Long liquidation in sight

Long liquidation in sight

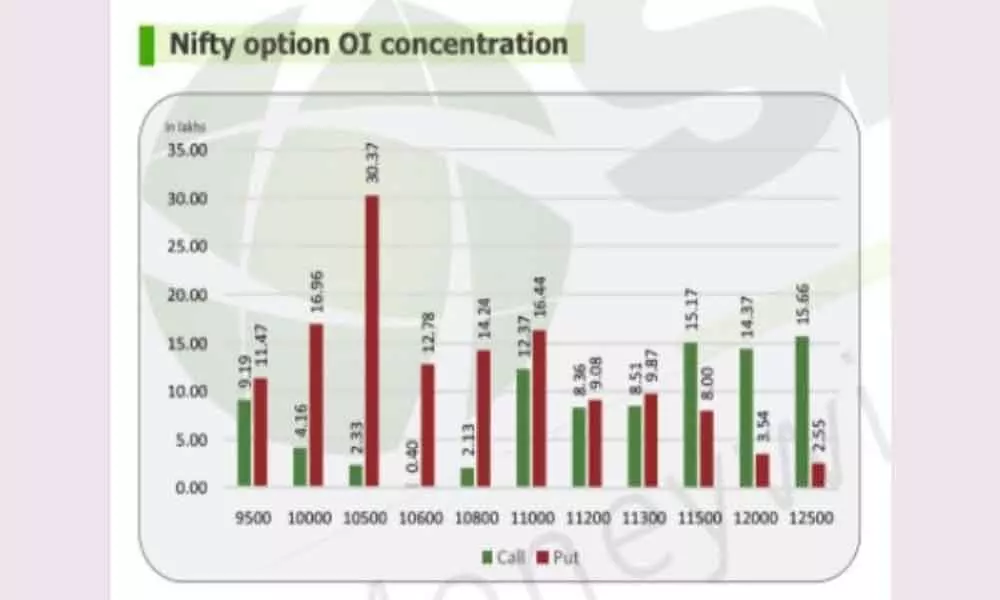

Highest concentration of Open Interest (OI) at 11,500CE and 10,000PE indicates 500 point range downwards when compared to the previous week.

Highest concentration of Open Interest (OI) at 11,500CE and 10,000PE indicates 500 point range downwards when compared to the previous week. Further, the tepid rollover to October derivatives series further holds undercurrent uncertainty and weakness in the market. After gaining in the last three monthly series, Nifty closed the September futures and options (F&O) series with 6.5 per cent loss. Nifty rollover to October in September expiry was 58 per cent as against 79 per cent in August. Bank Nifty rollover was 58 per cent when compared to previous rollover of 77 per cent. Nifty futures rollover was 71 per cent below the three-month average of 78 per cent.

"From derivatives front, Put writers added hefty Open Interest at 10,900 and 10,800 strikes, which should act as strong support for the Nifty," observes Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd. The 11,500 strike, which recorded maximum Call OI addition of 12.36 lakh contracts, has highest Call OI of 25.41 lakh contracts followed by 12,000 strike with 21.81 lakh contracts, 11200 strike with 20.39 lakh contracts and 11,300 strike with 19.81 lakh contracts. Further 11,300/11,350/11,400 strikes also witnessed reasonable build-up of Call OI.

Coming to Put side, the 10,000 strike, which also recorded highest Put OI of 13.25 lakh contracts, has highest Put OI build-up of 25.07 lakh contracts followed by 10900 strike with 21.22 lakh contracts, 10800 strike with 19.92 lakh contracts, 10500 strike with 19.49 lakh contracts. Other strikes that recorded significant Put OI addition include 10900/10500/10800 strikes.

The market was volatile during the last monthly expiry week. The NSE Nifty closed the September series 6.5 per cent lower in the settlement trade. However, a sharp recovery on Friday helped the Nifty end above 11,000 as short covering was experienced across sectors after a sharp fall. Analysts forecast that the Nifty may remain under pressure, while highs can be utilised for creating short positions.

The October F&O series commenced with just 85 lakh shares and it's one of the lowest Open Interest in the Nifty historically suggesting long liquidation. Sector-specific and stock-specific trading took place. Majority of major stocks recorded relatively low OI coming into the October series. On the options front, the Nifty has a major Call base at the 11,200 strike, which is likely to remain an immediate hurdle for the coming weekly settlement. Analysts predict that the Nifty may trade with a negative bias. According to ICICI Direct.com, from a rollover point of view, stocks like ITC, Coal India and most PSU and private sector banking heavyweights are starting the new series with significant short open interest. Closure of positions among these stocks may trigger a short covering rally in the October series.

"Indian markets began October series on a positive note as bulls made a comeback in Friday's session with Nifty reclaiming 11,000 levels after six consecutive days of losing streak. Gains were led by heavyweights like Infosys, TCS, ICICI Bank and Reliance industries. The sentiment was also lifted by stronger Asian peers on hopes of US stimulus," remarked Bisht.

For the week ended September 25, 2020, BSE Sensex tumbled by 1,457.16 points or 3.75 per cent lower and closed at 37,388.66 points from the previous close of 38,845.82 points. Similarly, NSE Nifty fell 454.7 points or 3.95 per cent, to end the week at 11,050.25 points as against last week's 11,504.95 level.

Bisht forecasts: "From technical front, Nifty bounced back sharply after taking support at its 200 days exponential moving average on daily charts, which is placed at 10,845 levels. For upcoming week, data indicates that as far Nifty is holding above 10,800 levels, the bias is likely to remain in favour of bulls. On the higher side, however, 11200 levels is a strong hurdle for Nifty." Volatility moved towards 23.5 levels towards settlement and declined below 21 level as the market recovered and significant option writing was observed across strikes for the new series. Derivatives analysts believe the volatility index may not move below 20 levels and witness an upward movement from 20 level.

India VIX rose 24 per cent on expiry day and 17 per cent for the week. "The Implied Volatility of Calls closed at 19.85 per cent, while that for Put options closed at 23.91 per cent. The Nifty VIX for the week closed at 20.67 per cent. PCR of OI for the week closed at 1.28 slightly down from the previous week indicating Put unwinding in OTM and Call writing," added Bisht.

Bank Nifty

Shedding 1,048.70 points or 4.76 per cent, Bank Nifty closed at 20,982.35 points as against the previous week's closing of 22,031.05 points. The Bank Nifty too concluded the September F&O monthly series on negative note as it closed below its major support of 21,000. Private banks Kotak Mahindra Bank, Axis Bank and HDFC Bank along with SBI eased on profit booking. As per ICICI Bank.com data, Despite the sudden move, there was no major closure in OI whereas ATM Call of 21,000 added near 13,000 contracts followed by 21,500 Call, which saw addition of 5,800 contracts. At the same time, no major ATM Put writing is visible. Major Put OI addition is at the 20500 strike, indicating a leg of retracement is due.

Many private banks violated their highest Put base and closed below it. However, on the very first day of the new series, the Bank Nifty moved two per cent higher and tested its sizeable Call base of 21,000.