Bankers non-committal on rate cuts

Bankers non-committal on rate cuts

Bankers non-committal on rate cutsBankers have hailed the third successive rate cut by the central bank as a move that will boost growth but remained non-committal on the specifics of how they intend to pass on the benefits to the borrowers.

Mumbai: Bankers have hailed the third successive rate cut by the central bank as a move that will boost growth but remained non-committal on the specifics of how they intend to pass on the benefits to the borrowers.

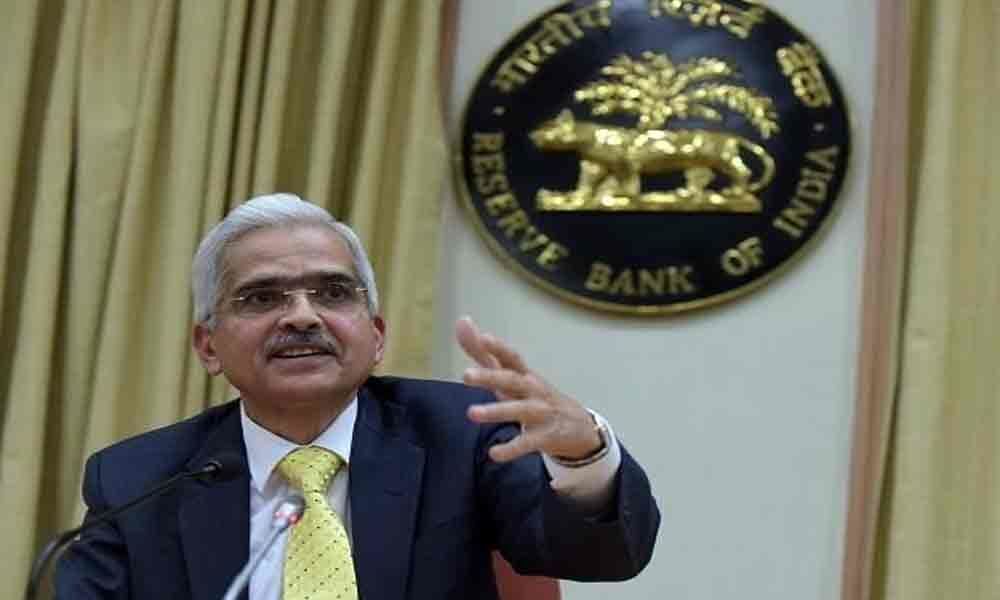

Speaking after the policy review on Thursday, governor Shaktikanta Das hailed banks' effort on transmission, but asked them to do more through "higher and faster" lending rate cuts to help boost demand in a slowing economy.

Das said bankers have so far passed 0.21 per cent of the 0.50 per cent rate cuts since January, going by the weighted average lending rate but this has helped only new borrowers and not those already are in the credit market. "To achieve sustained growth, there is also a need for a more efficient rate transmission framework," Tata Capital managing director and chief executive Rajiv Sabharwal said.

"Given the need for growth, banks would take a call on further rate cuts," industry lobby Indian Banks Association chairman Sunil Mehta said. The GDP growth-focused rate cut and shift in the monetary policy stance to accommodative, and comments centred around liquidity and also the crisis at NBFCs were hailed by the bankers.

"The decision to shift the policy stance to 'accommodative' will simultaneously help the financial system navigate to a lower interest rate regime and also look into growth concerns," SBI chairman Rajnish Kumar said. Commenting on the decision to lower the Basel III leverage ratio for banks, he said the move will augment lendable resources, and scrapping transaction charges for RTGS and NEFT will boost digital transactions. ICICI Bank's global markets head B Prasanna said the policy is "very positive" and there is a scope for more accommodation because of the focus on supporting growth and bolstering private investment.

He termed Das' statement on crisis within some NBFCs, where the governor promised all possible interventions to ensure financial stability, as "reassuring". Economists at HDFC Bank said there can be one more rate cut at in the August review and possibly one after that as well, given the rising headwinds to growth. Bank of India MD Dinabandhu Mohapatra said the RBI's intent is to be supportive of growth in the near-term and welcomed the leverage ratio announcement as a positive for the sector.

Foreign lender Standard Chartered Bank managing director and chief executive Zarin Daruwala also said the easing of the leverage ratio requirement will boost lending and should serve as the much-needed countercyclical stimulus and a review of the liquidity framework should aid monetary transmission.