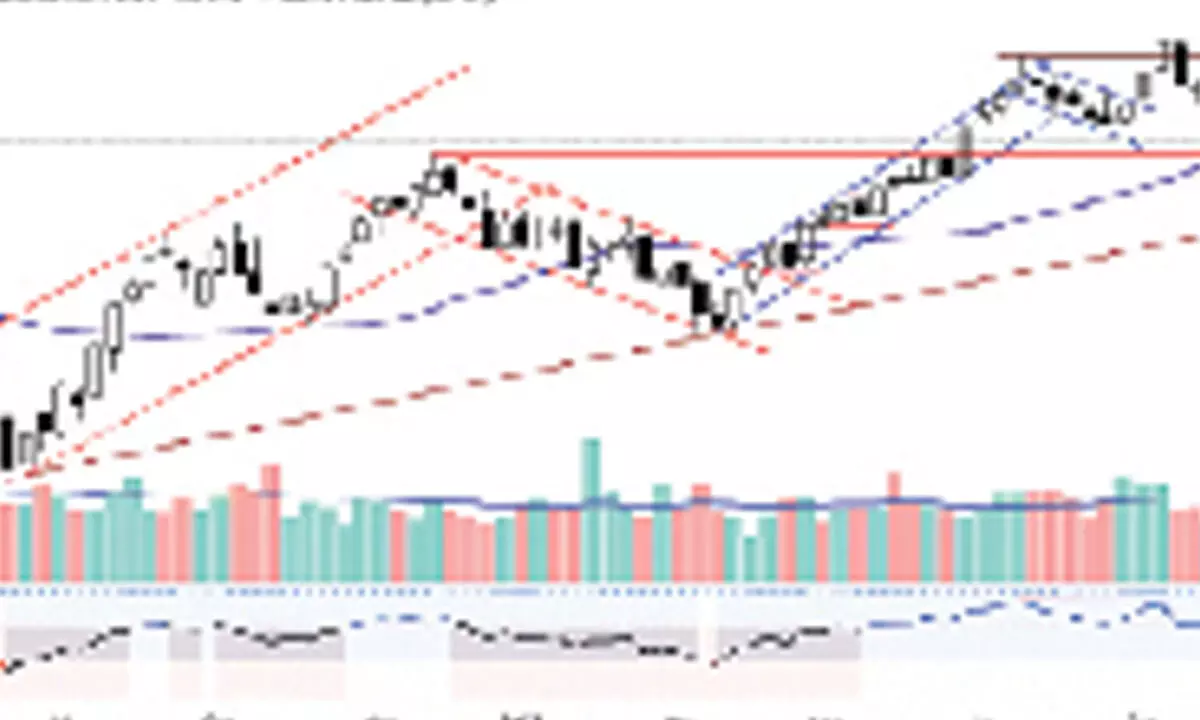

Charts point to bearish undertone

The equity markets witnessed one of the worst falls last week. NSE Nifty closed at 19,047.25 points with a net loss of 495.4 points or 2.53 per cent.

The equity markets witnessed one of the worst falls last week. NSE Nifty closed at 19,047.25 points with a net loss of 495.4 points or 2.53 per cent. BSE Sensex was down by 2.47 per cent. The broader market indices, the Nifty Midcap down by 2.95 per cent and the Smallcap index fell by 2.23. per cent. All sectoral indices closed lower last week. The Nifty Media is the top loser by 5.36 per cent, followed by the Metal index with a decline of 3.87 per cent. The market breadth is negative. The FIIs were aggressive last week. They sold Rs26,598.73 crore in October. The DIIs bought Rs23,437.14 crore worth of equities. The volatility index, India VIX, traded in a huge range between 8.82 and 12.70 and finally ended at 10.90.

The Nifty has registered one of the worst declines last week. It closed below the 31st August low and formed a major low. The current fall of 6.85 per cent from the top will be limited to category-1 (10-13%) correction, or will it extend to category-2 (25-30%) correction. After March 2020, all the corrections were limited to 3.84 per cent to 18.39 per cent. Only fall during October 2021-June 2022 met the category-1 correction. All other corrections were short-lived. The current correction of 6.85 per cent is sharper among all the corrections, which was in just six weeks. Whenever the market rallies over 100 per cent from the bottom, it normally corrects 25 per cent. Major corrections in the world markets are limited to category-1 and category-2 corrections.

After a fall of 6.85 per cent, the pullback is normal. The target for the present correction is around 18,525 points in the near term, which is a 50 per cent retracement of the prior uptrend. In any case, Friday’s pullback extends, and the index may test the 19,225-19,343 resistance zone, which has 38.2 per cent and 50 per cent retracement levels. We can’t expect more than this now.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)