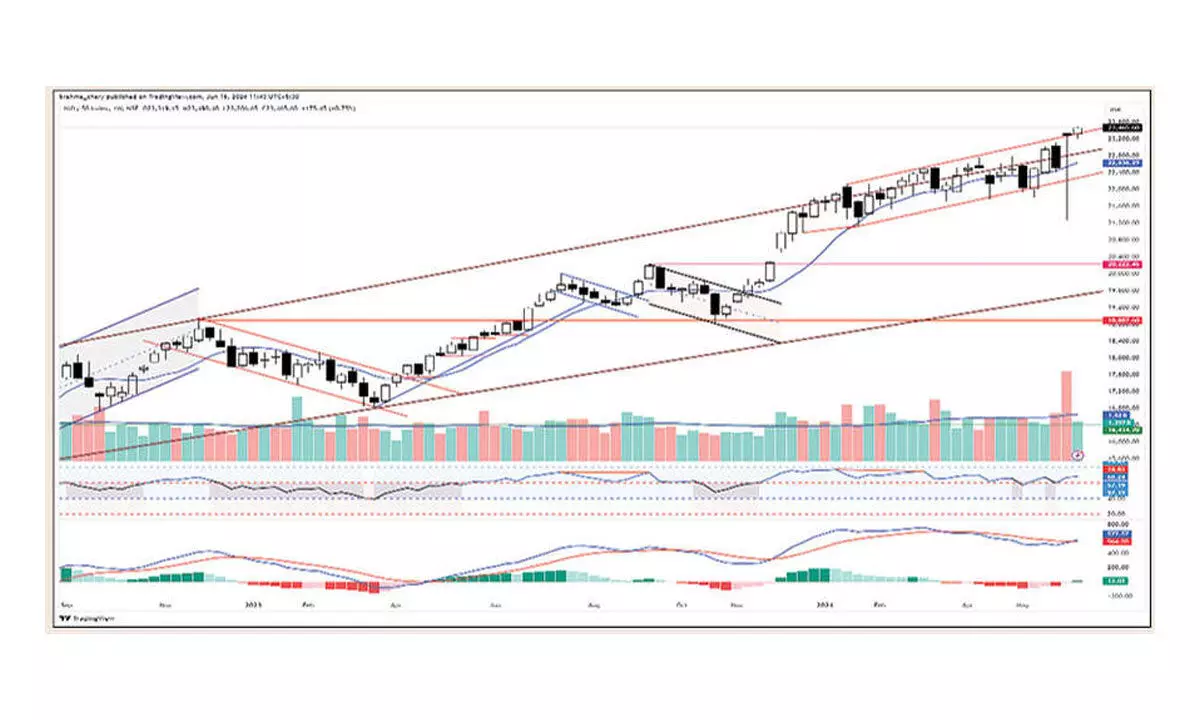

Derivatives Outlook: Rising OI points to undercurrent positive bias

The resistance level remained at 24,000CE for two weeks in a row, while the support level moved up by 500 points to 23,400PE level.

The resistance level remained at 24,000CE for two weeks in a row, while the support level moved up by 500 points to 23,400PE level.

The 24,000CE has highest Call OI followed by 24,500/ 25,000/ 23,500/ 23,400/23,600/ 23700/23,800/ 24,100 strikes, while 24,000/ 23,450/ 23,500/ 23,900/ 23,700/ 24,050/ 23,900 strikes recorded hefty to reasonable addition of Call OI. Minute OI fall was in deept Call ITM strikes in 22,950-22,100 range.

Coming to the Put side, maximum Put OI is seen at 23,400PE followed by 23,300/ 22,700/ 23,500/ 22,800/22,900/ 23,50/ 23,450 strikes. Further, 23,300/ 23,400/ 23,500/ 23,450/ 22,900/ 22,700/ 22,800/ 22,000/ 22,600 strikes witnessed significant build-up of Put OI. No fall in OI was visible on the Put options side.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “From the derivatives front, hefty Put writing was observed at 23,300 & 23,400 strikes, while Call writers were seen shifting at higher bands.”

“Indian markets ended an eventful week at fresh record highs with Nifty finished the week with gains of nearly 0.75 per cent and Banking index also closed above the key psychological level of 50k mark. Buying interest in the auto, realty, and metal sectors kept traders engaged, while the IT sector remained a bit lagged. Additionally, the broader market buoyancy contributed to a positive market breadth,” added Bisht.

BSE Sensex closed the week ended June 14, 2024, at 76,992.77 points, a net recovery of 299.41 points or 0.39 per cent, from the previous week’s (June 7) closing of 76,693.36 points. For the week, NSE Nifty also recouped part of previous week’s loss by 175.45 points or 0.75 per cent to 23,465.60 points from 23,290.15 points a week ago.

Bisht forecasts: “From the technical front, Nifty is moving towards its new record highs, while consolidation moves have been witnessed in the banking counter. For the upcoming sessions, the Nifty has a major support now in the 23,300-23,100 zone, while for Bank Nifty 49,400-49,200 would act as a support zone. For the upcoming week, we expect that bullish momentum is likely to carry towards new record highs and traders should use dips to create fresh longs as far Nifty holds above 22,300 mark broadly. A decisive close above 23,600 could trigger an uptrend towards the 24,000 zone as well. Meanwhile, a stock-specific trading approach is proving effective, and participants should align their positions accordingly.”

India VIX fell 4.93 per cent to 12.82 level on Friday.

“Implied Volatility for Nifty’s Call options settled at 15.45 per cent, while Put options concluded at 16.60 per cent. The India VIX, a key market volatility indicator, closed the week at 13.49 per cent. The Put-Call Ratio of Open Interest stood at 1.00 for the week,” observed Bisht.