Broad-based trading more likely

Put-Call Ratio of OI at 0.84 indicates strengthening support levels

The resistance level rose by 1,450 points to 25,000CE and the support level fell by 1,800 points to 21,700PE, according to the latest options data on NSE. The widening gap between support and the resistance levels is indicating broad-range trading for this week, observe derivatives analysts.

The 25,000CE has highest Call OI followed by 24,500/ 26,000/25,500/ 24,600/ 24,800/ 27,000/ 27,900/ 27,950/ 23,800/ 23,900 strikes, while 23,900/24,700/ 26,000/ 27,750 recorded heay build-up of Call OI. However, Call ITM strikes from 23,800 inwards recorded heavy fall in OI, while it's marginal decline at select OTM strikes.

Coming to the Put side, maximum Put OI is seen at 21,700PE followed by 23,500/ 22,500/ 22,000/ 21,600/ 21,800/ 23,200/ 23,300/ 23,700/23,900/ 24,000 strikes. Further, 23,900/ 23,800/ 23,500/ 23,000/ 23,400/ 22,500/ 22,600/21,600/ 21,700 strikes witnessed heavy addition of Put OI. And modest Put OI fall is seen at few Put ITM strikes.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market, the highest Call Open Interest for Nifty seen at the 24,000 and 23,900 strikes, while the notable Put Open Interest was at the 23,500 and 23,400 strikes.”

“Over the past week, Nifty gained over 1.5 per cent, while Bank Nifty outperformed with a gain of more than 1.9 per cent. Sector-wise, the Realty, Auto, and Consumer Durable sectors posted strong gains, while the Media and Financial Services sectors faced pressure on a weekly basis.”

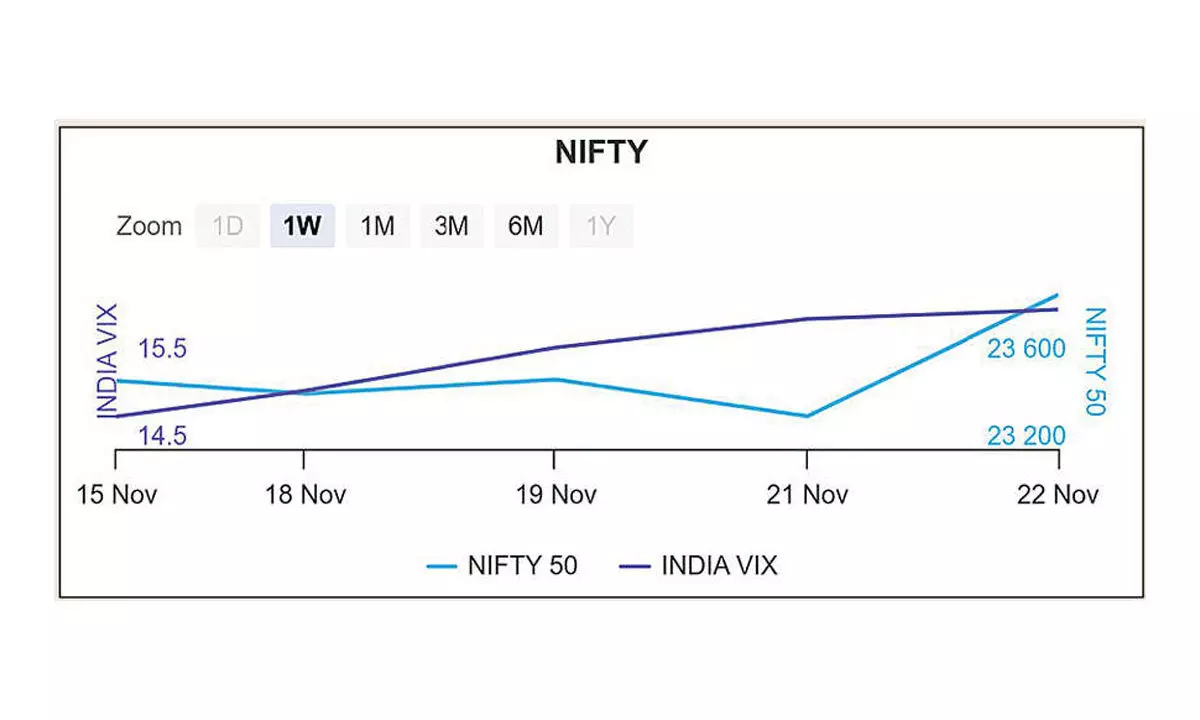

BSE Sensex closed the week ended November 22, 2024, at 79,117.11 points, a net recovery of 1,536.80 points or 1.98 per cent, from the previous week’s (November 14) closing of 77,580.31 points. For the week, NSE Nifty also rebounded by 374.55 points or 2.54 per cent to 23,907.25 points from 23,532.70 points a week ago.

Bisht forecasts: “On the daily chart, both Nifty and Sensex bounced back, closing above their 200EMA levels. From a technical standpoint, Nifty is currently trading near the 200EMA, and as long as it remains above this level, we can anticipate potential upward movement. For Nifty, support is expected around 23,700 and 23,500, while resistance is likely at 24,000 and 24,300.”

India VIX moved up by 0.67 per cent to 16.10 level. “Implied Volatility for Nifty’s Call options settled at 14.77 per cent, while Put options concluded at 15.03 per cent. The India VIX, a key market volatility indicator, closed the week at 16.10 per cent. The Put-Call Ratio of Open Interest (PCR OI) for the week was 0.84.”

Bank Nifty

NSE’s banking index closed the week at 51,135.40 points, higher by 955.85 points or 1.90 per cent from the previous week’s closing of 50,179.55 points.

“Meanwhile, Bank Nifty has consistently remained above its 200EMA on the daily chart. For Bank Nifty, the prominent Call Open Interest was seen at the 52,000 and 51,500 strikes, whereas notable Put Open Interest at the 51,000 and 50,000 strikes. Bank Nifty, on the other hand, continues to outperform, as it is holding above its 200 EMA.”