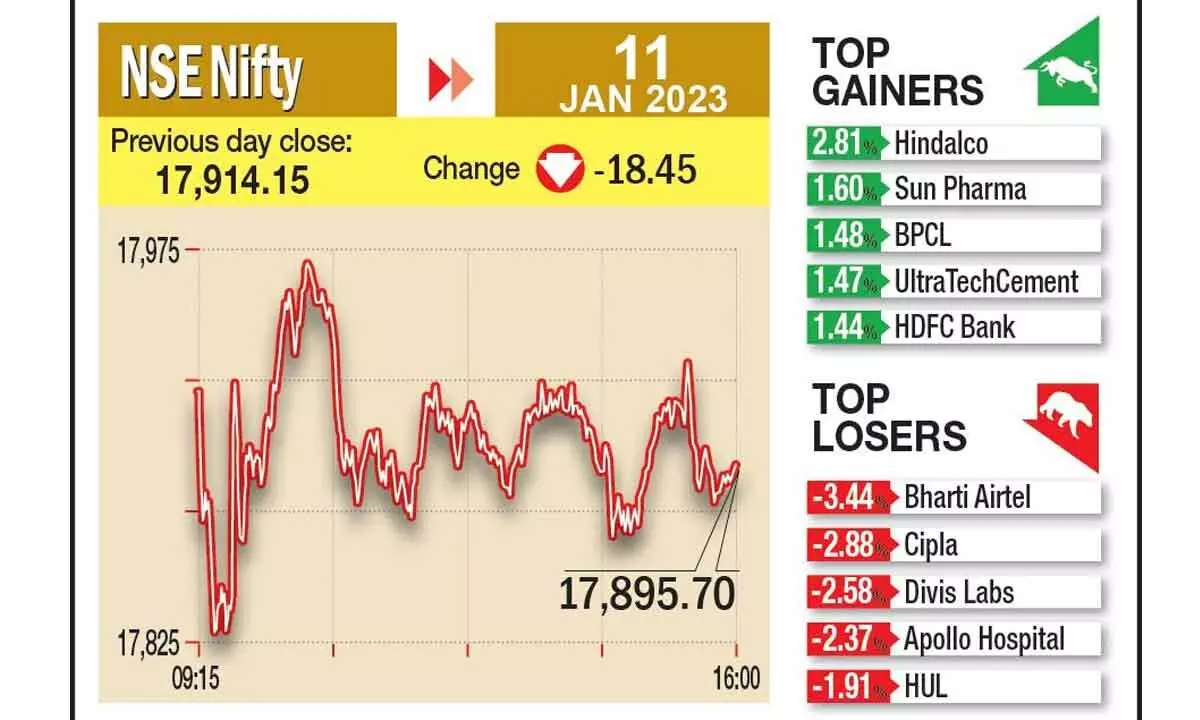

Key market indices end flat as investors turn cautious

FIIs in selling spree for 13 sessions in a row; Mkts in wait n watch mode ahead of macro data

Mumbai: In a highly volatile trade, equity benchmarks Sensex and Nifty ended on a flat note on Wednesday amid unabated foreign fund outflows and a weak trend in index heavyweight Reliance Industries.

Continuing its previous day's decline, the 30-share BSE Sensex dipped 9.98 points or 0.02 per cent to settle at 60,105.50. During the day, it fell 309.7 points or 0.51 per cent to 59,805.78. The broader NSE Nifty skidded 18.45 points or 0.10 per cent to end at 17,895.70. "The biggest drag on the market in the near-term is the sustained selling by FIIs for 13 continuous sessions, which has taken the cumulative cash market selling to Rs16,587 crore," said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

"After a volatile session, the domestic market anchored near the flat line as investors remained cautious ahead of the release of inflation data, though positive sentiments from global counterparts attempted multiple recoveries in between. The relentless selling by FIIs as a result of the premium valuation of the domestic market is weighing on the domestic market," said Vinod Nair, head (research) at Geojit Financial Services.

Foreign Institutional Investors (FIIs) offloaded shares worth Rs2,109.34 crore on Tuesday, according to exchange data.

From the Sensex pack, Bharti Airtel, Hindustan Unilever, Titan, Reliance Industries, Nestle, IndusInd Bank, Bajaj Finserv and NTPC were the major laggards. Sun Pharma, UltraTech Cement, Tata Motors, Larsen & Toubro, Tata Consultancy Services, HDFC Bank and Tata Motors were among the winners.

In the broader market, the BSE midcap gauge declined 0.27 per cent, while smallcap index ended marginally higher by 0.02 per cent. Among sectoral indices, FMCG fell 0.98 per cent, utilities declined 0.78 per cent, energy (0.53 per cent), auto (0.46 per cent), consumer durables (0.36 per cent) and consumer discretionary (0.34 per cent).