OI buildup moving to higher bands

OI buildup moving to higher bands

Indicating further upward undercurrent movement, the latest options data is pointing to rise in resistance and support levels

Indicating further upward undercurrent movement, the latest options data is pointing to rise in resistance and support levels. The resistance level rose by 700 points to 19,500CE and the support level jumped by 1,000 points to 19,000PE.

The 19,500CE has highest Call OI followed by 19,200/ 19,300/ 19,400/ 19,600/ 19,450/ 19,800 19,150/ 19100 strikes, while 19,400/ 19,200/19,300/ 19,450/ 19,500/ 19,600 strikes recorded significant build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 19,000PE followed by 19,100/ 18,800/ 18,700/ 18,500/ 18,000 strikes. Further, 19,100/ 19,000/18,300/18,600/ 18,800 strikes witnessed hefty to reasonable additions of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “The highest Call OI concentration for Nifty is at 19,500, while for Put options, stands at 19,000 strike.”

“The market started the July series with a positive note, with a strong comeback by the bulls in recent sessions, resulting in new highs. Nifty already surpassed the significant psychological level of 19,000, while Bank Nifty reached an all-time high during Friday’s session. Last week, the IT sector showed promising performance ahead of the result season, witnessing a rebound in stocks such as TCS, Infy, and others. Additionally, there has been buying activity in the auto, pharma, and healthcare sectors, while the media and oil & gas sectors faced some pressure,” added Bisht.

BSE Sensex closed the week ended June 30, 2023, at 64,718.56 points, a hefty recovery of 1,739.19 points or 2.76 per cent, from the previous week’s (June 23) closing of 62,979.37 points. During the week, NSE Nifty too rebounded by 523.55 points or 2.80 per cent to 19,189.05 points from 18,665.50 points a week ago.

NSE Nifty during June F&O series rose 3.55 per cent to 18,972 level. Bank Nifty too up by 1.48 per cent to 44,327 points. Nifty added 11 per cent to OI and began the July series with 1.3 crore shares in OI. On the rollover front, Nifty saw a higher number of 76.06 per cent versus 70.61 per cent in June series and the 3-month average of 69.07 per cent. And the rollover cost was 100.35 points. An OI addition and prices ending in the green indicate some of the long buildup in Nifty, long has got carried forward.

“Currently, the rollover in Nifty is higher than the previous month, which was at 70 per cent. This suggests the potential for further momentum in the Nifty index. Notably, this month’s rollover is the highest observed in the last three months,” observed Bisht.

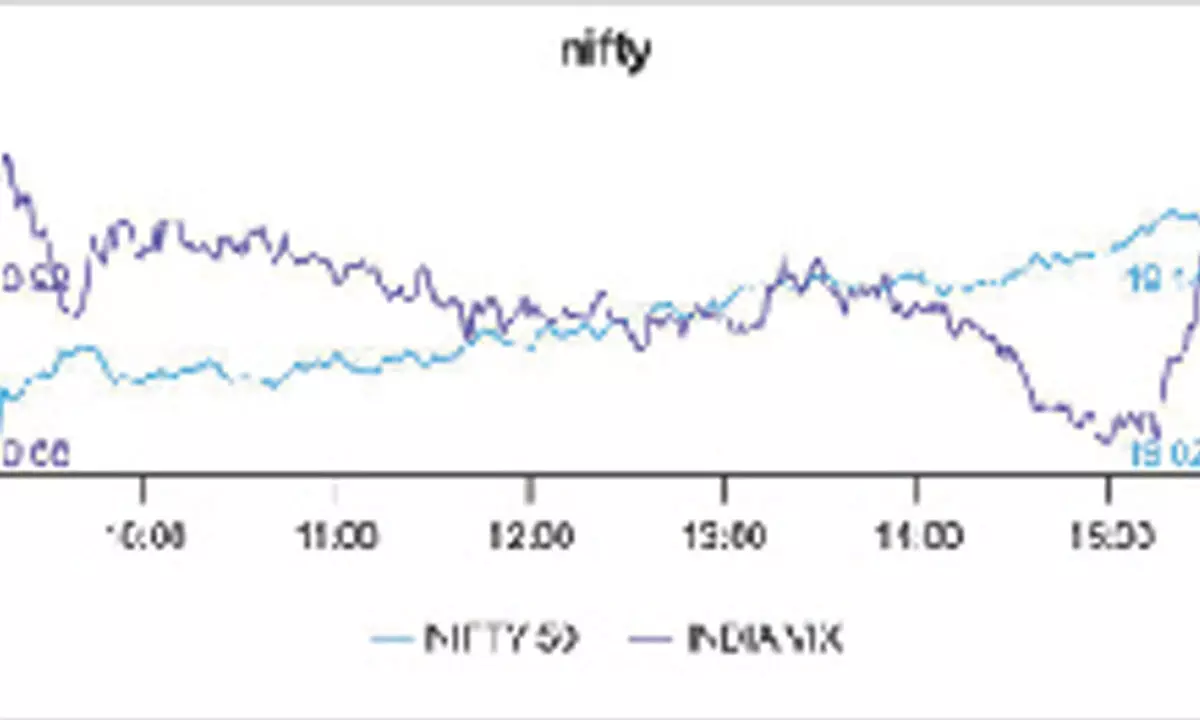

The India VIX fell 0.80 per cent to 10.80 level.

“The Implied Volatility (IV) of Calls closed at 9.96 per cent, while for Put options, it closed at 10.22 per cent. The Nifty VIX for the week concluded at 10.89 per cent. The PCR of OI for the week ended at 1.27. For the upcoming week, we expect markets to remain buoyant and any dip should be used to create fresh longs,” says Bisht.

Bank Nifty

NSE’s banking index closed the week at 44,747.35 points, a net gain of 1,124.45 points or 2.57 per cent from the previous week’s closing of 43,622.90 points. Bank Nifty PCR is 0.843 level.

“However, the rollover in Bank nifty remained unchanged, indicating a consistent momentum compared to the previous month. In Bank Nifty, the Call and Put OI concentration is at 44,500 strike, which points towards further consolidation in the index,” remarked Bisht.

Bank Nifty recorded two per cent addition in OI with an increase in prices, indicating long building seen in the index. Bank Nifty’s rollover was 79.03 per cent versus the 3-month average of 84.39 per cent with a rollover cost of 119.65 points.

| F&O Trading | ||||

| Product | Volume | Value (`/ Lakhs) | OI | PCR |

| Stock Futures | 8,67,402 | 65,11,640.27 | 29,50,480 | - |

| Index Options | 13,54,99,826 | 42,93,989.96 | 1,15,23,680 | 0.88 |

| Stock Options | 35,10,012 | 5,37,986.32 | 14,39,281 | 0.43 |

| Index Futures | 2,52,206 | 20,54,164.55 | 4,06,377 | - |