Markets get Covid vaccine boost

Markets get Covid vaccine boost

Scale new peaks as bank, finance stocks lead rally

Mumbai: Equity indices rallied to all-time highs on Tuesday, driven by banking, finance and metal stocks, as encouraging data from another Covid-19 vaccine trial bolstered investor sentiment.

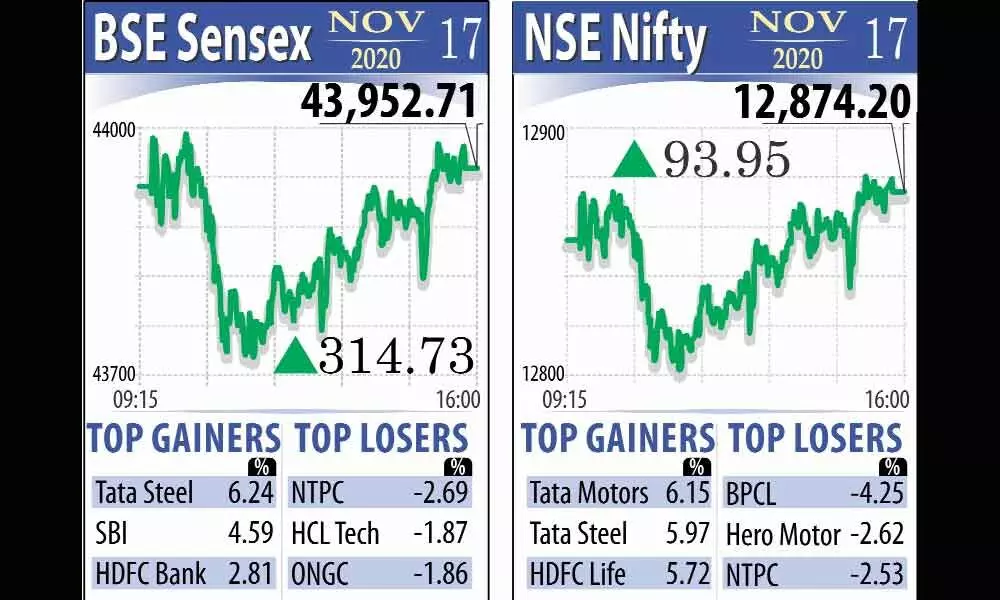

A recovering rupee added to the buying momentum, traders said. After touching its lifetime peak of 44,161.16 during the session, the 30-share BSE Sensex settled 314.73 points or 0.72 per cent higher at its new closing record of 43,952.71. Similarly, the broader NSE Nifty touched a fresh intra-day high of 12,934.05. It finally finished 93.95 points or 0.74 per cent up at its lifetime peak of 12,874.20.

Tata Steel was the top gainer among the Sensex constituents, surging 6.24 per cent, followed by SBI, HDFC Bank, Bajaj Finance, Axis Bank, L&T, Maruti, IndusInd Bank and HDFC. On the other hand, NTPC, HCL Tech, ONGC, Infosys, ITC, PowerGrid and Hindustan Unilever were among the major laggards, dropping up to 2.69 per cent.

Wall Street vaulted to lifetime highs in the overnight session after US-based biotechnology giant Moderna said its Covid-19 vaccine candidate was found to be 94.5 per cent effective in Phase 3 trials. The announcement came just a week after Pfizer and BioNtech said their Covid-19 vaccine was more than 90 per cent effective in preventing Covid-19, based on preliminary data. "The market hit the all-time high, factoring yesterday's trading holiday, led by banking stocks and investors rejoicing about the news of another vaccine to end the pandemic.

This week, global markets started well, however today, it experienced mixed sentiments owing to increase in virus cases and tighter restrictions in the western world.

"Optimism over the development of vaccine is still outweighing concerns over the next wave of Covid. We recommend investors to start considering partial profit booking, on a short-term basis, due to high gaps developing between the actual performance of the economy and the market," said Vinod Nair, Head of Research at Geojit Financial Services. Sector-wise, BSE industrials index jumped 2.27 per cent, followed by metal, capital goods, finance, bankex and realty.

However, oil and gas, healthcare, teck, IT, energy and FMCG closed in the red. Elsewhere in Asia, bourses in Shanghai and Seoul ended lower, while Hong Kong and Tokyo closed with gains. Stock exchanges in Europe were trading on a mixed note in early deals.

Meanwhile, international oil benchmark Brent crude was trading 0.25 per cent lower at USD 43.71 per barrel. In the forex market, the rupee appreciated by 16 paise to end at 74.46 against the US dollar. (PTI)