AP GST collections up 8.8% in Oct despite rate cuts

Reforms under GST 2.0, improved compliance lift revenues

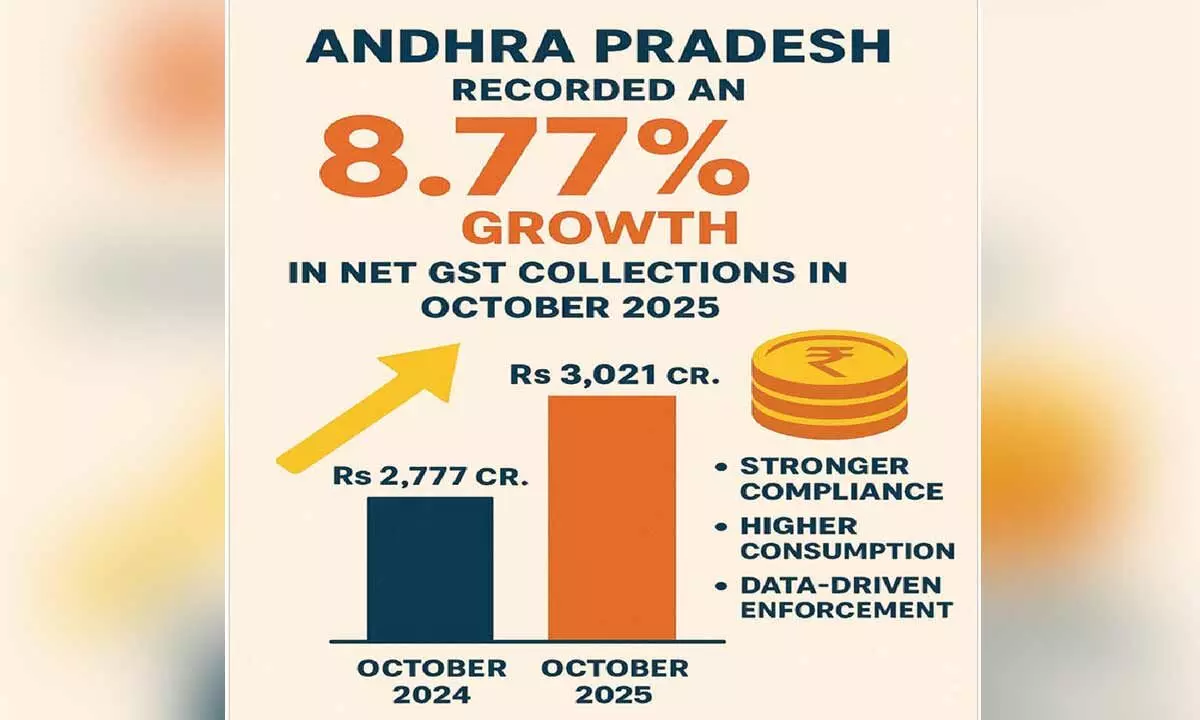

Vijayawada: Generate an illustrative image or graphic for this data Andhra Pradesh recorded an 8.77 per cent growth (Rs 244 crore) in net GST collections in October 2025, defying the impact of tax rate reductions under the new GST 2.0 regime. The state mobilised Rs 3,021 crore in net GST receipts as against Rs 2,777 crore in October 2024, driven by stronger compliance, higher consumption, and data-driven enforcement.

Despite the rollback of GST on life and medical insurance and rate cuts on key consumer essentials, durables, pharmaceuticals and cement, the state managed to post its second-highest October GST collection since 2017. Gross GST receipts for the month stood at Rs 3,490 crore, marking the third-highest October total since the regime’s inception.

Chief commissioner of state tax Babu A attributed the uptrend to rising consumption and reforms in enforcement. Enhanced analytics, real-time reconciliation of interstate transactions, and tighter return-filing compliance have improved the State’s tax efficiency. For seven consecutive months (April–October 2025), Net GST revenues have surpassed year-ago levels, signalling a steady revival in economic activity.

SGST collections touched Rs 1,247 crore in October, up 6.2 per cent year-on-year, while IGST settlements rose 10.65 per cent to Rs 1,773 crore. The petroleum VAT segment remained a stable performer with receipts of Rs 1,282 crore, showing 7.9 per cent growth.

Professional tax revenues surged 18.26 per cent in October and an impressive 46.55 per cent cumulatively up to October 2025, highlighting the State’s success in expanding the taxpayer base and tightening enforcement.

Cumulatively, total revenues across all heads touched Rs 31,144 crore in 2025 (April–October), up from Rs 29,499 crore in the corresponding period last year, a 5.58 per cent growth.

The chief commissioner credited the rebound to a mix of technology-driven audits, central-state coordination and performance-based officer deployment. The government also identified Rs 279 crore of wrongly parked IGST credits and reversed them in October alone, strengthening compliance discipline.

A special compliance drive was launched against high-value defaulters, while automation helped detect anomalies in Input Tax Credit claims and inter-state filings. The state has also tied officer performance metrics to tax collection efficiency and enforcement outcomes to sustain momentum.

Babu A said the state’s fiscal turnaround in October signals a stabilising revenue trajectory for the rest of 2025. “The rebound reflects the impact of analytics-led compliance, structural reforms under GST 2.0, and renewed consumption demand,” he said.