Co-living space new realty growth driver: Deepak Parekh

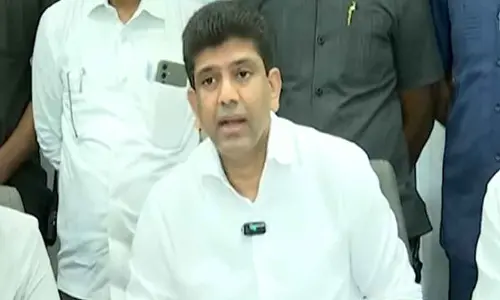

Deepak Parekh

Deepak ParekhConfident about real estate sector doing well as long as there are "right developers, right pricing and right unit size", eminent banker Deepak Parekh has said a number of new growth drivers are also emerging in form of student housing, retirement homes and co-living projects.

New Delhi: Confident about real estate sector doing well as long as there are "right developers, right pricing and right unit size", eminent banker Deepak Parekh has said a number of new growth drivers are also emerging in form of student housing, retirement homes and co-living projects.

He also said foreign investors have also been investing in a big way in good commercial projects, while warehousing is another segment where they are showing keen interest. "Student housing is a very big growth area and it has taken off well. Many universities, colleges and educational institutions are now in fact selling their own housing to raise money to build more classes, facilities etc," Parekh said in an interview.

"The other growth area right now is co-living. People, including foreign investors, have also started talking about rental housing. And many are also building projects for senior citizens, including some being built by people themselves. We are funding some of them actually," the Chairman of the country's biggest housing finance company HDFC Ltd said.

Retirement homes are like hostels with all kinds of facilities available for senior citizens, including medical facilities, and places like Delhi-NCR, Bengaluru and Mumbai-Pune region have started seeing such projects.

According to a recent study conducted by News Corp and Softbank-backed realty portal PropTiger, the co-living space has emerged as a "real estate goldmine" that remains largely untapped and has potential to become $93 billion market annually on rising demand from students and professionals.

"This is evident from the fact that the supply by organised players in co-living is currently limited to over one lakh beds. Assuming they earn Rs 1.44 lakh ($2,021) per annum per bed, organised players in this segment are currently $206 million," the study said.

The report further said that the co-living sector has total untapped demand of about 46.3 million beds, out of which 8.9 million is from student housing. Among the existing players in the segment are RentMyStay, Rentroomi, SimplyGuest and Flathood. Other players such as NestAway, Stanza Living, Zolo, Placio and CoLive have recently entered this sector and raised funds to spread the business.

On the other hand, the co-working space is also seeing huge growth. According to property consultant Knight Frank, co-working operators have leased 4 million sft of office space across eight major cities during the first half of 2019 to meet rising demand of such flexible area from corporates and startups. This marks a growth of 42 per cent over H1-2018.

Asked whether foreign investors, mostly private equity players, are also keen on investing in residential projects, Parekh said, "They are going big on commercial projects, malls etc. A large number of them are getting into joint ventures." "They are also getting into warehousing, including for food, data, commodities etc. Warehousing is a big business now," he said.

He said some foreign players are also keen on residential projects and they would be keen to buy parts of a project if they get good discounts and this can be of significant benefit for developers who have unsold projects.