Tirupati district credit outlay put at Rs 16,231 cr

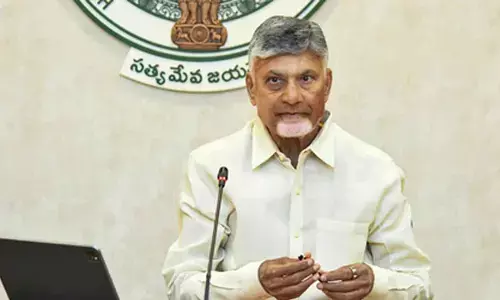

District Collector K Venkata Ramana Reddy and bankers releasing the annual credit plan booklet at the DCC/DLRC meeting on Friday

The District Consultative Committee/District Level Review Committee (DCC/DLRC) meeting has finalised the credit outlay under Tirupati District Credit Plan at Rs 16,231.36 crore.

Tirupati : The District Consultative Committee/District Level Review Committee (DCC/DLRC) meeting has finalised the credit outlay under Tirupati District Credit Plan at Rs 16,231.36 crore.

Of this, the credit outlay under priority sector is Rs 12,403.34 crore, while another Rs 3,838.02 crore has been earmarked for non-priority sector. The DCC/DLRC meeting was held at the Collectorate on Friday in which Collector K Venkata Ramana Reddy, Lead Bank district manager M Seshagiri Rao, NABARD DDM C Suneel, other bankers and officials participated.

Addressing the bankers, the Collector said the credit plan of the erstwhile Chittoor district has been divided between the two districts and the new outlay for Tirupati district has been finalised.

Accordingly, the agriculture and allied activities will get Rs 8,844.73 crore constituting 54.50 percent of the outlay under priority sector. The allocation to small & micro enterprises sector is Rs 2,484.24 crore constituting 15.30 percent of the priority sector outlay.

The other priority sectors have been allocated Rs 1,074.35 crore which constitutes 6.61 percent of the priority sector outlay. It is proposed to assist about 19,200 SHG groups with outlay of about Rs 899.89 crore under the SHG bank linkage programme.

Out of this, about 15,000 rural SHGs will be assisted with an outlay of Rs 601.02 crore and about 4,200 urban SHGs with Rs 298.87 crore. The share of the commercial banks is placed at Rs 12,876.26 crore contributing 79.20 percent of the District Credit Plan whereas the share of Saptagiri Grameena Bank in the ACP 2022-23 is placed at Rs 2,839.53 crore constituting 17.49 percent of the plan and that of APCOB and others is Rs 515.45 crore constituting 3.31 percent.

The Collector suggested to the bankers to provide loans to beneficiaries of Jagananna Housing colonies so that 8,000 houses which have reached up to walls and roof stage can be completed. Canara Bank Coordinator T Nagaraja Rao, Indian Bank Zonal Manager M Aruna, Union Bank of India Zonal Manager DV Sarma, Sapthagiri Grameena Bank Regional Manager G Jaya Kumar, District Agriculture Officer S Dorasani, DIC GM Prathap Reddy and other officials participated.