Options data flags wide range-bound trading

Net shorts by FIIs nearing extreme level of 1.5 lakh contracts; Nifty futures premium at just 75 points; Hence, a fresh round of short covering can’t be ruled out

After a continued range-bound trading, significant option writing took place at both Call and Put strikes. The resistance level remained at 26,000CE for a second consecutive week, while the support level declined by 1,000 points to 24,000PE, according to the latest options data on NSE.

The 26,000CE has highest Call OI followed by 25,000/ 24,900/25,200/25,300/ 25,550/ 24,850/ 26,150/ 26,550/ 27,000/27,500/ 27,900/ 27,950 strikes, while 27,750/ 27,900/27,950/ 25,300/ 25,400/ 24,900/25,100 strikes recorded reasonable addition of Call OI. Marginal Call OI fall is seen at 25,700/ 25,800/ 26,100/ 26,50026,700/ 26,800 strikes.

Coming to the Put side, 24,000PE has maximum Put base followed by 24,500/ 24,900/ 25,000/ 24,850/ 24,400/ 24,300/ 24,100/ 23,900/ 23,800/ 23,000/ 23,050/ 23,100/ 23,200/ 23,400 strikes. Further, 23,000/ 24,000/ 24,500/24,600/ 24,700/ 24,800/24,850 / 23,200/ 23,900 strikes witnessed moderate to heavy build-up of Put OI.

Barring 23,500 strike, no Put OTM strike recorded a fall in OI, while minute OI fall is visible at Put ITM strikes from 25,200.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market, the highest Call Open Interest for Nifty seen at the 25,000 and 25,200 strikes, while the highest Put Open Interest was at the 24,800 and 24,500 strikes.”

Nifty OI remained with 1.4 crore shares despite continued build-up of short positions by FIIs. The net shorts are nearing an extreme level of 1.5 lakh contracts. Nifty futures premium is just 75 points. Hence, a fresh round of short covering can’t be ruled out from oversold territory. Only a move below 24,800 may be treated for the fresh weakness.

“Geopolitical tensions, weak earning season and a lack of any positive trigger weighed down the Indian market last week, resulting in major indices closing in the red. While the infrastructure and IT sectors outperformed, profit-taking was noticeable in the auto, media and consumer sectors,” remarked Bisht.

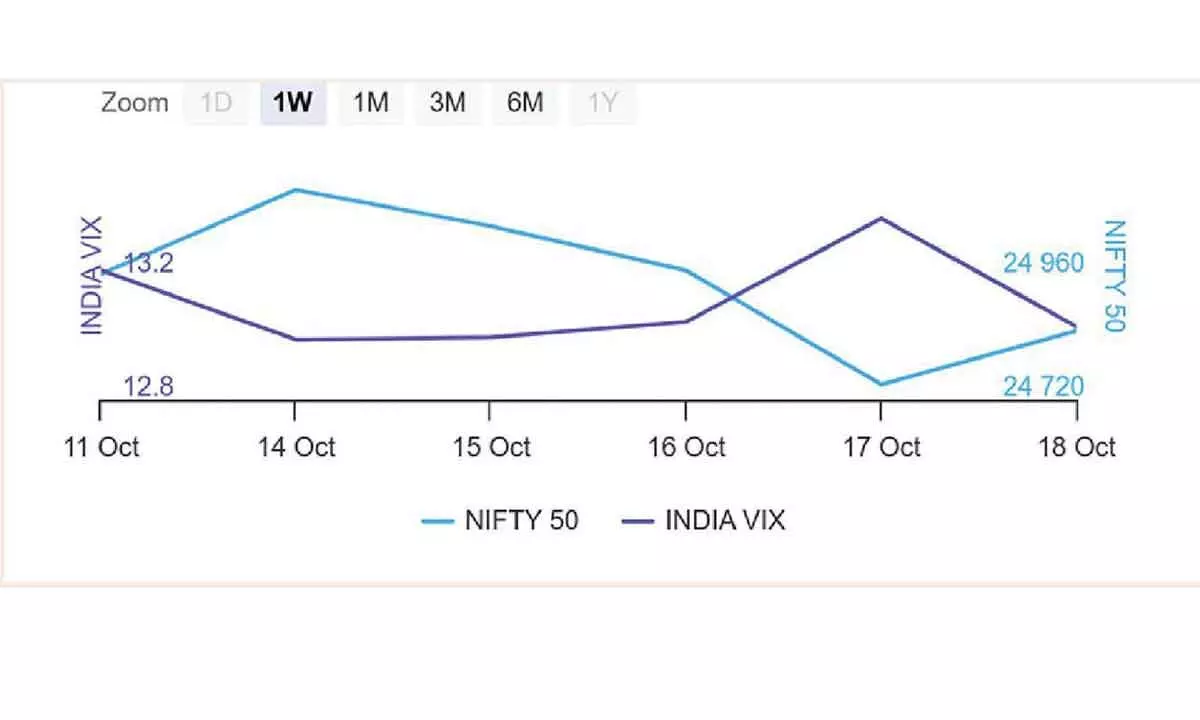

BSE Sensex closed the week ended October 18, 2024, at 81,224.75 points, a marginal loss of 156.61 points or 0.19 per cent, from the previous week’s (October 11) closing of 81,381.36 points. For the week, NSE Nifty edged lower by 110.20 points or 0.44 per cent to 24,854.05 from 24,964.25 points a week ago.

Bisht forecasts: “From a technical perspective, the Nifty’s next support level is seen at 24,700, with key resistance placed at 25,100. Traders are advised to exercise caution due to geopolitical news and the upcoming earnings announcements this week. Technically any decisive move below 24,700 could lead to a further decline toward 24,500 in Nifty.”

India VIX fell 2.61 per cent to 13.04 level. “Implied Volatility (IV) for Nifty’s Call options settled at 13.06 per cent, while Put options concluded at 13.98 per cent. The India VIX, a key market volatility indicator, closed the week at 13.39 per cent. The Put-Call Ratio of Open Interest stood at 0.98 for the week,” said Bisht.

Bank Nifty

NSE’s banking index closed the week at 52,094.20 points, recovery by 921.90 points or 1.80 per cent from the previous week’s closing of 51,172.30 points. “For Bank Nifty, the prominent Call Open Interest was seen at the 52,500 and 53,000 strikes, whereas notable Put Open Interest at the 51,000 and 51,500 strike,” added Bisht.