It's time to stay cautious

It’s time to stay cautious

A reasonable correction in an overextended market is welcome, readjust the portfolio accordingly

The Indian stock market scaled up a new lifetime high during the week. However, as the profit booking triggered at new highs, it fell for four consecutive days. The benchmark index, Nifty, fell by 181.55 points or 1.2 per cent and settled at 14,981.75. The BSE Sensex also ended with a 1.3 per cent loss. The broader indices, Nifty Midcap-100 and Smallcap-100, outperformed with 0.9 per cent and 0.6 per cent advance. On the sectoral front, the PSU Bank index up by 10.7 per cent and the Energy index rose by 5.2 per cent.

The Metal index also advanced by 1.9 per cent during the week. But, Nifty Pharma and Auto indices were down by 3.4 per cent each. For the entire week, the market breadth was negative as decliners outnumbered by advances. There was a gradual decline in FII buying. They invested Rs 4,408.26 crore worth of equities during the week. The DIIs sold Rs 10,692.04 crore worth of shares.

Technically, the Nifty formed a bearish engulfing pattern on a weekly chart. Earlier, whenever it formed a bearish engulfing pattern at a lifetime high, the Nifty witnessed decent corrections. In January 2018 it corrected 10.51 per cent, and in September 2018, it corrected 14.87 per cent. In the recent past, January 2020, the fall was almost 40 per cent.

There was other bearish engulfing in May 2018 and August 2020 at swing highs, not at lifetime highs. But, these are unsuccessful and limited to one to three weeks. If the history repeats this time, expect an average correction of 12-13 per cent. This is equal to the 29th January swing low of 13,596, that means there is a probability of another 1,400 points correction in the Nifty

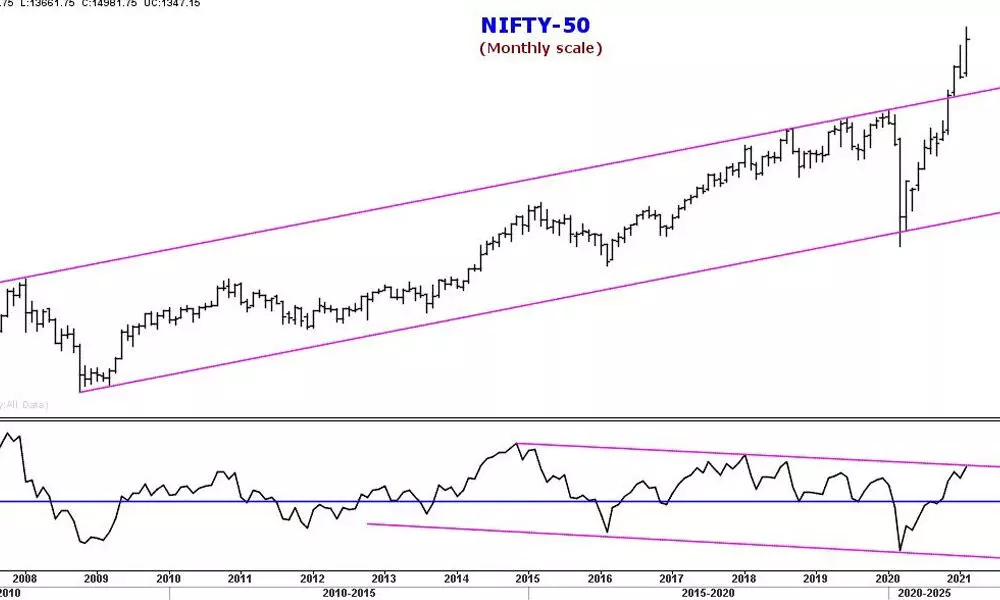

Another historical fact, which we have been discussing for the past two years, is the "Doubling Factor". Whenever the market doubles from the low, it corrected an average of 25 per cent and doubled again. We discussed this fact in detail in the previous columns. The Nifty bounced 105 per cent from the March 24, low 7,511 to 15,431 on February 16.

After achieving the 105 per cent rise, the bulls turned cautiously and began to book the profits at higher levels. The Monthly upward channel breakout occurred in November. The retesting level is around 13,300. The 23.6 per cent retracement level of the March-February uptrend placed at 13,562. This confluence zone of support is 13,300 – 13,562 is an important support for the current bull market. A reasonable correction in an overextended market is welcome, readjust the portfolio accordingly.

The Nifty achieved the 2nd February's measured gap target at 15,363 on Tuesday. It opened at the target and also registered a new lifetime, fell sharply. For the last three days, the Nifty is closing below the previous day's low. To come out of this weakness, it must close above the previous day's high to resume the uptrend. On the indicators front, there is a negative divergence in RSI and in +DMI.

As we discussed in the last, the momentum is waning. The MACD line closed below the signal line and triggered a sell signal. The next immediate support is at 20DMA (14758), which is just 1.51 per cent away. Currently, there are six distribution days. Any increase in distribution day counts as a breach of 20DMA change the market structure to 'uptrend under pressure'. A close below the 50DMA 14,321 and filling the February 2, gap is having a downtrend implication. Stay cautious by keeping these levels in mind.

(The author is a financial journalist and technical analyst. He can be reached at [email protected])