Live

- Man Sets Himself on Fire Near Rail Bhawan in New Delhi, Investigation Ongoing

- From Pushpa 2 to Devara: The Year in Telugu Cinema

- Balachandar Ramalingam on revolutionizing manufacturing with AI-driven component management

- Srikanth Avancha speaks on leadership, innovation, and risk management in IT services

- Munirathna Attacked in Bengaluru

- Centre Revives Coffee Development Plan to Aid Farmers- Goyal

- Sensational Crime Incidents in Andhra Pradesh and Telangana: 2024 Year in Review

- Tragic Loss for Beejady Village: Lance Havaldar Anoop Poojary Among Five Soldiers Killed in Poonch Accident

- Mass Rally Organized by BJP in Hyderabad on Atal Bihari Vajpayee's Centenary Celebration

- J&K: With over 25,000 houses built under PMAY, Doda ranks second in Jammu region

Just In

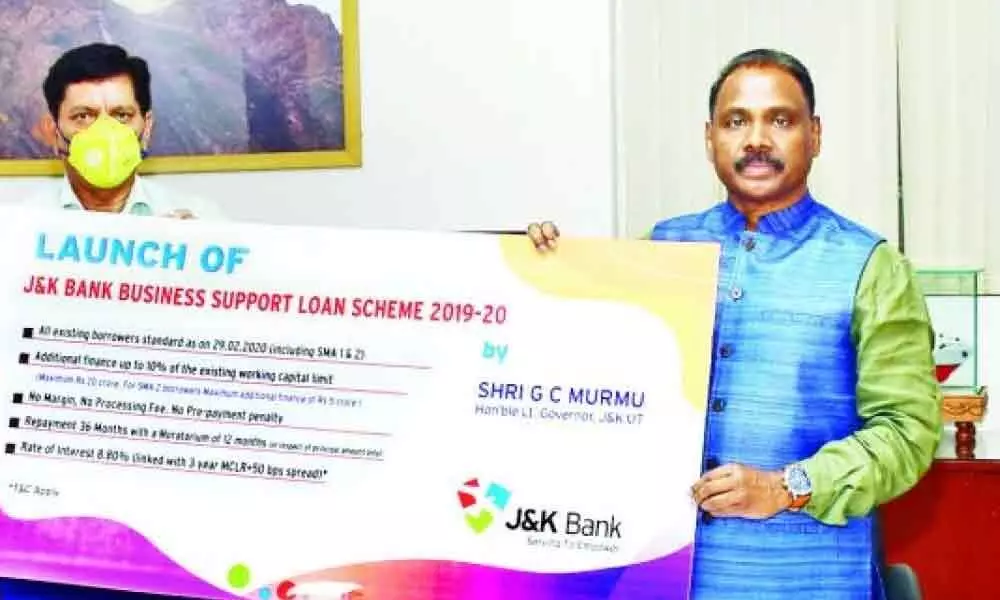

To provide adequate financial support to different business communities in Jammu and Kashmir (J&K), the J&K Bank has launched two products titled ‘J&K Bank Business Support Loan Scheme 2019-20’ and ‘J&K Bank Business Support Loan Scheme 2019-20 for Hotels and Guest Houses.

To provide adequate financial support to different business communities in Jammu and Kashmir (J&K), the J&K Bank has launched two products titled 'J&K Bank Business Support Loan Scheme 2019-20' and 'J&K Bank Business Support Loan Scheme 2019-20 for Hotels and Guest Houses. The support has been launched to overcome business challenges that have propped up due to the prevailing conditions.

The schemes were launched by the Lieutenant Governor G C Murmu. While launching the schemes, Mr Murmu said the bank's schemes are a timely financial intervention for businesses of the region especially hotels and guest houses, which are crucial for the sustenance and development of tourism sector. He has called for collaborated efforts by all stakeholders in this direction.

With an observation that the state has a vast potential to be a major tourist destination, which includes religious tourism as well, Mr Murmu added that the government is making resolute efforts to tap the immense potential in this sector.

R K Chhibber, CMD, J&K Bank, who thanked the Lt Governor for his support and foresight, said the purpose of tailoring J&K Bank Business Support Loan Scheme 2019-20 for businesses is to provide them much needed financial cushion so that they can meet the temporary mismatch in their cash flows caused by the business challenges during 2019 followed by COVID-19 pandemic.

In the case of 'J&K Bank Business Support Loan Scheme 2019-20 for Hotels and Guest Houses', he said, the aim is to support the units financially for meeting their expenditure towards salaries to staff and other recurring fixed costs. It was informed that the credit scheme titled 'J&K Bank Business Support Loan 2019-20' has been engineered keeping SMA1 & SMA2 borrowers into consideration.

The highlights include 10% enhancement in existing working capital limit in the form of a 3-year working capital term loan (which includes a one-year moratorium on principal), subject to an upper limit of Rs 5 crore for SMA2 and Rs 20 crore for other standard loans.

It was further informed that the other scheme, titled as 'J&K Bank Business Support Loan 2019-20 for Hotels & Guest Houses'. All existing customers under this segment i.e. Government recognized/registered hotels and guest houses are eligible under this scheme including the SMA1 and SMA2 borrowers. The quantum of finance under this scheme has been linked with recurring fixed expenses for the preceding 9 months of the COVID-19 pandemic with an upper cap of Rs 2 crore. The scheme will also have an initial moratorium of 12 months on principal with a maximum allowed repayment period of 36 months.

To provide a breather to the stressed businesses, the bank has decided to waive off processing charges, foreclosure charges & margin requirement under both the schemes. Moreover, the finance under these schemes shall be available at a very competitive interest rate of only 8.80 per cent per annum, which has been linked with 3-year MCLR with a markup of only 50 bps. Both the schemes are valid up to October 31, 2020, and loans will be sanctioned and disbursed within the stipulated time frame.

© 2024 Hyderabad Media House Limited/The Hans India. All rights reserved. Powered by hocalwire.com