE. The 22,000CE has highest Call OI followed by 22,500/ 22,200/ 21,600/ 21,800/21,700 /21,600 strikes, while 22,200/ 22,000/ 21,700/ 21,550/ 21,600 strikes recorded reasonable build-up of Call OI.

Coming to the Put side, maximum Put side is seen at 21,300PE followed by 21,200/ 21,400/ 20,900/ 21,000/ 20,500/ 20,600 strikes witnessed significant addition of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “The highest Call Open Interest for Nifty options is concentrated at 21,500 and 21,600 strike prices whereas the highest Put Open Interest is observed at the 21,300 and 21,200 strike prices, indicating strong support zones.”

Call writers were aggressive last Friday with 22,000 Call holding the highest OI base as very nominal OI offloading took places at 21,300CE and deep ITM strikes. Analysts observe that any move beyond 21,050 should be crucial for continued uptrend in the index. On the downside, Nifty has a Put base of 21,300 while no fall in OI bases. Hence, the market is taking a good support in the coming week.

“The market witnessed a strong bullish sentiment, with Nifty gaining over two per cent and Bank Nifty recording a gain of more than 1.5 per cent. Both indices reached all-time highs, reflecting strong investor confidence and positive market sentiment.

The IT, metal and PSU bank sectors exhibited notable strength, contributing significantly to the overall market gains whereas the pharma sector emerged as a major laggard, experiencing a relative underperformance compared to other sectors,” added Bisht. BSE Sensex closed the week ended December 15, 2023, at 71,483.75, a further rally of 1,658.15 points or 2.37 per cent, from the previous week’s (December 8) closing of 69,825.60 points.

During the week, NSE Nifty surged 487.25 points or 2.32 per cent to 21,456.65 points from 20,969.40 points a week ago. Bisht forecasts: “The current market outlook is optimistic, marked by strong gains in key indices. However, the cautious stance indicated by the elevated India VIX suggests the importance of prudent risk management. In the upcoming week, Nifty may test the 21,100 level on the downside, while on the upside, it may test the 21,700 level.” The volatility index rose sharply last week and tested almost 14 levels before settling the week near 13 as India VIX rose 6.55 per cent to 13.13 level.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com