Dependence on fossil fuels on the wane

The rising demand for oil in India will overtake that in China by 2027, points out a report by International Energy Agency (IEA).

The rising demand for oil in India will overtake that in China by 2027, points out a report by International Energy Agency (IEA).

‘Oil 2023’, the multilateral agency’s outlook for the next five years, said China’s demand will fall consistently from 2024 after a massive rise this year. The United States, China and India are the world’s three largest oil consumers in that order.

IEA raised its forecast for world oil growth demand to 2.4 million barrels per day in 2023, after the Chinese economy rebounded towards growth faster than expected. It will account for nearly 60 per cent of global growth in oil demand.

Later, slowing industrial growth and falling domestic consumption will reduce China’s demand.

On the other hand, demand in India is expected to rise steadily. It consumed 222.30 million tonnes of petroleum products in 2022-23, which is 10.2 per cent more year-on-year. Global crude output reached an estimated 82.3 million barrels per day till April 2023 due to record production runs in Asia. The report predicted a steep fall in the annual growth in demand for oil in the short to medium term.

Electric vehicles (EV) and improved technology and logistics will reduce global growth in demand for oil, from the present 2.4 million barrels per day to 400,000 barrels per day by 2028. IEA said that after 2024 oil demand growth will be less than one million barrels per day. “Global oil demand will rise by six percent between 2022 and 2028 to reach 105.7 million barrels per day,” it said.

Despite this cumulative increase, annual demand growth is expected to shrivel from 2.4 million barrels per day this year to just 0.4 million barrels per day in 2028, putting a peak in demand in sight. The share of electricity in final energy consumption is estimated to have reached 20% in 2023, up from 18% in 2015. While this is progress, electrification needs to accelerate rapidly to meet the world’s decarbonisation targets. In the IEA’s Net Zero Emissions by 2050 Scenario, a pathway aligned with limiting global warming to 1.5 °C, electricity’s share in final energy consumption nears 30% in 2030.

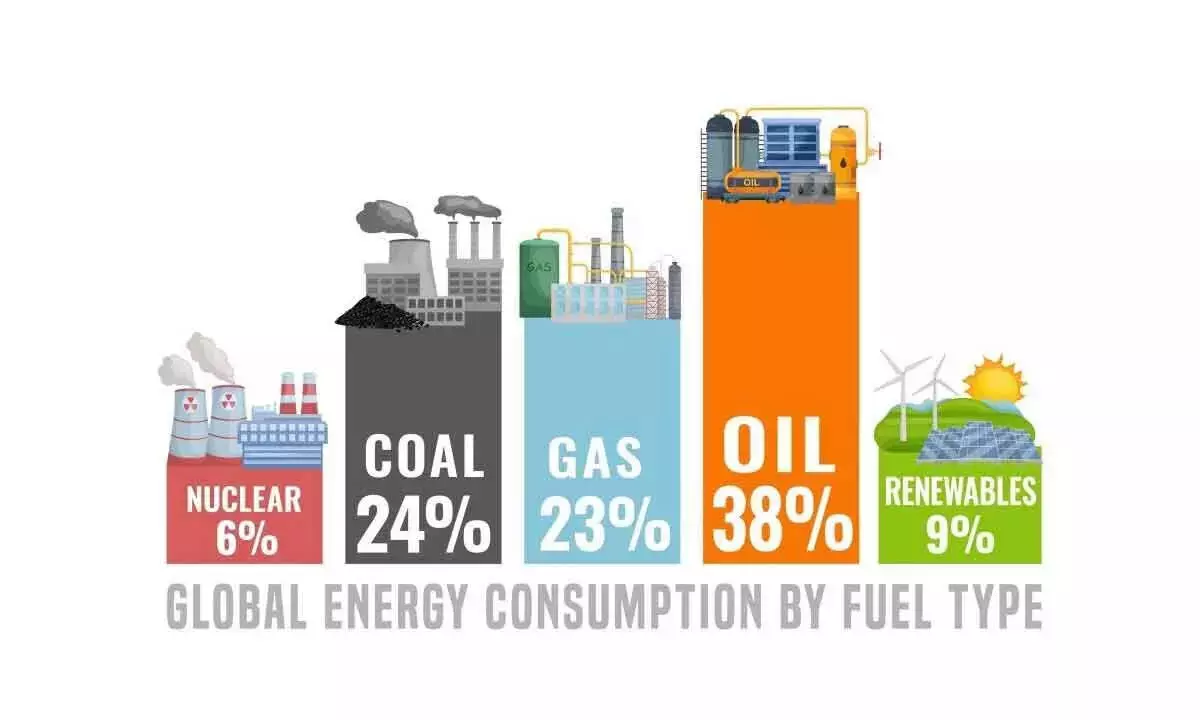

The energy market is expected to continue growing as populations grow and economies develop. However, the mix of energy sources is expected to shift towards cleaner and more sustainable options, with renewable energy sources like solar, wind and hydropower projected to continue growing rapidly. Fossil fuels are expected to gradually decline in importance, although they are likely to remain significant contributors to the global energy mix for several decades, especially in countries that rely almost totally on fossils.

The fossil fuel energy market is expected to face significant challenges and changes in the coming years. While there is still significant demand for oil, natural gas, and coal, the industry is increasingly facing pressure from the growth of renewable energy sources, as well as concerns over climate change and environmental impacts, with many companies and governments investing in carbon capture and storage technologies, as well as exploring alternative sources of energy. However, countries with significant fossil fuel reserves and/or a reliance on fossil fuel exports may continue to prioritize their use, at least in the short term. For example, Saudi Arabia and Kuwait have announced plans to increase their oil production in the coming years. By this May and June, India hopes to produce 45,000 barrels per day, which will be seven per cent of our total crude oil production and seven per cent of our gas production. ONGC conducted a search operation in deep sea near Krishna-Godavari Basin and then started production. They have now started 47,000 barrels of ONGC production from there. It will be 75000 barrels in the future.

The basin itself is well-known as a treasure trove of hydrocarbon reserves, and ONGC has been committed to digging out its vast potential. The start of oil production from Block 98/2 is accredited to the company’s relentless pursuit of the region’s potential, backed by comprehensive geological surveys, seismic studies, and drilling operations. Phase 3, leading to peak oil and gas production from the basin, is already underway and likely to be over in June 2024. The 98/2 project is likely to increase ONGC’s total oil and gas production by 11 per cent and 15 per cent respectively.

India, the world’s third-biggest oil importer and consumer, is dependent on crude oil from various sources in the global market to meet its domestic demand.