YSRCP seeks cut in fuel prices

- Party MP Vijaysai Reddy points out that consumers who were paying Rs 9.48 as tax per litre of petrol in 2014, now are paying Rs 27.90

- Referring to Centre's frequent appeals to state to reduce VAT on petrol, the MP says out of every Rs 100 it earns as tax from petrol, it shares just Rs 2 with the states

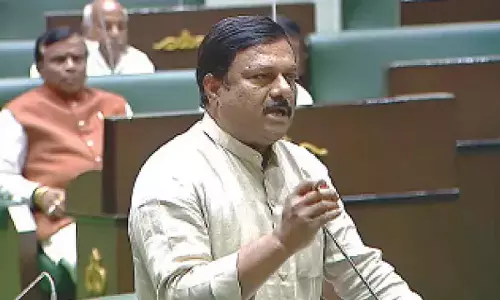

New Delhi: YSRCP Parliamentary Party Leader V Vijayasai Reddy, in a Special Mention in Rajya Sabha here on Thursday said that there was an urgent need to restructure taxes on petrol to ease the burden on consumers and to make tax-sharing with states more equitable.

"I urge the government to take necessary steps for reducing its overall taxes on petrol and for making cesses on petrol shareable with the states," he said.

High petrol prices had been causing huge financial burden on common man, he said. The Centre might blame this on the rise in global crude oil prices but the reality remains that Central taxes on petrol have tripled in the 8 years of the present government, he added.

In 2014, consumers were paying Rs 9.48 as tax per litre of petrol whereas today, they were paying Rs 27.90. Overall, the Centre had increased its tax revenue from petroleum products by 223 per cent, from Rs 1.15 lakh crore in 2014-15 to Rs 3.72 lakh crore in 2020-21.

On many occasions, the Centre had also appealed to the states to reduce VAT on petrol. But it had conveniently failed to admit that out of every Rs 100 it earns as tax from petrol, it shares just Rs 2 with the states. The Centre had done this by heavily increasing cesses on petrol, which were not being shared with the states. In just 5 years, cesses had increased from 56 per cent to 95 per cent of the total central taxes on petrol, which was the highest till date.

To compensate for its shrinking revenue, the states had been forced to increase VAT on petrol, Vijayasai Reddy stated.