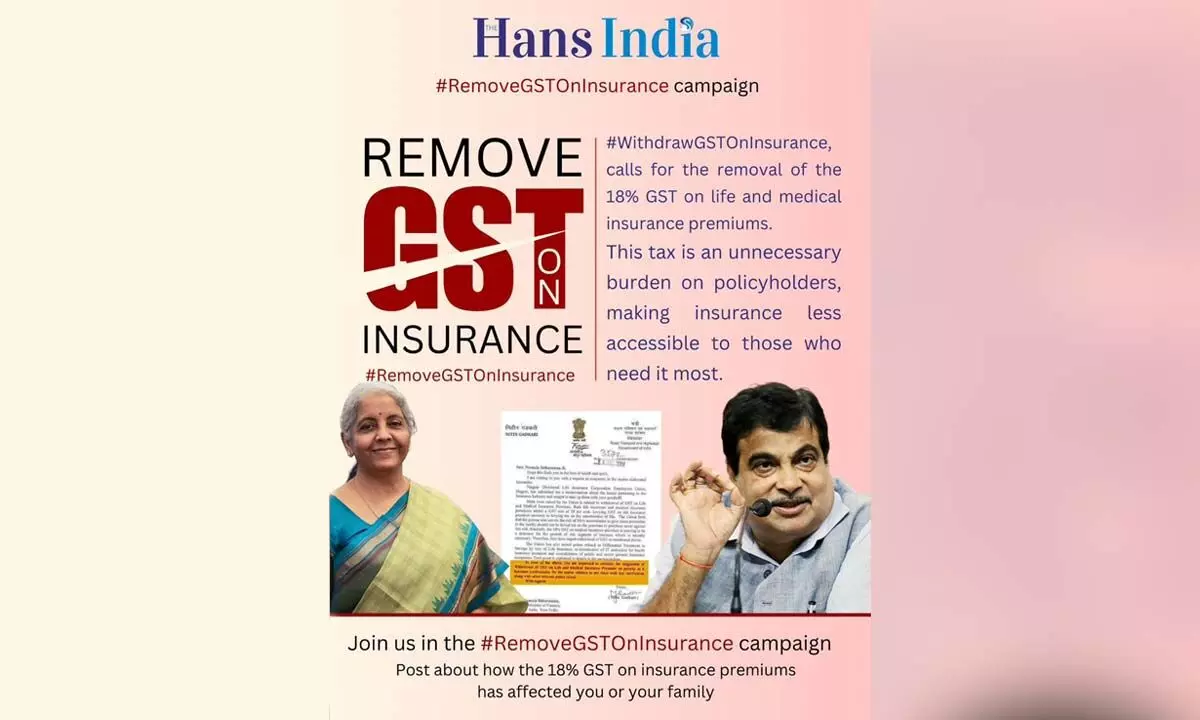

Gadkari's Propsal to remove GST on Insurance gets all round support

In Today's senerio Insurance is most valuable thing for any family and individual, by this anyone can save himself and his/her family from any unfortunate in a good manner

Rajeev Makol : Life & Health insurance advisor

In Today's senerio Insurance is most valuable thing for any family and individual, by this anyone can save himself and his/her family from any unfortunate in a good manner

The removal of service tax on health and life insurance is a necessary and significant benefit for individuals for several reasons:

1. Affordability: Removing service tax reduces the overall cost of health and life insurance premiums. This reduction in cost makes these essential services more affordable, encouraging more people to obtain insurance coverage.

2. *Increased Coverage: Lowering the cost barrier can lead to higher insurance penetration rates. More people, especially those from lower-income groups, will be able to afford insurance, thereby enhancing social security .

3. Health Security: For health insurance, the removal of service tax can lead to better health outcomes. When more people are covered by health insurance, they are more likely to seek medical care without delay. This early access to medical services leads to early diagnosis and treatment of diseases, which can significantly improve health outcomes.

4. Financial Protection: Life insurance provides financial security to the families of the insured in case of an untimely death. Removing the service tax makes it easier for individuals to invest in life insurance, ensuring that more families are protected against financial hardships, thus fostering greater financial resilience.

5. Encouraging Long-term Planning: By making insurance products more attractive and affordable, individuals are more likely to engage in long-term financial planning. This can lead to a more financially secure population that is better prepared for unforeseen events, contributing to individuals

Levying 18 percent GST on medical and term insurance is a deterrent factor to go for insurance policies for citizens along with micro insurance products. By eliminating the GST burden, the government is certain to do yeoman service to boost the insurance business, which presently is ranked tenth globally. Also, it would be nice if the possibility of ‘on tap bonds’ be explored to raise the funds for medical health insurance

-- Col Satwant (Retd) vice president (Operations and Projects), Radha Spaces

The 18 percent GST unfairly burdens people trying to protect themselves financially and health-wise, making insurance more unaffordable. Also, the cost could stop people from availing insurance policies, leaving them at risk. Such a tax goes against the government's goal of helping people and might hurt tax revenue in the long run due to less people going for insurance policies. Hope the trend changes soon.

-- Raghu Pokala, CEO of eDesk BPO Services

Human Life is uncertain.if there is 18 percent GST it will decrease insurence payment capacity of the citizens. It leads to uncertainity of life. Where as article 21 guarenteed right to life and personsl liberty.

Each State has a prime responsibility and its duty to protect, promote and implement all those rights and fundamental freedoms, by adopting necessary steps . Levying 18 percent GST on health insurance diminishes the protection of fundamental right guarenteed under art 21.

Bold and revolutionary decision taken by the central government and it is useful to common and poor people. Lifting of 18 percent GST on medical and health and life insurance policies. Life is uncertain and insurance sector is essential to expand like in advanced countries. Waiver of GST will boost the insurance policies in our country.

KV Jagannadha Rao, Retired Bank Official, Srikakulam

Medical, health and life insurance policies need to cover more people in our country. The decision to waive GST on these policies will save people of our country. Insurance policies at present in our country covered less percentage of people. This decision will help to cover more people to face any untoward incidents and will protect safety of families.

Beena Dhilli Rao, BC Union State General Secretary

More than 300 Parliamentarians, cutting across party lines, lent their support to the request of insurance employees to withdraw GST on insurance premium in the month of July. Nevertheless, the Union Finance Minister didn't make any announcement in the budget proposals of 2024-25. GST was projected as a major tax reform initiated by the government aimed at doing good to the people and the nation at large when the Government of India rolled out Goods and Service Tax (GST) bill from 1st July 2017. It is an irony that after food, clothing and shelter, insurance protection is an important need of the people. Despite it, the GST on term insurance, health and ULIP policies was fixed at 18 percent. The life insurance industry has been rightfully demanding withdrawal of GST on life and health insurance premium, which is unjust as Indian constitution makes the right to dignified life and health a fundamental right. In the background of dent in the financial savings, steep hike in household debt of the country, a coherent policy framework effecting crucial policy changes are quintessential to shore up the dwindling savings ratio in our country. It goes without saying that the overall situation warrants repeal of GST on insurance.

- P Satish, president of South Central Zonal Insurance Employees Federation

“ Taxing life insurance is akin to taxing the uncertainties of life” - this is a very pertinent point and definitely the Goods and Services Tax on life and Medical insurance should be removed to help the commoner and as well as the needy. The Finance Minister must give a serious thought to it .

Ambika Ananth,Author and Independent Journalist

Treat Insurance not only as social cover it also as a mode of saving

Khammam:Expressing. Happy that the Cabinet Minister Gadkari has endorsed removing 18 percent GST levied on Health and Life Insurance premium. By levying GST are making the premiums expensive. Insurance not only as a social cover but also as made of savinng so it should remove the GST. I supporting the Gadkari demand.

V L Narasimha Rao, Khammam

“ Tax on Life’s Uncertainties : Dr G Venkateswarlu Khammam

Khammam :I supported to Transport and Highways Nitin Gadkari Letter on removing the 18 percent Goods and and Services Tax( GST) on life and medical insurance premiums as it leader to levying taxes an uncertainties of life and restricts the sector’s growth.

I feels that a person who covers the risk of life's uncertainties to give protection to the family should not be levied tax on the premium to purchase cover against the risk. I supported to Nitin Gadkari the suggestion of withdrawal of GST on life and medical insurance premium on priority as it becomes cumbersome for senior citizens as per rules with due verification.

Dr G Venkatateswarlu, Managing Director,Sri Raksha Hospitals,Khammam.

The Union Road and Transport Minister Sri Nitin Garakari ji appeal for the consideration of GST on Life and Medical Insurance is genuine to consider for the amendment.

Lanka Dinkar AP BJP Spokesperson

Shekhar Rao Yadagirin State President.Telangana Recognised School Management Association(TRSMA): The teaching and non-teaching staff of the private schools do not get salaries on par with the teachers of the government schools. Removal of GST on life and medical insurance does give small relief. The insurance agents will go to people to get more people into the insurance net citing the removal of GST. However, it is the lowering of the premieres that helps better. The suggestion made by Union Minister Nitin Gadkari is a positive step in the right direction.

Amar, Head of Slate Schools, Hyderabad: Removal of GST on medical and health insurance is not a big issue. What needs to be looked into is to focus on preventive medical care. The lack of it forcing people to opt for medical and health insurance due to growing health issues. The suggestion of Union Minister Nitin Gadkari is positive. But, that does not address the real factors.

Prof Arjuna Rao, Principal Arts College, Osmania University, Hyderabad:

"How many out of 140 crore people in the country have taken health and life insurance? Where is the date of coverage to conclude whether GST in any way provides much-needed relief to the people? The real issue that needs to be addressed is how to provide coverage to a large chunk of the population to provide relief by reducing the risk burden of health and uncertainties in life.

Prof Papi Reddy, former Chairman, Telangana Council of Higher Education (TGHE): While the suggestion is positive. The real issue in a developing country like India is the rationalisation of GST on several goods and services and the income tax. The burden of indirect taxes, the GST and the income tax together put more burden on the lower, middle and upper middle-income middle classes, who pay taxes. In other countries, they have a tax of 40 per cent on the incomes of the individuals with incomes over and above Rs 1 or Rs 2 crore. But, in India, people have to pay a 30 per cent tax on the salaries drawn at Rs 15 lakh. There is a need for rationalisation of GST and income tax.

The decision of union minister Nithin Gadkari's appealing the union finance minister Nirmala Sitaraman to consider of withdrawing Goods Service Tax on is acceptable.

This decision will be beneficial to crores of people would have great relief.

Dr. B. V. Subbareddy assistant professor Department of Social Work. Vikrama Simhapuru University.

GST since its inception has done a great service to the tax collecting system blocking several loop holes. However as time passes we need to make modifications regularly to make it better and more acceptable. We need to encourage people to spend money for their safety and hence life insurance has become a norm for the future of every citizen.

Removing GST on life insurance payments will go a long way in more people opting for the payment of the premiums and will reduce the burden for those who are already paying premiums. I strongly feel that the Govt of India can do away with the GST on Insurance premiums for all the money so collected through premium payments will be utilized for the development of the country only .

Dr.T.V.Narayana Rao, Consultant Urologist,Soujanya Hospital, Prakash nagar , Rajamahendravaram 533 103

Phone: 0883 2467090, 2461690.

The decision of central government to waive Goods Service Tax on these policies to help cover scores of people in the country. Comparitively with other countries India has been lacking behind having insurance policies for various reasons. in these circumstances waiver of GST would be more benicificial to people as they would come forward for making medical and health in large numbers.

Konjeti Gopal. Rice Trader. Balaji Nagar. Neĺlore City.

Union Minister Nitin Gadkari recently appealed to Finance Minister Nirmala Sitharaman to remove the 18% GST on life and medical insurance premiums. In his letter, Gadkari highlighted that this tax burdens senior citizens and discourages the growth of the insurance sector.

He argued that taxing insurance premiums is akin to taxing life's uncertainties, and suggested that people should not be penalized for seeking to protect themselves and their families. Samanchi Srinivas has expressed support.

Samanchi Srinivas, Advocate, Tirupati

Dr Srinvas Chakravarty, Oncologist

Treat Insurance not only as social cover it also as a mode of saving

Khammam : Expressing. Happy that the Cabinet Minister Gadkari has endorsed removing 18 percent GST levied on Health and Life Insurance premium. By levying GST are making the premiums expensive. Insurance not only as a social cover but also as made of savinng so it should remove the GST. I supporting the Gadkari demand.

V L Narasimha Rao, RK Medical Agencies

KVVS MURTHY (Writer and Translator), Bhandrachalam

Remove GST on Life Insurance, Medical Insurance

Nitin Gadkari's suggestion of withdrawing GST on health insurance premiums is apt and very beneficial to senior citizens. It is a welcome suggestion. This 18% GST on health premiums is also a deterrent to the insurance business. Though this GST helps to foster competition among insurers, it becomes burdensome for policy holders. If withdrawing completely is not possible the lower rates of GST may be levied on health insurance premiums as it was done in the case of endowment policies.

Forum for Better Bapatla secretary Dr P C Sai Babu

Now days insurance is important to all of us.. But government should give health promise to all citizens by dropping GST on medical and health insurance.. It is very useful to all policy holders and new coming insurance policy holders.

R Vara Prasad, Private employee, Adoni

GST on insurance is not at all acceptable. It's meaningless and extra burden. Hence it should be removed immediately for the favor of the needed public.

P Picham Raju, Retd Gazetted Head Master

After Covid-19 pandemic, people are now keen on going for life and medical insurance policies. However, the 18 percent GST is a deterrent factor to avail the policies. If it gets slashed down by the Centre, lower income group families too will come forward to enroll themselves and their families into medical and life insurance policies so that their family members have something to look into in times of any unforeseen incidents.

-- Vandrangi Visweswara Rao, advocate from Vepagunta, Visakhapatnam.

GST on insurance is not acceptable

GST on insurance must be withdrawn immediately. Common people suffer a lot with high percentage ofGST. The objective of taking insurance is to give protection to the family. The government should give protection to people and must not burden with high percentage of GST. Levying GST must be opposed by everyone in the country

MS Rao, Trader Vijayawada

Dr M.Naveen kumar Reddy

Senior cosmetic dental surgeon and JEO.Sri Balaji medical College.hospital and Research institute. Tirupati

Here is the view from Mr. Sandeep Katiyar, Co-Founder & CFO of Finhaat

1) Why do you think that 18% GST on insurance premiums is exorbitant and why removing it will help Indians?

We believe that financial security is essential for every individual, and insurance is a key component in achieving this security. To ensure that basic necessities are accessible and affordable, it is crucial that the Goods and Services Tax (GST) on these items be either eliminated or reduced to a negligible rate.

2) What is the government's logic of imposing an 18% GST on insurance products?

Insurance has been categorized under various services, which is why it is subject to Goods and Services Tax (GST).

3) Is the life and health insurance industry seeking a total removal or a lower GST bracket? Why?

In our opinion, there should not be a complete removal of taxes. Instead, the tax should be linked to the annual premium and the type of insurance product. Taxes on premiums for individuals at the bottom of the economic pyramid or senior citizens should be eliminated. For other income segments, the tax should be lower on pure term plans and medical insurance premiums.

4) What has been the growth in the life insurance industry in India? How do you see it vis-a-vis other countries?

Life insurance firms collected 18% more premiums in FY23 compared to the year before. Life insurers collected Rs. 3.71 lakh crore (US$ 44.85 billion) as the first-year premium in FY23 as against Rs. 3.14 lakh crore (US$ 37.96 billion) in FY22. India is predicted to have the fastest-growing insurance sector among G20 nations for the next five years to 2028, with a real-term growth of 7.1% in total insurance premiums. The life insurance segment is expected to expand by 6.7% due to increased demand for term life coverage and the adoption of Insurtech.

5) What has been the government's earnings through GST in life and non-life products?

We avoid answering this question.

6) Have you come across cases where due to the heavy premium users have settled for a smaller sum insured?

Premium payment capacity is directly linked to disposable income, which is limited for the poor and lower-middle-class segments. If premiums decrease due to lower taxes, individuals in these groups will be able to obtain higher coverage.

7) What can insurance companies do to bring down premiums in life and health insurance products? -

We believe that the cost of insurance can be reduced by leveraging technology for underwriting and distribution. This approach will help rationalize costs and lead to more effective underwriting of products.

Shashank Avadhani Co-founder & CEO, Alyve Health, said:

Completely concur with Mr Gadkari’s request . Life and medical insurance products are necessities in today’s society. Waiver of GST will enable increased penetration due to lower costs and create a level playing field between out of pocket healthcare expenses ( in which there is no GST for most use cases ) and premiums paid as part of insurance or health plan subscriptions.

Dr Monica B. Sood, Chairperson, National Unity and Security Council

Nitin Gadkari's recent appeal to Finance Minister Nirmala Sitharaman for the abrogation of GST on life and medical insurance premiums is both

sagacious and imperative. Life insurance, as a fundamental pillar of financial security, provides indispensable support to families during exigent times. Imposing taxes on such essential services subverts their primary purpose, rendering it increasingly arduous for individuals to fortify their futures. The abatement of GST on life and medical insurance would render these services more accessible and affordable, thereby encouraging their widespread adoption and enhancing the overall financial resilience of the populace.

The recommendation from the Nagpur Divisional Life Insurance Corporation Employees Union further illuminates the pervasive industry apprehension regarding the deleterious impact of GST on the insurance sector. The excision of GST would not only alleviate the financial encumbrance on policyholders but also invigorate the insurance sector, thereby fostering greater economic stability. Gadkari’s proposal harmonizes with the overarching objective of augmenting financial security and welfare for all citizens, marking a laudable stride towards a more supportive economic infrastructure.

Moreover, this initiative possesses the potential to catalyze economic growth by augmenting household disposable income, which could subsequently precipitate increased consumer expenditure and investment. It would also serve as an impetus for a larger demographic to procure life and medical insurance, thereby expanding the risk pool and potentially diminishing premiums due to elevated participation. A tax exemption on insurance could further propagate financial literacy and awareness, impelling more individuals to undertake proactive measures for safeguarding their financial futures.

Additionally, the removal of GST on insurance premiums would exemplify the government's commitment to ameliorating the quality of life for its citizens, reinforcing the social safety net, and ensuring equitable access to vital financial services. By addressing the multifaceted concerns of both the industry and policyholders, this initiative can pave the way for a more inclusive and secure financial milieu, thereby cementing the government's dedication to the welfare and prosperity of its citizenry.

In summation, the abolition of GST on life and medical insurance premiums is a judicious and forward-thinking measure that promises to fortify the financial stability of individuals while concurrently bolstering the broader economic framework. Such a policy would not only alleviate immediate financial pressures but also engender a culture of prudent financial planning and security, ultimately contributing to the holistic development and prosperity of the nation.

GST should be removed on Insurance!

Insurance indemnifies against the uncertainties or losses from specific contingencies or perils by providing the compensation to dependents of insured. Surprisingly, in India only 30℅ of the population has Life Insurance and 41℅ of the Households have Health Insurance coverage. Presently, the Central Government is imposing 18℅ of GST on both Life and General Insurance premium which is increasing the additional financial burden on the policy holders. Tax on Insurance means taxing the uncertainties of life. Therefore, the Central Government should unconditionally remove the GST on Life and Medical Insurance so as to reduce the premium burden besides increasing the coverage of Insurance in India.

Dr. M. Malla Reddy, Asst. Professor of Commerce, SRR Govt. Arts & Science College (Autonomous), Karimnagar.

The timely, sensitive response from a person of Cabinet Minister rank is the citizens voice ably represented by Nithin Gadkari to Finance minister Nirmala Seetharaman is welcome sign. The 18 % GST on life and medical insurance will surely burden the common man in addition to related companies, both public and private. He requested finance minister to remove the existing GST tax to benefit the insurance sector and insurance payees for their future securities to tackle uncertainties of modern life. The request from LIC employees associations to withdraw the 18 % GST to strengthen the companies along with boosting the morale of senior citizens for their unexpected medical emergencies. We the senior citizens request finance minister to remove the tax and also thank Gadkariji for responding positively in favour of general public.

Dr B Madhusudhan Reddy, Principal Rtd, Govt Degree & PG College, Karimnagar

Bhanu Prakash insurance adviser Nalgonda

Eliminating GST on life and medical insurance will be one of the milestone step in the year 2024 post elections as it will be in good faith for the people of India which will help lower and middle class people to make them believe in the Modi 3.0 and give a powerful message and mark the beginning of new India under the Supreme and trusted leadership of Prime Minister Narendra Modi. As insurance provides safety and makes it more affordable would encourage more people to invest in their well-being and security. -- Mir Firasath Ali Baqri, a resident of Old city Hyderabad

Removing GST from life insurance will enhance the financial resilience and well-being of vulnerable segments of our population especially Pasmandas, contributing to their socio-economic upliftment. Union minister Nitin Gadkari’s vision of affordable life insurance means more families can secure financial protection. -- Adnan Qamar, Telangana President, All India Pasmanda Muslim Mahaaz

Dr K Ramakrishna Rao, Senior Faculty in Higher Education Department, Nagar Kurnool

Imposing GST on Medical and Life Insurance premiums further deprives the middle and poor families of insurance cover: Chaitanya, a councilor from Jadcherla Municpality

Mahabubnagar: Imposing GST on Medical and Life Insurance premium by the Finance minister Nirmala Seetaraman is completely irrational and unjust. Ironically, another Union Minister of BJP party Nitin Gadkari raising the issue with the Finance Minister and urging her to completely abolish GST of 18 per cent imposed on the premiums of Medical and Life Insurance, has been widely welcomed.

In my opinion, it is the opposition party that has to raise the issue and confront the government. But it has failed to do and thanks to Nitin Gadkari for raising this issue and urging their own colleague to reconsider of abolishing the 18 per cent GST is welcome.

I feel that while more than 80 per cent of population in the country is not at all covered any of the Medical and Life insurances, the government’s unmindful of levying GST will further distance the lower, middle and upper middle classes to be stay away from any of the insurance coverage.

As already the people are bearing the brunt of higher healthcare costs and many poor families are slipping into poverty due to uncertain incidents, it is high time that the central government must bring in new schemes to encourage more and more people to come under the ambit of insurance and therefore must shun away from levying any kind of GST on insurance premiums.

Kaveti madhu - freelance photo grapher

Suresh private employee nalgonda

Comments on GST from Medical Expert, Dr. V. Shekhar, Medical Director from Ravi Children's Hospiltal:

The imposition of an 18 percent GST on medical and life insurance premiums significantly impacts the insurance industry, particularly affecting elderly individuals, poor families, and those at higher risk of life-threatening conditions. The increased cost of premiums due to this tax makes it difficult for these vulnerable groups to afford insurance coverage, distancing them from obtaining necessary protection.

Dr. Shekhar, Medical Director of Ravi Children's Hospital in Mahabubnagar, emphasized the need for government intervention. He advocates for encouraging policies that ensure all citizens have access to insurance, which is crucial for securing the future of families and dependents. Dr. Shekhar pointed out that such measures would be especially beneficial for the elderly, providing them with much-needed relief in managing medical emergencies.

Sharath Reddy business man Nalgonda

Satish computer institute owner nalgonda

Shravan mobile shop owner Nalgonda

Kinnera Sridevi, Principal, Gitam High School, Tirupati

A Manjunath, Member of Tirupati Chamber or Commerce

US returned Techie , B Shashidhar from Hyderabad

He wondered why the union government imposed a huge burden on GST on life and health insurance. Paying premiums is a burden for the common man . Now, GST burden will put more burden for policy holders.

Dr P Usharani, Senior Professor and Head Department of Clinical Pharmacology and Therapeutics Nizam’s Institute of Medical Sciences, Hyderabad.

Removing the 18% Goods and Services Tax (GST) on health and life insurance premiums, as recommended by the road transport and highways minister Nitin Gadkari, would have several potential advantages like increased affordability, better coverage, encouragement of long-term financial planning, increased savings, improved public health, reduced burden on public healthcare, alignment with the social welfare goals of the government.

-Thota Naga Jyothi, Contract Employee, Ongole

The advocacy made by the Road and Transport Minister frames life insurance as a necessity rather than luxury. The goal is to make these life insurance policies more affordable, potentially increasing their adoption and improving the financial security for a larger segment of the population. In a country like India, where social security in the form of medical coverage or life insurance is not provided to taxpayers, more affordable life insurance could reduce the financial burden on the dependents of the deceased and potentially reduce the strain on social welfare systems.

However, considering life insurance is a significant market in India, eliminating GST could lead to a notable decrease in Government revenue. Additionally, removing GST from life insurance might spark debates and advocacy concerning GST levy on other types of general insurance or financial products related to life's uncertainties (such as accident policies, etc.)

This proposal, originating from a high-ranking Union Minister, demands thorough evaluation and a nuanced response. The government will need to weigh this recommendation against broader economic and policy implications, while also being mindful of public perception and potential political ramifications. They may consider a baby step approach and as an initial step, they may consider reducing the tax rate on life and health insurance policies instead of removing it in entirety. Depending on the outcomes, they can then decide on whether to proceed with complete removal or implement other adjustments or a full roll back.

Sanjay Chhabria, Indirect Tax lead at Nexdigm

Sk Azeer, DGM, BSNL, Guntur-Ongole telecom districts

Shekhar Rao, Chief Advisor , Telangana Recognised Schools Management Association (TRSMA)

Dr. KSR Murthy, Associate President of Andhra Pradesh Federation of Residents Welfare Associations (APFERWAS)

V.Dali Naidu District president, Human rights committee Parvathipuram Manyam

D k ravi real estate consultant bangalore

Shivam Bajaj- Communication and PR Professional

Syed Bilal, vice president of Human Rights Forum

By levying tax on insurance, the government is depriving and discouraging those who are underpreviledged. I welcome the stand taken by Union Minister Nitin Gadkari, as taxing the insurance is uncalled for because it is impacting the decision made by the middleclass. With huge tax on medical and allied sectors, the underpriveleged would rather avoid entirely rather buy the insurance.

Harish Daga, a techie

There should be slab while applying GST on insurance, so that it is more affordable for the middle class. Similar to tax slabs, those who are paying premiums for policies which are less than Rs 15 lakhs should be exempted. This strategy will encourage more citizens to turn policyholders and only those who are above that would not feel the impact of the tax burden. I hope that this will become reality in the coming days, in wake of Union Minister Nitin Gadkari raising the issue.

Vishnumahanti Murali Priya, D/O VSVS Rama Krishna, B tech 3rd Year, Bhadrachalam.

Somula Varshitha, BA,LLB Final year ( 5th year ) Bhadrachalam

Kandukuri Subrahmanyam, Gold Jeweller, Tenali

It is not correct to levy Goods and Service Tax (GST) on life insurance and medical insurance. The government needs to draw a line to safeguard the interests of the common man. Nitin Gadkari’s observations are spot on in identifying the malady. The number of persons who take health insurance itself is less. The GST will be an added burden. It will discourage many from taking health and life insurance. It’s also to be noted that the insurance companies also pay some commission and it’s also from the purse of the policyholders.

Dr Ramaka Srinivas, Cardiologist, Hanumakonda

It’s high time that the Union Government take proactive measures to bring all the people under the coverage of life and health insurance. To make it happen, the onus is on the government itself to cancel the GST on life and health insurance. I am welcoming the Minister of Road Transport and Highways Nitin Gadkari’s proposal to waive GST would help the poor and middle classes to access medical insurance policies.

Sangala Ephraim Raj, SDLCE SC/ST Association Vice-President, Hanumakonda

I will support Union Minister Nitin Gadkari’s request to Union Finance Minister Nirmala Sitharaman to withdraw the 18 per cent GST on life and medical insurance premiums. It helps the needy to take up health insurance policies. Buying insurance policies is burdensome for the poor and middle classes as the medical and allied sectors are placed in a high tax regime. The Centre needs to come out with a policy that sans GST on health insurance premiums.

Pulla Srinivas, AIUEC (All India Universities Employees Confederation) Vice-President, Warangal

G. Varaprasad Rao, General Secretary, Insurance Corporation Employees Union , Visakhapatnam Division