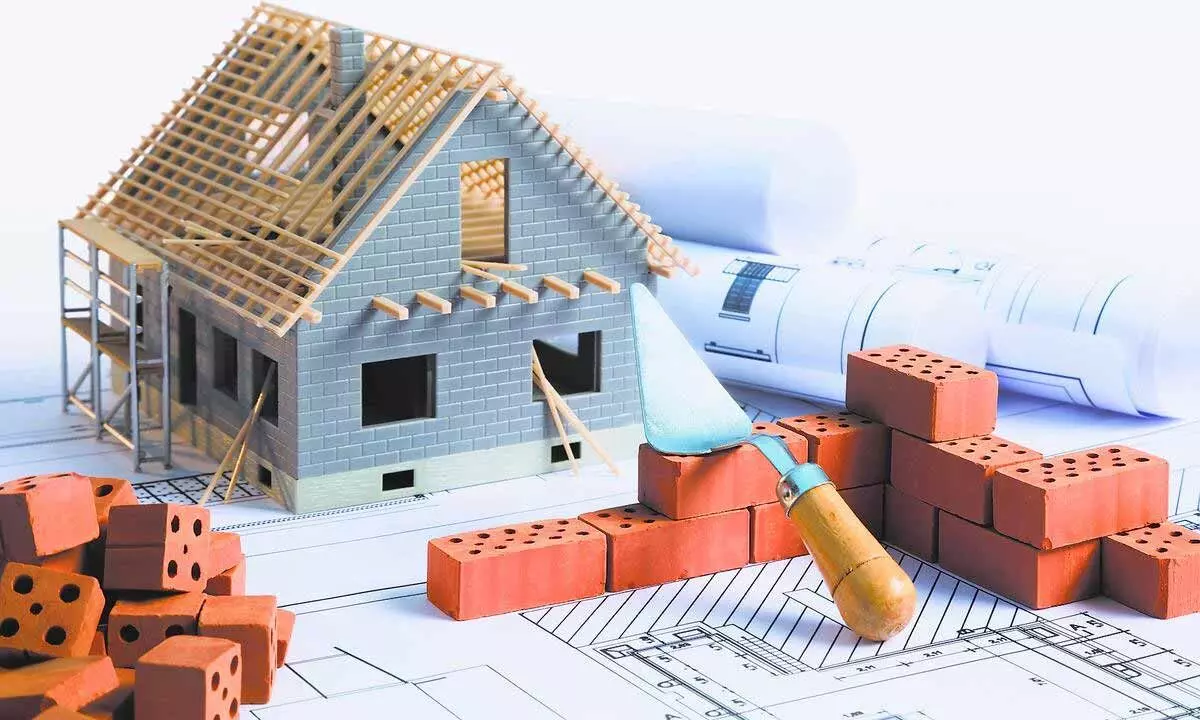

Budget to boost affordable housing

Budget to boost affordable housing

Realtors hail hike in PMAY allocation to `79,000 cr but rue absence of immediate 'booster shots'

Hyderabad: Union Budget 2023 is a balanced one for the economy while missing out on key real estate sector demands, say developers and consultants while welcoming the government's decision to hike the outlay for the Pradhan Mantri Awas Yojana (PMAY) by 66 per cent to Rs 79,000 crore as it will boost supply-demand of affordable housing.

Many developers also termed the Rs 10 crore cap on deduction from capital gains on investment in residential property as a big deterrent. Their long-pending demands of industry status for the real estate sector, single-window approval system, increase in size of stress fund SWAMIH to complete stalled projects and higher deduction on interest paid on home loans were not met in this Budget.

Samantak Das, Chief Economist and Head of Research and REIS, JLL India said: "The government imposed a limit of Rs 10 crore for deduction on long-term capital gains tax for reinvestment in residential properties under Section 54 and 54F of the Income Tax Act. These two sections deal with reinvestment of proceeds from sale of long-term assets (houses) to buy residential units."

Anuj Puri, Chairman of Anarock Group, said that the new measures announced in the Union Budget may certainly help unleash Indian economy's potential. The special tax benefits and deductions can have a rub-off effect on the real estate sector. However, there were no major direct announcements that could be seen as immediate booster shots to this sector.

Puri said, "The enhanced allocation for PMAY is certainly a boost for affordable housing, which was flagging due to increased input costs and also because the buyers in this segment, mostly from the unorganised sector, were still reeling under the impact of the pandemic. It is another step towards the government's 'Housing for all' mission."

The Budget lays much emphasis on building the infrastructure and last-mile connectivity. Improved urban infrastructure will provide further impetus to tier 2 & 3 cities. The unwavering focus on infrastructure will indirectly drive real estate growth over the next one year. The tourism sector also has something to cheer for as the budget aims to boost domestic and international tourism, he added.

Changes in the income tax slabs, including exemption for income up to Rs 7 lakh under the new tax regime and the new tax slabs, will doubtlessly benefit the middle class. However, whether the housing sector will get a collateral boost remains to be seen. The new tax regime offers no benefits that taxpayers can avail of under any Sections, including Section 80C - the previous home loan tax benefits.

Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE also said that the measures such as an increased outlay for affordable housing, enhanced focus on tourism and development of unity malls in key cities across the country would give a fillip to the real estate sector, which will be further aided by the tax relief to citizens which should boost consumption appetite.

"Moreover, the sustained attention on manufacturing and improvement of urban infrastructure is likely to boost the industrial and logistics (I&L) sector and at the same time spur economic activity and job creation. The 33 per cent rise in capex is heartening in a year that has been marked by global headwinds," he said.

Colliers India CEO Ramesh Nair said the increase in outlay of PMAY will go a long way in bridging the gap between demand and stock in affordable housing. "Further, expected changes in income tax slabs will result in higher disposable incomes, boding well for prospective homebuyers, mainly in the affordable and mid-segment," he said.

Navin M Raheja, CMD of Raheja Developers, said that the budget also nudges the States and cities to take up urban planning, and we expect this to lead to planned real estate development in the country. "It will also improve living standards in cities and provide developers with an opportunity to provide a better home," he said.

Tata Realty and Infrastructure Ltd MD and CEO Sanjay Dutt said: "From a real estate industry point of view, the budget has been disappointing. The sector was taken aback by the capital gains set off on investment in residential homes under Section 54, which is now capped at Rs 10 crore. This has been done to remove the speculative nature of the asset class with HNIs/UHNIs.

The industry actually wanted the real estate sector as an asset class to be encouraged with investors. Rajeev Talwar, former CEO of DLF, hailed higher allocation in the PMAY but said the government should have announced more incentives to further boost the real estate sector that has been performing well post pandemic.

Abhishek Lodha, MD & CEO of Macrotech Developers said: "The government has not only focused on creative, productive capital expenditure and growing our infrastructure, but also put money in the hands of the hardworking Indian consumer. With both these steps together, it will unleash and sustain India's growth trajectory and help it overcome the challenging global conditions."

Devanshu Bansal, Director, UK Realty said: "Considering the prevalent domestic and international scenarios and keeping up with the growth achieved so far, the budget is holistic and growth oriented. Increased tax rebates will provide more disposable income to the lower end of the income spectrum. It may motivate individuals to purchase homes which would further enhance the growth of this sector."

An increased capital outlay of Rs 10 lakh crore, a hike in PM Awas Yojana outlay and a Rs 9,000 crore credit guarantee scheme for MSMEs will have a positive multiplier effect on economic growth and help realise the Prime Minister's vision for 'Housing for All'.

– Harsh Vardhan Patodia, President, CREDAI

The incremental PMAY allocation will give impetus to affordable housing. Rebates in personal tax will permit additional disposable income in the hands of the discerning homebuyers to be invested back in a safe asset 'home'.

– Niranjan Hiranandani, Vice Chairman, NAREDCO

The welcoming of private investment in public and urban infrastructure will increase the pace of development. This will emerge as a critical component in addressing the infrastructure needs of the future.

– Gauri Shankar Nagabhushanam, CEO, India Business Parks, CapitaLand Investment

The proposed AI-led research in sustainable cities will hopefully solve manycomplexities we face in the design, construction and planning of urban landscapes.

– Ajitesh Korupolu, Founder & CEO, ASBL

Continued emphasis on housing and increase in income tax threshold for individuals should provide impetus especially to the low-ticket size housing segment.

– Aniket Dani, Director-Research, CRISIL Market Intelligence & Analytics

The emphasis on building the infrastructure and last-mile connectivity will indirectly drive real estate growth over the next one year.

– Samir Jasuja, Founder & CEO, PropEquity