Change In Repo Rate Stuns Realty Industry in India

RBI on Wednesday announced to jack up the interest rates by to 4.40 percent and the CRR by 50 basis points to 4.50 percent.

New Delhi, May 4: As the Reserve Bank of India (RBI) on Wednesday announced to jack up the interest rates by to 4.40 percent and the Cash Reserve Ratio (CRR) by 50 basis points to 4.50 percent. The RBI Governor Shaktikanta Das cited rising inflation as the reason behind this move. The change, however, has irked the real estate industry.

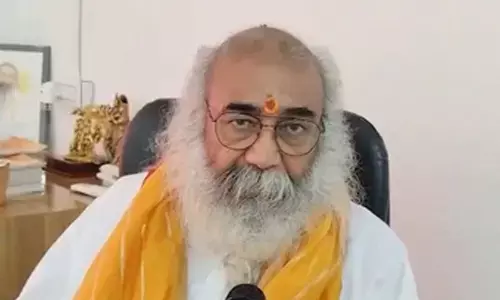

Shortly after the announcement, several real estate associations and experts expressed their concern over the hiked repo rates, the main policy rates, which the RBI has revised after four years of consistency. The National Real Estate Development Council President Rajan Bandelkar believes that though the realty industry in India has been performing well, the change in Repo Rates might play a spoilsport in the residential segment.

"We believe this rate hike is short-term and going forward, housing sales will continue to grow. Acquiring a home is seen as the biggest decision of one's life and these short-term decisions are unlikely to have an impact on a buyer's decision. Builders are still offering attractive schemes and, in a few months, we will be amidst the festive season, which will bring back the buyers," he said in an official statement.

"The rate hike by RBI will impact the growth in residential sale, albeit in the short-term. The low interest rate was one of the biggest reasons for the sale to breach the pre-Covid level. Recently, developers across the country also hiked the unit prices owing to continuous rise in the raw material cost," he added.

Another realty association, Confederation of Real Estate Developers' Associations of India (CREDAI) also issued a statement shortly after RBI Governor's announcement saying that the previous low repo rates had given a boost to the real rate sector during the course of the pandemic.

CREDAI has said that the raising of repo rate by RBI "is a surprise" for the Real Estate industry given the current inflationary trends. Amid a growth in the realty sector, CREDAI says that the developers have largely stayed resilient in the midst of challenges from the pandemic. The association anticipated that the change in repo rate will impact the buying power of consumers.

Pritam Chivukula, Co-Founder and Director, Tridhaatu Realty and Treasurer, CREDAI Maharashtra Chamber of Housing Industry (MCHI) says,

''After two years of unchanged repo rate at 4%, RBI 's decision to hike the interest rate by 40 bps to 4.40% has come as a sudden surprise to the real estate industry in an off-cycle monetary policy meeting held today. In keeping with the stance of withdrawal of accommodation, the sharp acceleration of rates will affect the homebuyers with concerns of EMI on home loans. The State Government which is the largest beneficiary of housing demand should come forward to support the home buyers by reducing stamp duty rate to 3%.''