Options data flags rising volatility

Thelatest options data on NSE, after the last Friday session, is pointing to a 1,000-point fall in resistance level to 25,000CE, while the support level fell by 1,500 points to 23,000PE.

The latest options data on NSE, after the last Friday session, is pointing to a 1,000-point fall in resistance level to 25,000CE, while the support level fell by 1,500 points to 23,000PE. The 25,000CE has highest Call OI followed by 25,500/ 25,100/ 25,300/ 26,000/ 25,800/ 26,500/ 27,000/ 31,000/ 30,000/ 28,000 strikes, while 30,000/ 31,000/ 25,200/ 25,000/ 23,900/ 24,000/ 23,700 strikes. Call OTM strikes 24,300/ 26,000/ 26,400/ 26,350 and ITM strike 22,500 had moderate to heavy fall in OI.

Coming to the Put side, maximum Put OI is visible at 23,000PE followed by 23,500/ 23,600/ 23,200/ 23,400/ 23,700/ 23,800/ 24,000/ 24,500/ 24,700/ 14,000 strikes. Further, 20,000/ 21,000/ 22,000/ 22,400/ 23,200 strikes witnessed moderate to hefty build-up of Put OI. Several Put ITM strikes witnessed heavy to moderate OI offloading. Nifty futures OI fell last week owing to short covering. The low OI suggests prevailing indecisiveness in terms of directional movement.

Despite the sharp move seen on Friday, Nifty may extend its consolidation in the coming sessions. From the options front, due to sharp move seen on Friday, no major option writing is visible near ATM strikes and option bases can be seen forming at 25,000 Call and 23,000 Put strikes indicating broader range for the coming week.

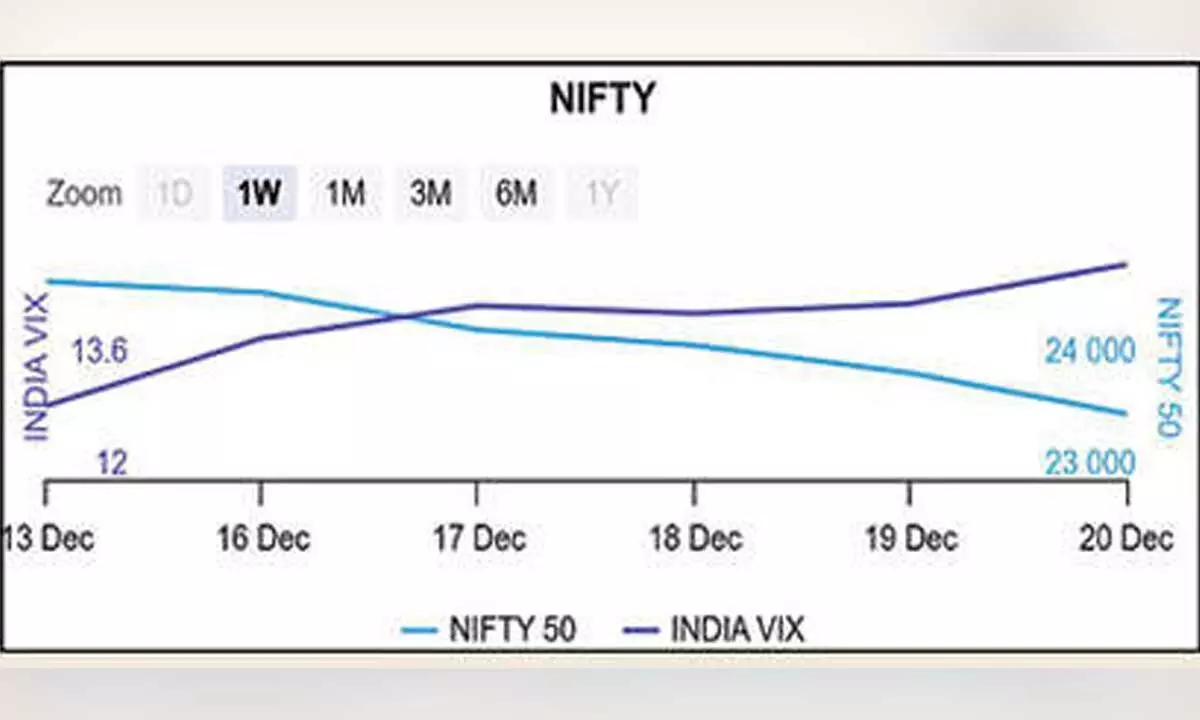

For the week, BSE Sensex closed the week ended December 20, 2024, at 78,041.59 points, a modest recovery of 4,091.53 points or 4.98 per cent, from the previous week’s (Dec 13) closing of 82,133.12 points. NSE Nifty also climbed 1,180.80 points or 4.76 per cent to 23,587.50 points from 24,768.30 points a week ago.

NSE benchmark index went through a significant breakdown, losing 4.98 per cent last week below the crucial 23,800 support level and the 21week-EMA. It resulted in broad-based selling across sectors.

Technical charts indicate next key support is at 23,200, where prices may find some cushioning, while strong resistance lies in the 23,800-23,900 range. And a break above this may drive Nifty towards 24,300. India VIX rose 3.88 per cent to 15.07 level. The volatility index rose further as the trading had been hovering in indecisive mode. As FOMC meeting and FTSE rebalancing are scheduled this week. So, intraday volatility is likely to remain high.

Considering the options OI bases, derivatives analysts predict a bearish broader market sentiment, with a sell-on-rise approach prevailing. They advise traders to exercise caution, closely monitoring support and resistance levels amid heightened volatility and weak technical signals.