Global trade growth tipped to rise over two-fold this year

The world trade system is in a phase of upheaval and uncertainty.

The world trade system is in a phase of upheaval and uncertainty. While the 2030 Agenda for Sustainable Development considers a rule-based and fair multilateral trading system as the basis for achieving the Sustainable Development Goals (SDGs), in the World Trade Organization (WTO) the Doha Development Round negotiations are deadlocked. New rules on environmental aspects, investment or digitization are negotiated in plurilateral and regional trade agreements. Increasingly, the legitimacy of independent dispute resolution mechanisms for trade and investment conflicts is questioned. In addition, more and more countries resort to protectionist measures.

Global trade growth is set to increase by more than two-fold this year, driven by low inflation and a booming US economy.

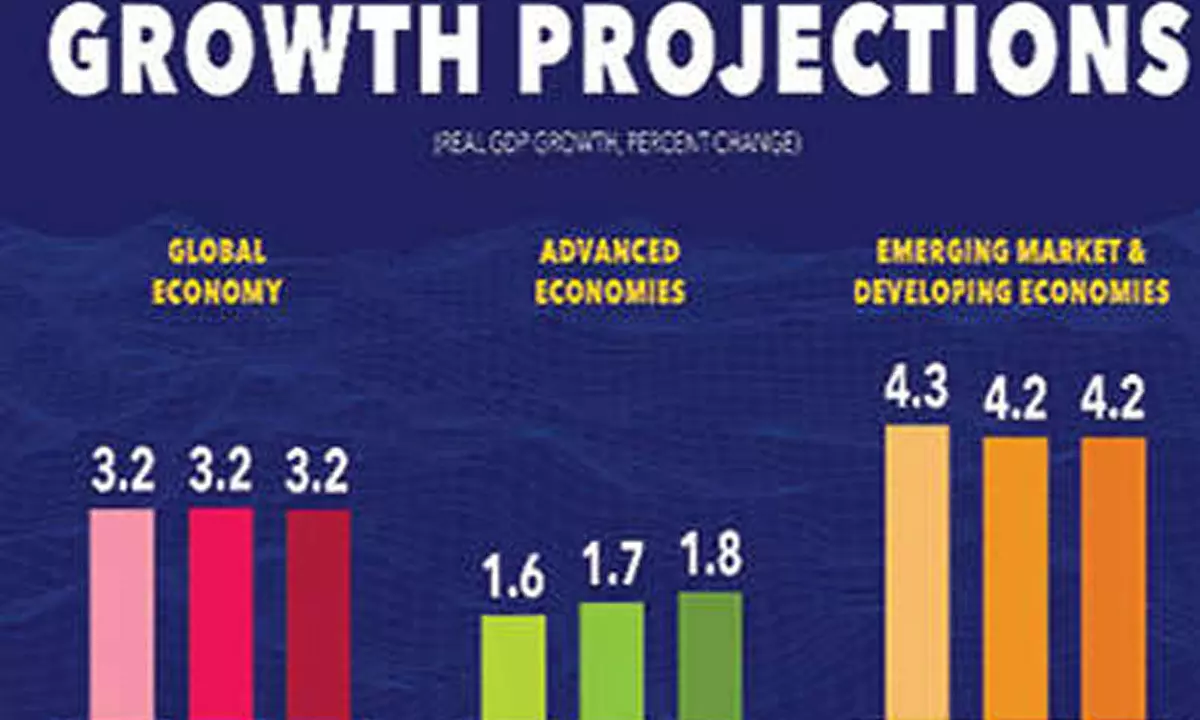

That’s according to the three major international economic organizations – the International Monetary Fund (IMF), the Organization for Economic Co-operation and Development (OECD) and the World Trade Organization (WTO) – which all forecast an uptick in global trade flows in 2024. The OECD expects global trade in goods and services to grow by 2.3% this year and 3.3% in 2025 – more than double the 1% growth seen in 2023. Slow but steady economic growth at 3.2% for 2024 and 2025 is predicted by the IMF in its World Economic Outlook – with a small uplift for the advanced economies but slightly lower growth in emerging and developing economies.

And the WTO projects world merchandise (goods) trade volumes to grow 2.6% and 3.3% in 2024 and 2025, respectively, after a significant decline last year. The IMF also predicts the world economy will see less “economic scarring” from the multiple consecutive crises of the past four years, including the trade impact of the pandemic and the war in Ukraine, which pushed up energy and food prices leading to high interest rates. It suggests that the US economy has already overcome the impact of these trends and is exceeding its pre-pandemic performance. Despite the cautiously optimistic outlook delivered by the IMF, OECD and WTO, world trade is not out of the woods yet.

The Red Sea crisis and conflict in the Middle East are causing delays and increasing shipping costs for some sectors, the WTO says in its report. The organization also points to signs of fragmentation and a regrouping of trade along geopolitical lines.US-China trade grew less than the two countries’ trade with the rest of the world, for example. While, since the start of the war in Ukraine, trade within blocs of politically aligned economies – roughly split into “East” and “West” – increased by 4% more than trade between them, it says. The WTO also points to environmental risks such as the low water levels in the Panama Canal – one of the world’s main shipping arteries – adding to the geopolitical issues affecting this and another major trade channel, the Suez Canal.

All three organizations highlight ongoing monetary risk factors. Inflation could take longer to come down than anticipated, interest rates are likely to remain volatile and there may be a lag in impact for those tied into high interest rates for long periods, such as mortgage holders.

In the face of rising government debt, the OECD recommends prudent monetary policy – containing inflation and servicing mounting debt burdens. It also calls for a stronger policy of investment to drive long-term growth and living standards through fostering innovation and tackling climate change.

However, while developed countries can look ahead with increased optimism, the IMF warns about the deepening chasm between them and many low-income countries. Low growth and high inflation in these markets will require structural reforms to encourage domestic and international investment, alongside reducing reliance on funding, debt management and mobilizing countries’ young populations, it says. The forecast for 2024 is broadly positive, with GDP growth expected to continue at around 3%. The demand for environmental goods, especially electric cars, is set to play a crucial role in driving trade growth. However, the logistical challenges such as shipping disruptions in the Red Sea, Black Sea and Panama Canal cast shadows over the optimistic outlook, threatening to raise costs and disrupt supply chains. The ongoing geopolitical tensions and regional conflicts could also renew volatility in energy and agricultural markets. Additionally, the growing need to secure access to minerals critical for the energy transition could affect prices and add to market volatility for these commodities.

There are downside risks to the global economy in 2024 and inflationary pressures may persist. There are uncertainties around current forecasts, but most international agencies are suggesting that 2024 will be tougher because of the need for interest rates to stay “higher for longer” to ensure that inflationary pressures emanating from the monetary system are dampened.